The significant rise in housing expenditures has emerged as a critical factor influencing family size decisions across the nation. Many individuals and couples are finding themselves at a crossroads, where the aspiration of expanding their family clashes with the reality of steep property prices and escalating living expenses. This economic squeeze is compelling a noticeable portion of the population to revise their initial family goals, leading to a trend of smaller households than previously envisioned, as financial prudence takes precedence over traditional family structures.

The Economic Impact of Housing on Family Growth

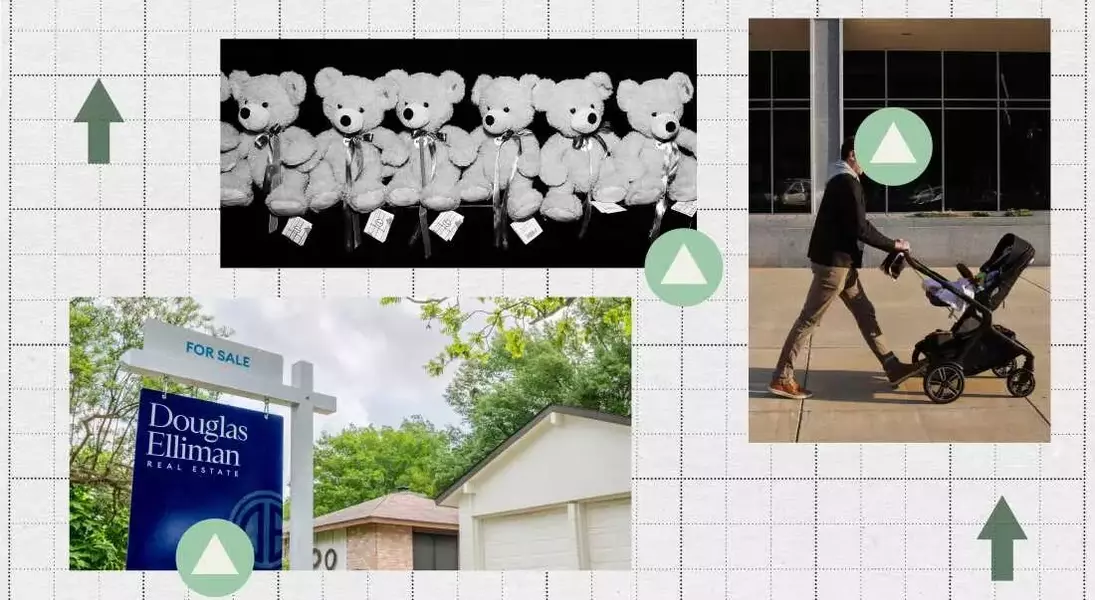

The current economic climate, particularly the substantial escalation in housing costs, is undeniably shaping the family planning choices of many Americans. With property values having surged by 56% since early 2020, families are facing unprecedented financial pressures. This trend is compelling individuals to make difficult decisions, often prioritizing housing stability over the desire for more children. For instance, some couples are choosing to forgo a second child to secure a larger home in a better neighborhood, demonstrating how housing affordability directly impacts the realization of family dreams. This shift highlights a growing concern where financial constraints, rather than personal preferences, dictate family size.

This reevaluation of family size is not merely an abstract concept but a lived reality for many. The narrative of Ava Rimal, who opted for a larger home over a second child due to financial limitations, powerfully illustrates this dilemma. Her decision reflects a broader societal trend where the cost of living, particularly housing, forces couples to compromise on their family aspirations. Similarly, Chelsea Clouser's hesitations about having children at all, driven by the high cost of rent and the struggle to save for a down payment, underscore the pervasive nature of this issue. These stories reveal a significant societal shift where the financial burden of housing is directly influencing demographic patterns, with a clear move towards smaller families or even child-free living among those grappling with economic insecurity.

Navigating High Costs: Adjusting Family Aspirations

In response to the persistent elevation of housing expenses, a growing number of individuals and couples are strategically adjusting their family size aspirations. This adaptation is a direct consequence of the challenging economic landscape, where the financial demands of housing, coupled with other daily expenses, necessitate a more conservative approach to family planning. Many are finding that achieving their ideal family size is increasingly untenable without making significant financial sacrifices elsewhere, leading to a recalculation of what is truly feasible. This pragmatic shift underscores a broader trend where economic realities are reshaping personal life decisions, particularly those related to expanding one's family.

The current housing market dynamics, characterized by significant price hikes and fluctuating mortgage rates, play a pivotal role in these evolving family decisions. The disparity between those who secured low mortgage rates before the market shift and those now facing high rates creates a distinct financial divide. This division often translates into differing capacities for family expansion. Furthermore, the pervasive challenge of high rental costs impedes savings for a down payment, thereby delaying or completely derailing homeownership—a traditional cornerstone for family growth. Consequently, the dream of a larger family often diminishes under the weight of financial calculations, with many concluding that the economic strain of more children outweighs the benefits, leading to difficult, yet necessary, personal choices.