The market for Single-Family Rental (SFR) Real Estate Investment Trusts (REITs) has recently seen a notable decline in share prices, driven by political discourse surrounding potential restrictions on institutional home buying and a temporary oversupply in the housing market. This downturn has, paradoxically, positioned major players like Invitation Homes (INVH) and American Homes 4 Rent (AMH) at more appealing valuations than they have seen in years. While short-term challenges persist from the increased housing supply and evolving regulatory landscape, the fundamental strengths of these large-scale rental operators—including impressive operating margins, effective property management, and strategic market positioning—suggest a resilient long-term outlook. This analysis delves into the industry's current dynamics, assesses the valuation of leading SFR REITs, and explores the nuanced implications of policy changes on their future growth trajectory.

Single-Family Rental Market: Navigating Supply, Demand, and Policy Shifts

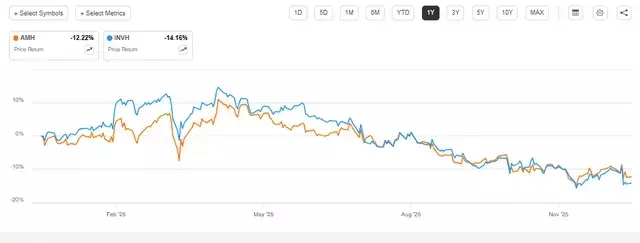

In the dynamic realm of residential real estate, Single-Family Rental (SFR) REITs are undergoing a significant period of adjustment, marked by both market-induced pressures and potential policy shifts. The past year has seen a notable depreciation in the stock values of leading SFR REITs, such as Invitation Homes (INVH) and American Homes 4 Rent (AMH), primarily influenced by discussions within the former Trump administration regarding a possible prohibition on institutional investors acquiring single-family residences. This contemplation arrives at a juncture when the SFR market is already contending with the aftermath of a construction boom that commenced in 2022, leading to an elevated supply of new homes throughout 2023.

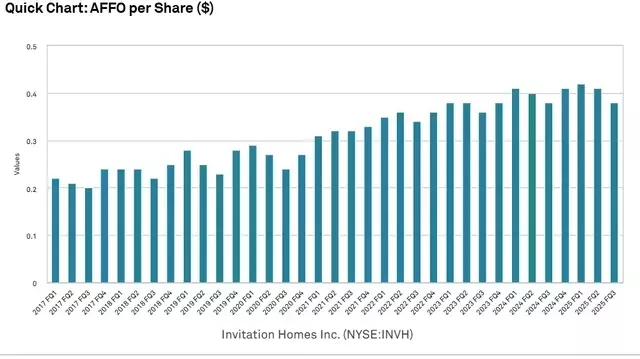

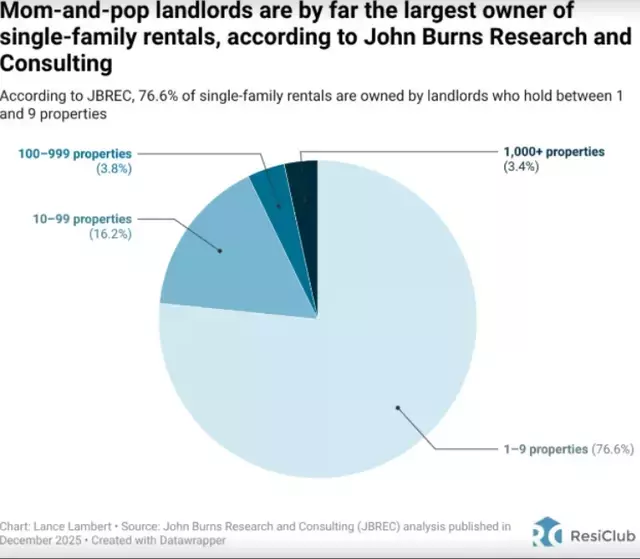

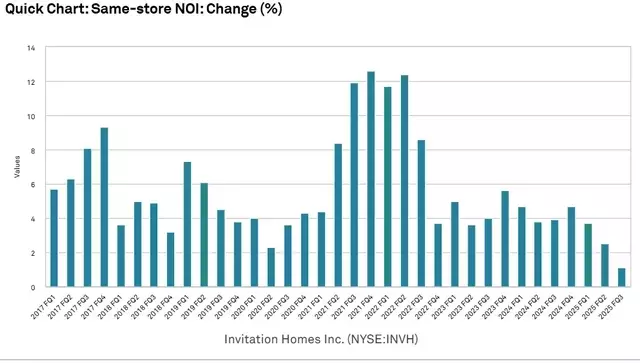

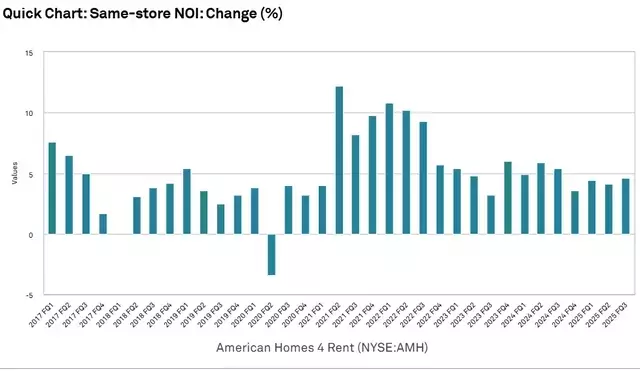

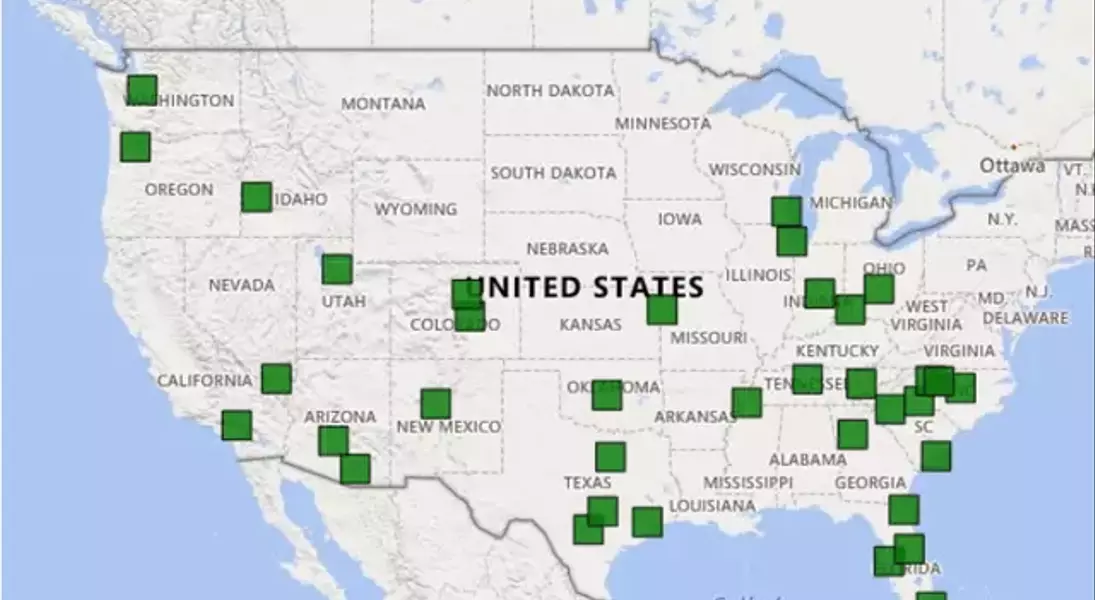

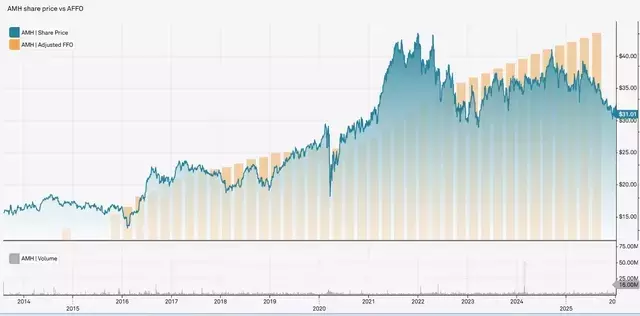

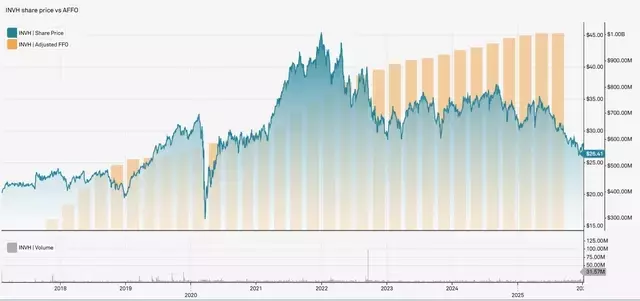

Historically, SFR REITs have demonstrated remarkable success, evidenced by their consistent growth in Funds From Operations (AFFO) per share. This success is largely attributable to their ability to leverage extensive portfolios—INVH manages over 85,000 homes, and AMH over 61,000—to achieve significant economies of scale. This scale allows for enhanced operational efficiency, superior customer service, and robust operating margins, with both INVH and AMH reporting margins exceeding 55% in the third quarter of 2025. These large operators concentrate their assets in key submarkets, enabling them to deploy dedicated teams for maintenance and management, thereby reducing costs and improving responsiveness compared to the fragmented landscape dominated by smaller landlords.

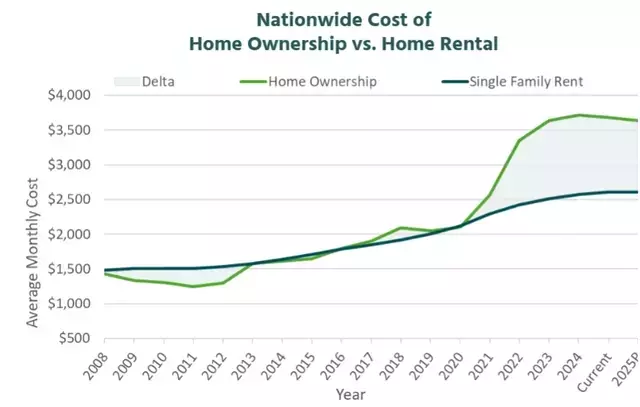

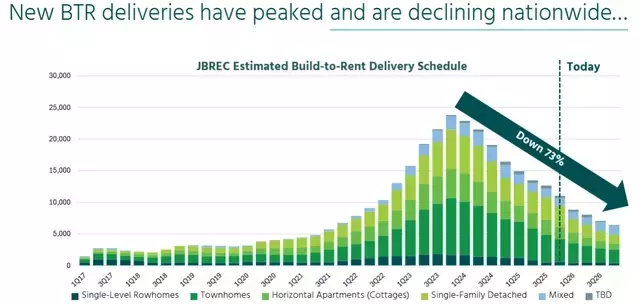

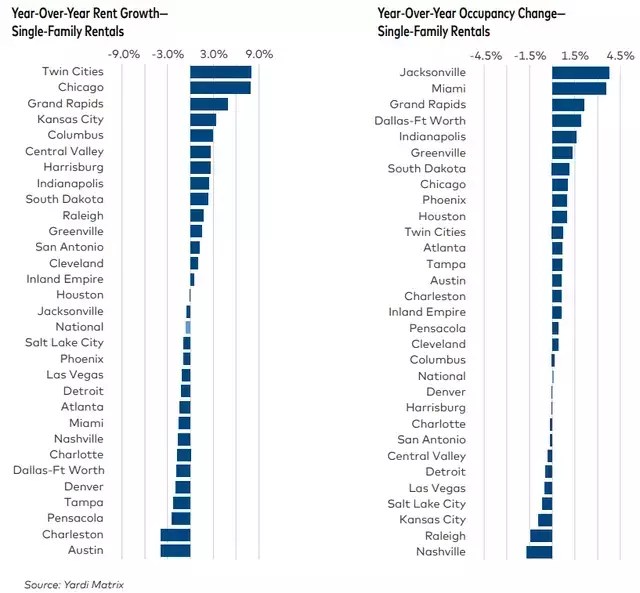

The surge in rental demand, propelled by escalating home prices and rising mortgage rates, initially created a favorable environment for rent increases and high occupancy rates across the rental sector. However, this prosperity also spurred a wave of new single-family home developments. While new construction starts have recently slowed, the existing pipeline continues to deliver homes at an accelerated pace, intensifying competition for incumbent properties. This influx of supply has exerted downward pressure on rental rates and impacted same-store Net Operating Income (NOI) growth, particularly in markets like Phoenix, Atlanta, and Florida, where INVH has a significant presence.

Conversely, AMH, with its more diversified geographical footprint, has largely maintained its organic same-store NOI growth rate, showcasing the resilience afforded by strategic market selection. Looking ahead, the anticipation of reduced forward supply and sustained demand for rentals suggests a potential resurgence in healthy organic growth rates for the SFR sector post-2025. The persistent gap between the affordability of renting versus owning indicates substantial room for future rental rate appreciation.

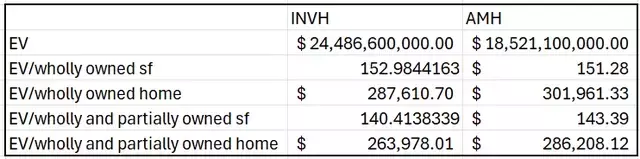

Against this backdrop, the valuation of SFR REITs has become particularly compelling. Previously commanding premium valuations, INVH and AMH now trade at 16.0x and 17.8x their AFFO, respectively, aligning them with the broader REIT index. This shift, coupled with their trading at significant discounts to Net Asset Value (NAV)—INVH at 68.7% and AMH at 75.7%—underscores their current attractiveness. INVH, in particular, appears to be an opportunistic investment given its larger scale and the temporary nature of supply-driven weaknesses in its core markets.

The proposed ban on institutional home buying introduces a layer of uncertainty but also potential benefits. While it could constrain external growth by limiting acquisition opportunities, it might also reduce future supply competition, thereby bolstering organic growth for existing portfolios. The precise impact remains to be seen, contingent on the specifics of any enacted policy, including exemptions for foreclosures or purchases from homebuilders. Investors will need to closely monitor these developments, as the market's initial reaction may not fully account for the nuanced interplay of supply and demand dynamics.

Navigating the Evolving Landscape of SFR REITs

The current landscape for Single-Family Rental (SFR) REITs, as exemplified by Invitation Homes (INVH) and American Homes 4 Rent (AMH), presents a compelling case for reevaluation. The recent market downturn, influenced by both an increase in housing supply and speculative policy discussions, has brought their valuations into an attractive territory. This situation highlights the inherent strengths of these large-scale operators, particularly their ability to maintain high operating margins and deliver consistent growth through efficient management and economies of scale. Despite temporary headwinds in certain markets due to increased supply, the long-term fundamentals of the SFR sector, driven by sustained rental demand and the affordability gap relative to homeownership, remain robust. For investors, this moment offers a unique opportunity to consider these REITs not just for their current undervalued status but for their enduring capacity to generate value within a critical segment of the housing market. The ongoing dialogue around institutional buying bans underscores the need for vigilant monitoring of policy developments, which could reshape market dynamics in unforeseen ways, potentially benefiting existing portfolios by mitigating future competition. Ultimately, the strategic accumulation of such assets at current prices could yield substantial rewards as the market recalibrates and long-term trends reassert themselves.