Starrygazey Inc. is currently embarking on a United States initial public offering (IPO) endeavor, seeking to secure approximately $16.9 million in growth capital. The company's business model centers on offering advisory services, particularly catering to entities aspiring to launch IPOs in Hong Kong. Despite its remarkable 233% revenue surge and commendable profit margins, the proposed valuation for its IPO, with a Price/Sales ratio of 55.9x and a Price/Earnings ratio of 116.6x, appears to be disproportionately high. This elevated valuation, combined with significant client and geographical dependencies, a highly competitive market landscape, and the inherent regulatory complexities associated with its Hong Kong operations, presents a notably speculative investment scenario, leading to a recommendation to divest or avoid.

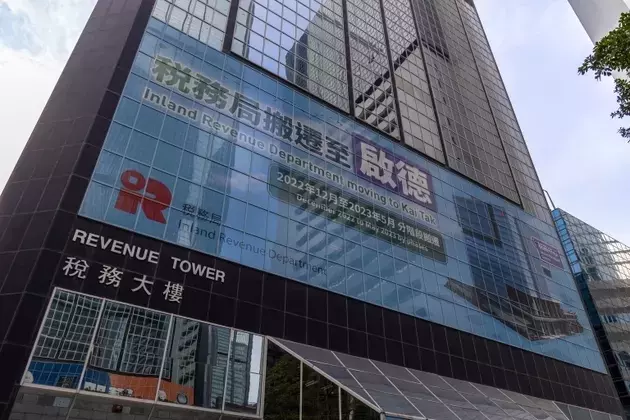

Starrygazey Inc. (MARH), a firm specializing in a diverse array of business services, has officially initiated the process to secure capital through a US IPO. This move is detailed in its SEC F-1 registration filings. The core of MARH's service offerings is directed towards supporting companies navigating the intricate pathways of an IPO, primarily within the Hong Kong market. The company has demonstrated impressive financial metrics, reporting a substantial 233% increase in revenue. This growth is complemented by robust profit margins, reflecting an efficient operational structure. However, a critical analysis of the company's IPO prospectus reveals a significant concern regarding its valuation. The proposed pricing suggests a Price/Sales multiple of 55.9 times and a Price/Earnings multiple of 116.6 times, figures that are substantially higher than industry averages and raise questions about the long-term sustainability of such a premium.

The company's operational landscape is further complicated by several factors. Firstly, MARH exhibits a high degree of client concentration, meaning a large portion of its revenue is derived from a limited number of clients. This creates vulnerability to changes in client relationships or business conditions. Secondly, its geographic concentration in Hong Kong exposes it to specific regional economic and political risks. The regulatory environment in Hong Kong, while established, can be dynamic and impact the company's operations and profitability. Thirdly, the advisory services sector is characterized by intense competition, with numerous established players and new entrants vying for market share. This competitive pressure could constrain MARH's future growth and pricing power. Given these circumstances, the risk-reward profile for investing in MARH's IPO is deemed highly speculative. The company's relatively short operational history, combined with its ambitious valuation, suggests that potential investors should exercise extreme caution.

In summary, while Starrygazey Inc. showcases strong revenue growth and healthy margins, its impending US IPO is marked by an excessively high valuation. The inherent risks stemming from client and geographic concentration, coupled with intense market competition and regulatory uncertainties in its primary operational region, collectively paint a picture of a high-risk, speculative investment. For those considering an investment, the current outlook strongly advises against participation due to the disproportionate risk-reward balance.