Navigating the Shifting Tides: Decoding the Dow's Premarket Moves

As the world grapples with the ever-evolving economic landscape, investors are closely watching the premarket movements of the Dow Jones Industrial Average (DJI). The latest reports indicate a significant dip in Dow futures, setting the stage for a potentially turbulent start to the fourth quarter of 2024. This article delves into the underlying factors driving these market shifts, providing insights that can help investors navigate the uncertain waters ahead.Uncovering the Catalysts: Deciphering the Premarket Signals

Cautious Optimism Tempered by Fed Uncertainty

The three major benchmarks, the S&P 500 (SPX), Nasdaq-100 Index (NDX), and the Dow Jones Industrial Average (DJI), have all experienced a positive run in September, marking the first time since 2019 that they have collectively posted gains. This surge has been accompanied by sizable quarterly gains, instilling a sense of cautious optimism among investors. However, the premarket dip in Dow futures suggests that this optimism may be tempered by lingering concerns.One of the key factors contributing to this market sentiment is the recent commentary from Federal Reserve Chair Jerome Powell. His indication that the central bank is "not on any preset course" regarding its next policy moves has sparked investor caution, as the market grapples with the potential implications of the Fed's future actions.Technical Landscape: Decoding the S&P 500's Allure

Amidst the premarket volatility, the S&P 500 appears to have an enticing technical backdrop, according to Senior Vice President of Research, Todd Salamone. This technical analysis provides a glimmer of hope for investors, as they navigate the shifting tides of the market.Navigating the Worst Performers: Identifying Potential Pitfalls

As the market landscape evolves, it is crucial for investors to stay informed about the 25 worst-performing stocks of the month. This knowledge can help them make informed decisions and potentially avoid potential pitfalls in their investment strategies.Analyst Insights: Unpacking the Latest Recommendations

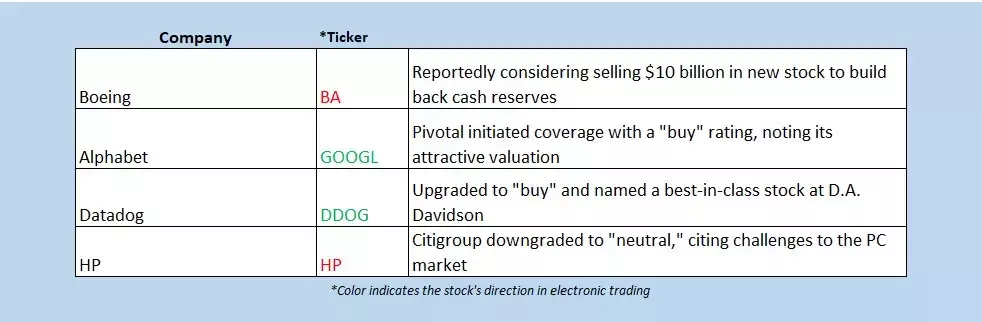

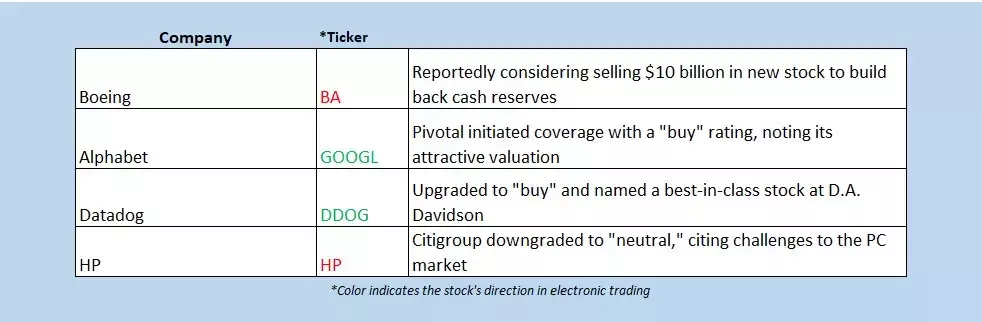

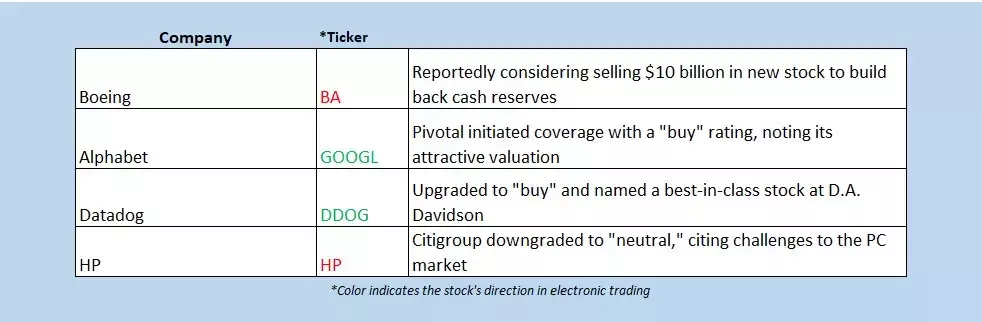

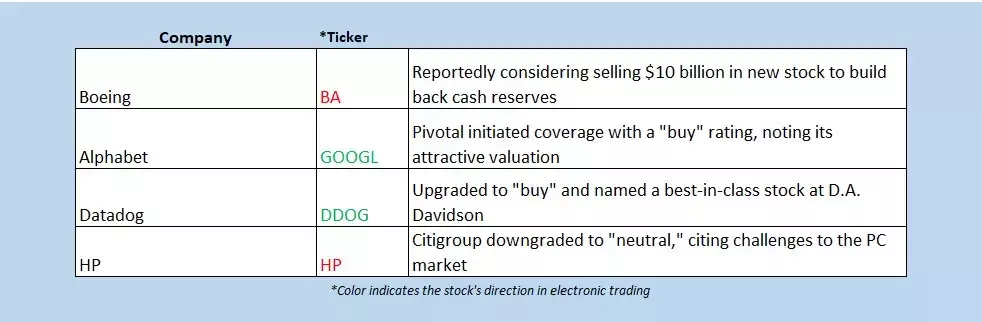

In addition to the broader market trends, investors should also pay close attention to the latest analyst notes and recommendations. These insights can provide valuable guidance on specific sectors, industries, and individual stocks, helping investors make more informed decisions in the current market environment.Anticipating the Week Ahead: Preparing for the Next Chapter

As the market navigates the transition into the fourth quarter of 2024, investors must be prepared for the week ahead. By staying informed about the upcoming events and potential catalysts, they can better position themselves to capitalize on the market's fluctuations and make strategic investment decisions.Global Perspectives: Tracking the International Landscape

The premarket movements of the Dow are not isolated events; they are influenced by a complex web of global economic factors. By examining the performance of Asian and European markets, as well as the latest developments in the eurozone, investors can gain a more comprehensive understanding of the broader market dynamics and their potential impact on the Dow's trajectory.In conclusion, the premarket dip in Dow futures serves as a stark reminder of the volatility and uncertainty that characterize the current market landscape. However, by staying informed, analyzing the underlying factors, and leveraging the insights of industry experts, investors can navigate these turbulent waters with greater confidence and potentially uncover opportunities amidst the challenges. As the market continues to evolve, the ability to adapt and make informed decisions will be crucial in achieving long-term investment success.You May Like