Standard Lithium's stock experienced a notable increase, driven by recent geopolitical and financial developments. China's new export regulations on lithium battery components have spotlighted the necessity for the U.S. to bolster its domestic supply chain for these vital materials. This situation, coupled with a significant investment pledge from JPMorgan Chase, has positively influenced investor sentiment toward Standard Lithium, a company positioned to become a key player in the lithium sector.

Standard Lithium's Market Surge Driven by Geopolitical Shifts and Strategic Investments

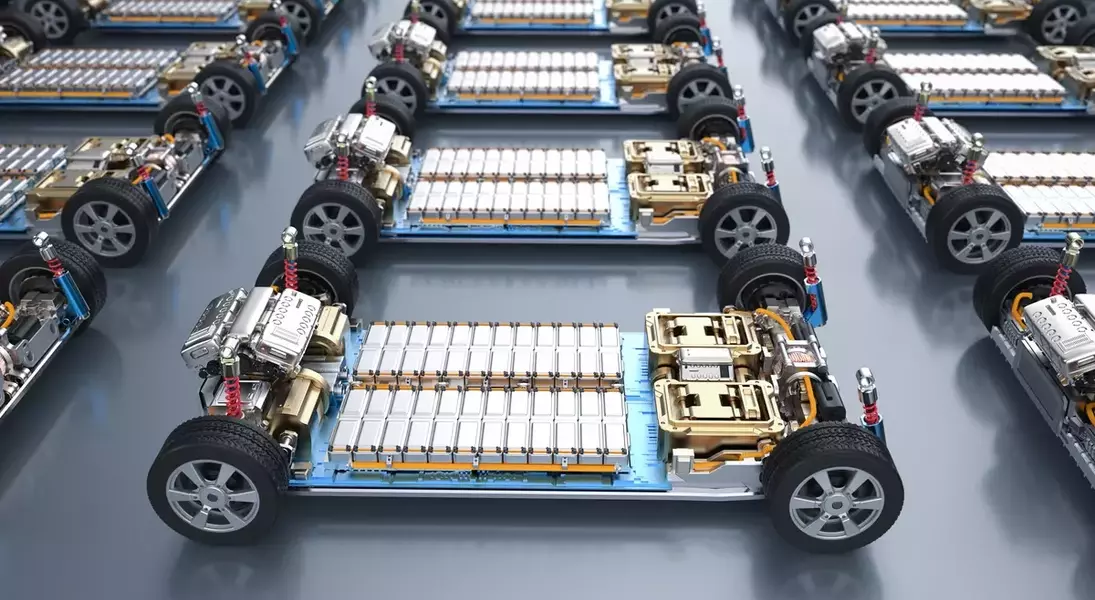

On October 13, 2025, before 1 p.m. ET, shares of Standard Lithium (NYSEMKT: SLI) saw an impressive surge of 15.3%. This remarkable increase came as the market began to process two major pieces of news: China's latest trade policy adjustments and a substantial investment initiative by JPMorgan Chase. China's Ministry of Commerce and the General Administration of Customs announced new export controls on critical materials essential for lithium batteries and their associated supply chain. Effective November 8, any Chinese entity intending to export specified lithium battery materials will be required to obtain a license from the State Council's commerce department. This strategic move grants China, a dominant force in the global lithium battery production market, considerable leverage in its ongoing trade discussions with the United States. Consequently, it underscores the urgent need for the U.S. to fortify its own domestic supply chain for these crucial battery and electric vehicle (EV) components. In this evolving landscape, Standard Lithium, with its two primary lithium-brine-bearing assets located in the Smackover Formation of southern Arkansas, is perceived as a significant beneficiary. The market's excitement was further fueled by JPMorgan Chase's recent commitment of $1.5 trillion to its \"Security and Resilience Initiative,\" an endeavor that aligns strategically with the interests of lithium material companies like Standard Lithium. Despite this positive momentum, it is crucial for investors to recognize that Standard Lithium is still in its pre-revenue phase, meaning it will be some time before the company generates substantial earnings. Furthermore, there are no definitive guarantees regarding future external investments or the stability of lithium material prices.

The recent developments underscore the intricate connection between global trade policies, national security, and the burgeoning clean energy sector. For investors, this scenario highlights the potential for substantial returns in companies strategically positioned within critical supply chains, particularly those benefiting from national efforts to achieve resource independence. However, it also serves as a reminder of the inherent risks associated with pre-revenue companies and the volatility of commodity markets. Diligent research into long-term market trends and geopolitical influences is paramount before committing to such investments.