Stocks Poised for Breather After Record Highs

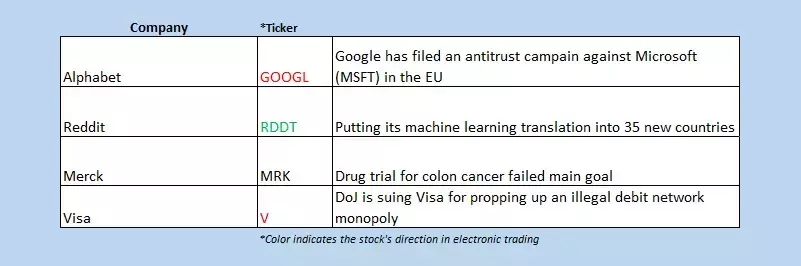

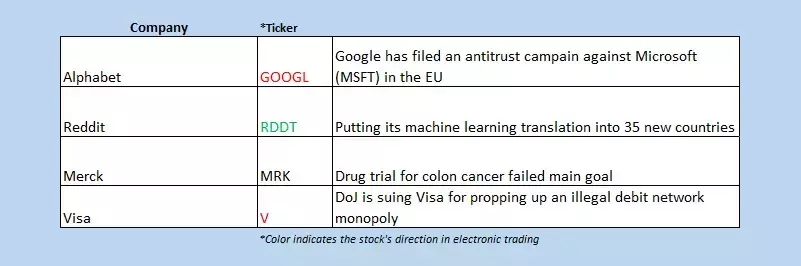

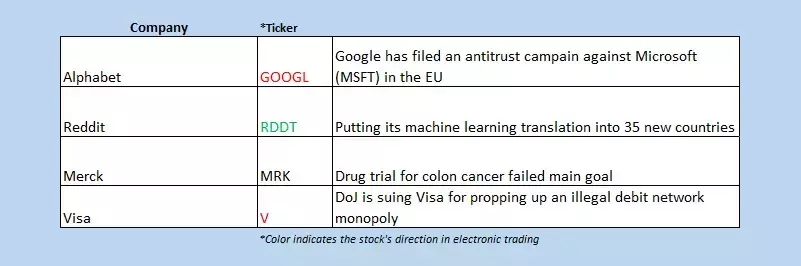

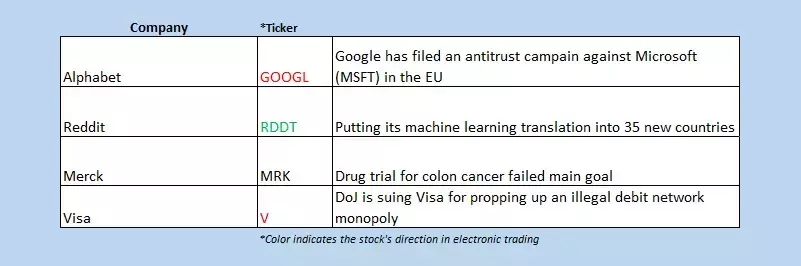

Stock futures are inching lower today, poised to take a breather from the string of record highs nabbed by the S&P 500 Index (SPX) and Dow Jones Industrial Average (DJI). As the month of September winds down, all three major benchmarks are headed for outsized monthly gains. New home sales data is due out at 10 a.m. ET today, and investors are also monitoring U.S. Treasury yields, which have been in an uptrend since last week's interest rate cut.Navigating the Shifting Tides of the Stock Market

Cooling Off After a Scorching Run

The stock market has been on a remarkable run, with the S&P 500 and Dow Jones Industrial Average both reaching new all-time highs. However, it appears that the market is poised to take a breather, with stock futures inching lower this morning. This pause in the market's upward momentum is not entirely unexpected, as markets often need to consolidate gains after a prolonged period of strong performance.The pullback in the major indexes comes as the month of September winds down, a period that has historically been a challenging one for stocks. Despite the potential for near-term volatility, the broader market remains in a strong position, with all three major benchmarks on track to post outsized monthly gains.Investors will be closely watching the release of new home sales data later today, which could provide insights into the health of the housing market. Additionally, the ongoing monitoring of U.S. Treasury yields, which have been trending higher since last week's interest rate cut, will be a key focus for market participants.Navigating the Shifting Landscape

As the market navigates this period of potential consolidation, investors will need to be nimble and adaptable. While the long-term outlook for stocks remains positive, the near-term path may be more volatile and unpredictable. Staying informed about the latest economic and market developments, as well as maintaining a well-diversified portfolio, will be crucial in weathering any potential market turbulence.It's important to remember that market cycles are a natural part of the investment landscape. The recent record highs have been driven by a confluence of factors, including accommodative monetary policy, strong corporate earnings, and investor optimism. As these dynamics shift, the market may experience periods of consolidation or correction, which can present both challenges and opportunities for savvy investors.Adapting to the Changing Tides

In this environment, investors will need to be nimble and adaptable, adjusting their strategies and portfolios as the market landscape evolves. This may involve reevaluating risk exposures, exploring alternative investment opportunities, and maintaining a disciplined approach to portfolio management.By staying informed, diversifying their holdings, and being willing to adjust their approach as needed, investors can navigate the shifting tides of the stock market and potentially capitalize on the opportunities that arise. While the near-term outlook may be uncertain, the long-term prospects for the market remain promising, provided investors are willing to adapt and stay the course.