Bullish Momentum Fuels Market Resurgence

After a brief downturn, the markets have regained their footing, with stock futures rallying across the board. Investors are finding optimism in the latest economic data, which points to resilience in the face of ongoing challenges.Powering Ahead: Stocks Surge on Positive Signals

Dow and Nasdaq Futures Soar

The Dow Jones Industrial Average (DJI) and Nasdaq-100 Index (NDX) futures are surging, with triple-digit gains indicating a potential record-setting day for the Dow. This resurgence comes on the heels of yesterday's downturn, suggesting that the market's resilience is once again on display.The S&P 500 Index (SPX) futures are also trading in positive territory, further underscoring the broad-based nature of the market's recovery. Investors are closely watching these key benchmarks, as they often serve as barometers for the overall health of the stock market.Economic Data Fuels Optimism

The latest economic data appears to be a driving force behind the market's renewed optimism. Initial jobless claims came in at 218,000, remaining near four-month lows, indicating a continued strength in the labor market. Additionally, durable goods orders were flat in August, outperforming the expected 3% decline.Furthermore, the Commerce Department reported that the US economy grew at a 3% annualized rate in the second quarter, exceeding previous estimates. This positive economic data is likely providing a boost to investor confidence, as it suggests that the economy is weathering the current challenges more effectively than anticipated.Sector Spotlight: EV Stocks and KB Home

While the broader market is enjoying a resurgence, not all sectors are experiencing the same level of success. Two notable examples are the electric vehicle (EV) industry and homebuilder KB Home.EV stocks are facing headwinds, as the sector grapples with a range of challenges, including supply chain disruptions and regulatory uncertainties. Investors will be closely monitoring the performance of these companies, as the EV market continues to evolve and adapt to the changing landscape.In contrast, KB Home stock fell sharply from last week's record highs, as the company's latest earnings report raised concerns about the state of the housing market. This development serves as a reminder that not all sectors are moving in lockstep, and investors must remain vigilant in their analysis of individual companies and industries.Earnings Movers: Micron, CarMax, and Southwest Airlines

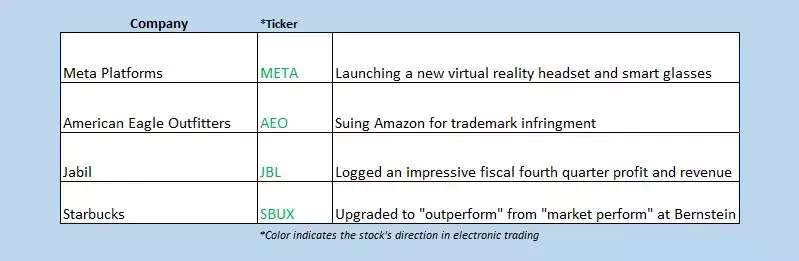

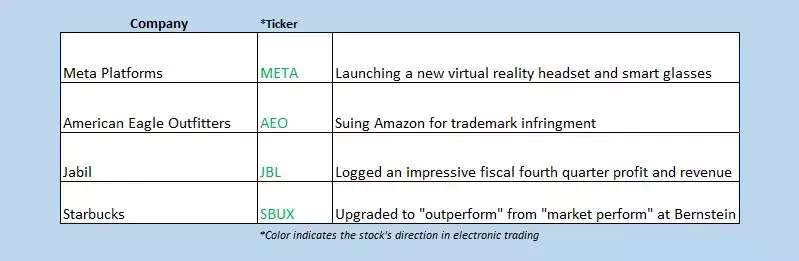

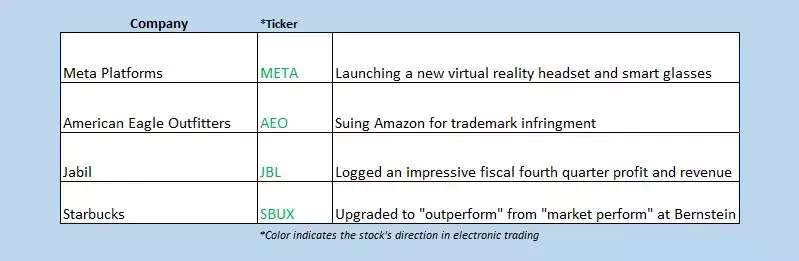

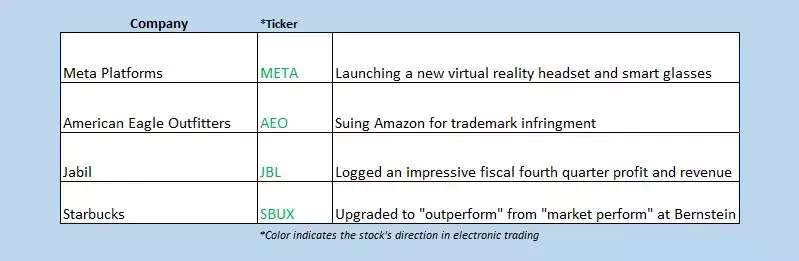

The earnings season continues to shape market sentiment, with several notable companies reporting their latest financial results. Micron Technology Inc (NASDAQ:MU) saw its shares surge 17.6% in premarket trading, thanks to a stronger-than-expected first-quarter revenue forecast and robust demand for its products, particularly in the artificial intelligence (AI) space.Meanwhile, CarMax Inc (NYSE:KMX) is down 7.1% premarket, despite reporting better-than-expected second-quarter sales. Investors appear to be focused on the larger losses from the company's car loan business, which overshadowed the positive sales figures.On a more positive note, Southwest Airlines Co (NYSE:LUV) is up 4.8% before the bell, after the company raised its summer revenue forecast and announced a $2.5 billion share buyback plan. This news has the potential to propel the stock into positive territory for the year, as the airline industry continues to navigate the post-pandemic landscape.Global Markets Reflect Renewed Optimism

The positive sentiment in the US markets is echoed across global financial centers. Asian indexes enjoyed healthy gains, with China's Shanghai Composite rising 3.6% and Hong Kong's Hang Seng adding an impressive 4.2%, reaching a multi-month high. South Korea's Kospi also saw a 2.9% jump, driven by a surge in chip stocks.European markets are also moving higher, with the household goods, tech, and mining sectors leading the charge. Luxury French retailers are also posting noteworthy gains, further underscoring the broad-based nature of the market's resurgence.As investors navigate the ever-evolving market landscape, the current rally serves as a reminder of the market's inherent resilience and the importance of maintaining a balanced and well-informed approach to investment decisions.