The Global Silver Surge: Uncovering Opportunities Beyond the USD

In a captivating exploration of the silver market, we delve into the intriguing dynamics unfolding across various global currencies. While the silver price in US dollars may not have reached new all-time highs, a closer examination reveals a remarkable trend – silver is setting new records in multiple international markets, signaling a robust global bull market. This analysis sheds light on the broader implications and potential opportunities for savvy investors seeking to capitalize on silver's ascent.Unlocking the Global Silver Narrative: A Treasure Trove of Opportunities

Silver's Ascent Across Currencies: A Bullish Tapestry

Out of 10 major global currencies analyzed, silver has set new all-time highs in 4 of them, and is mere inches away from reaching new peaks in 3 additional currencies. This global trend paints a compelling picture of silver's strength, transcending the constraints of the US dollar. Investors attuned to the broader currency landscape can uncover a treasure trove of opportunities as silver continues its upward march.The USD Conundrum: Opportunity Knocks

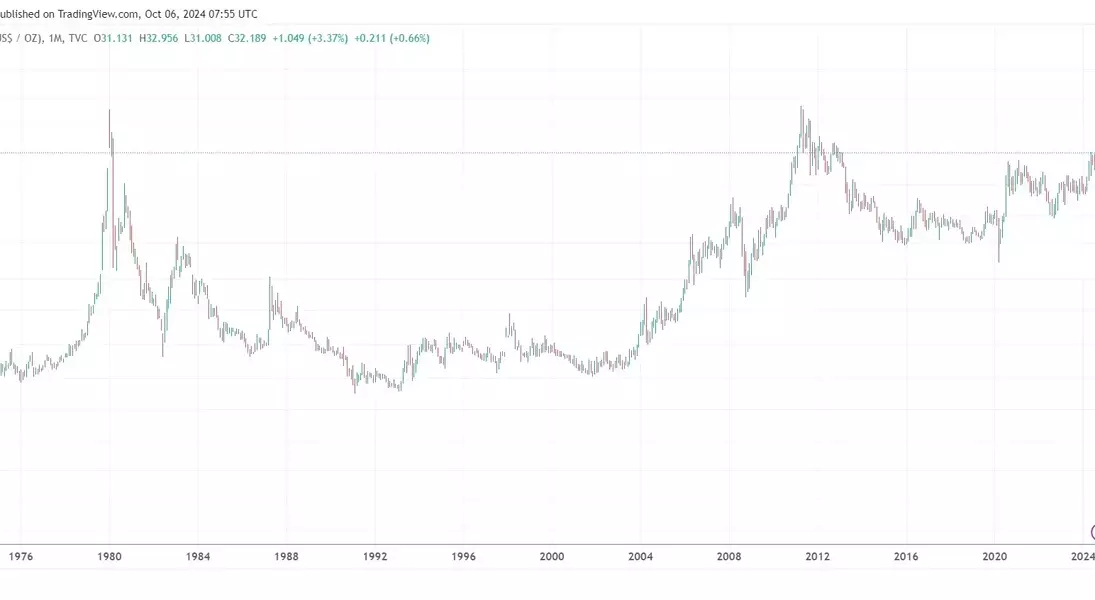

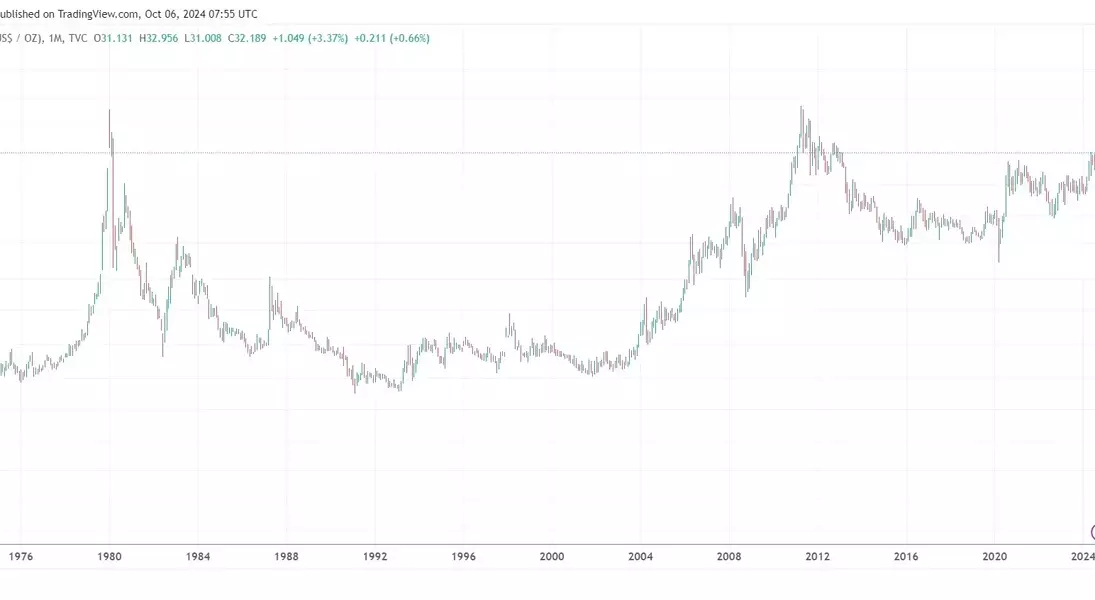

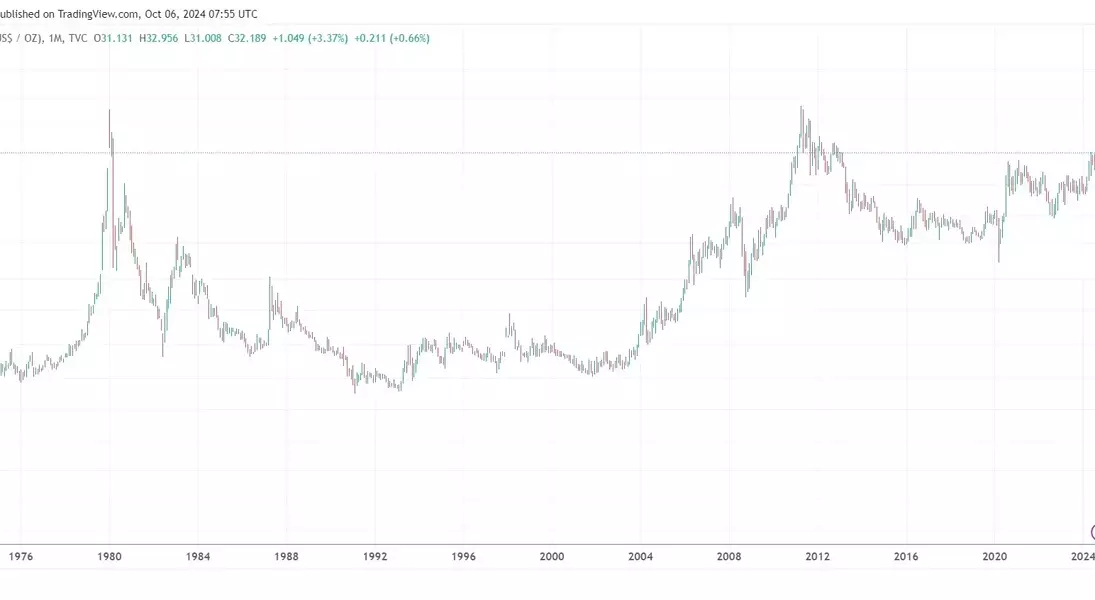

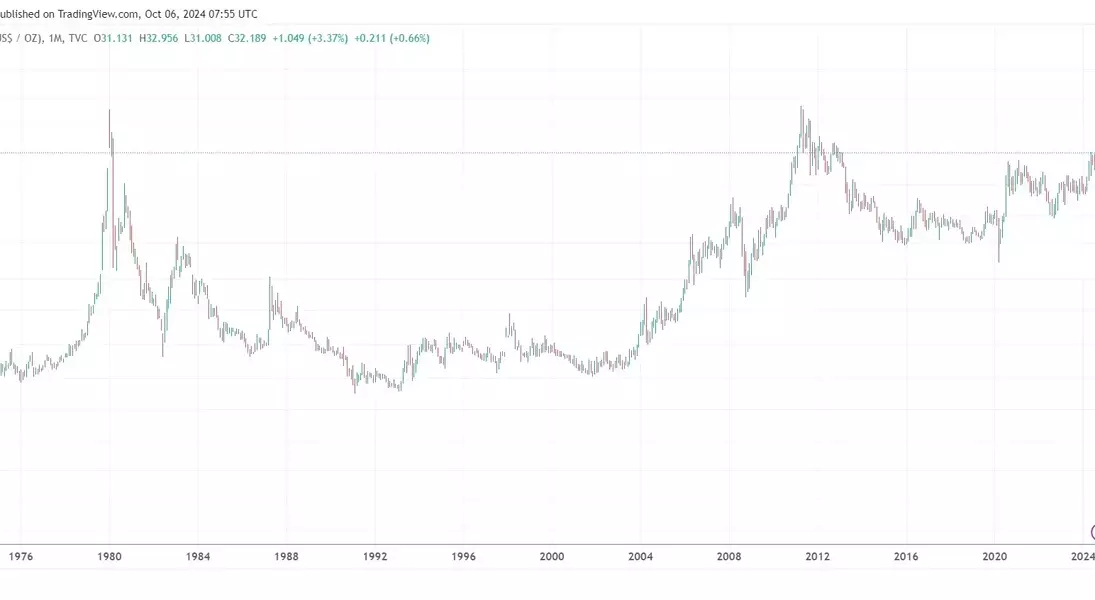

While silver in US dollars may not have hit new all-time highs, this should not be viewed as a deterrent. In fact, it presents a unique opportunity for savvy investors. The silver price chart structure in USD suggests a bullish "cup and handle" formation, indicating that a test of the $50 per ounce level is likely a matter of time. This setup, coupled with silver's global outperformance, underscores the potential for significant upside in the USD-denominated silver market.Shining Bright in Emerging Markets: Silver's Global Dominance

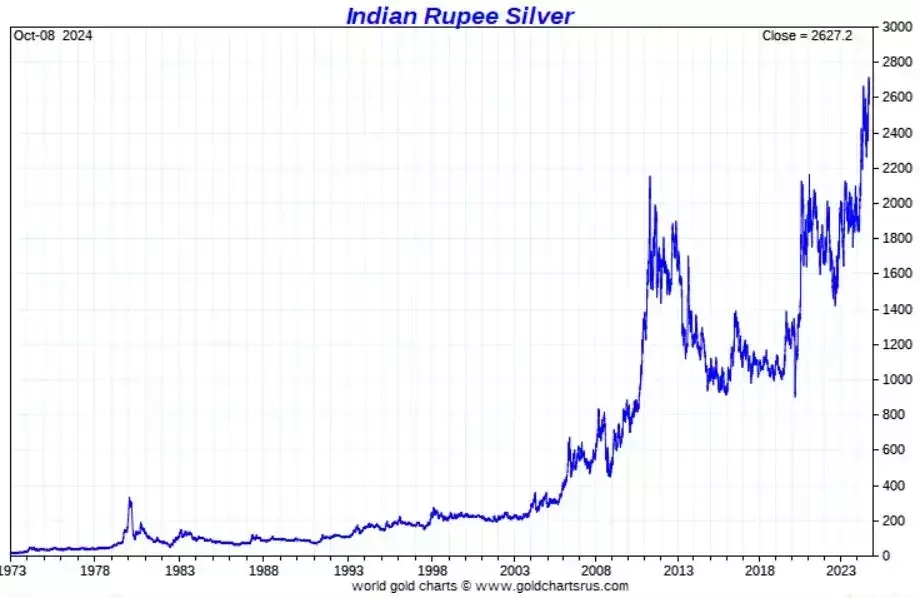

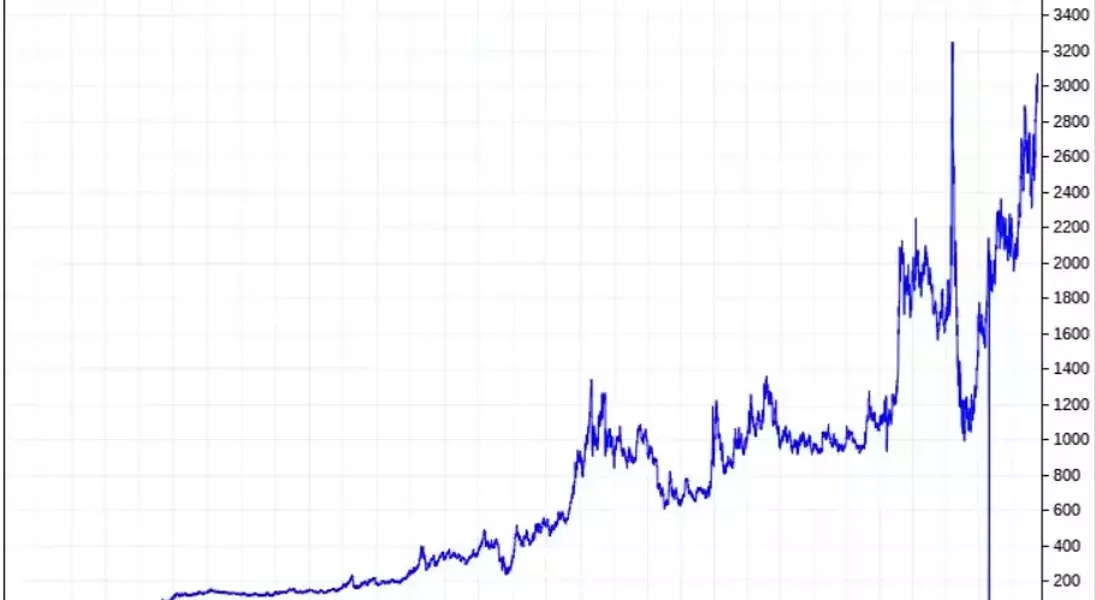

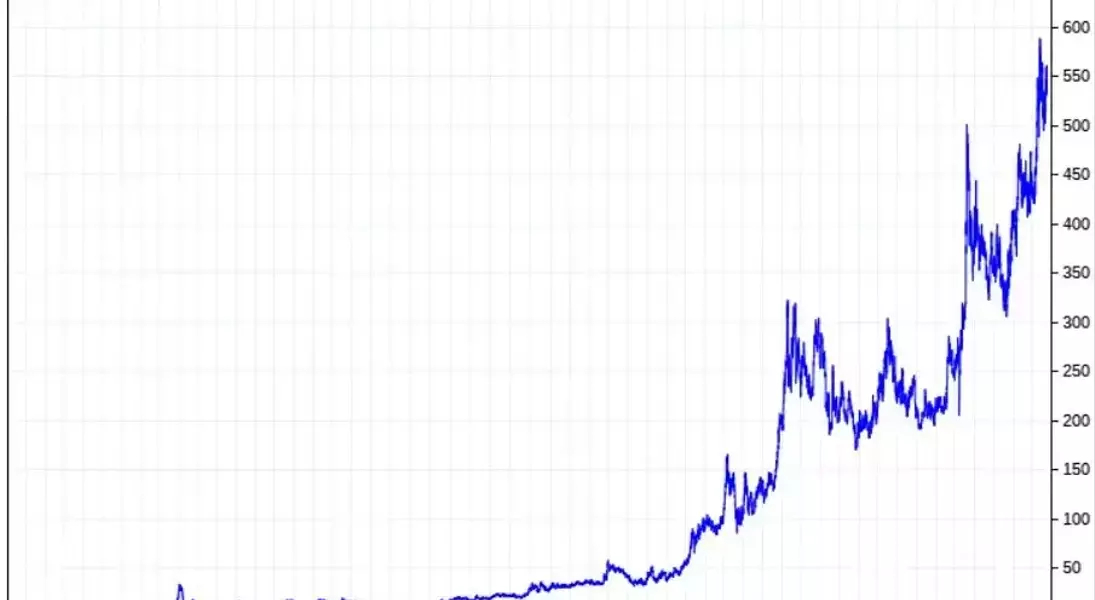

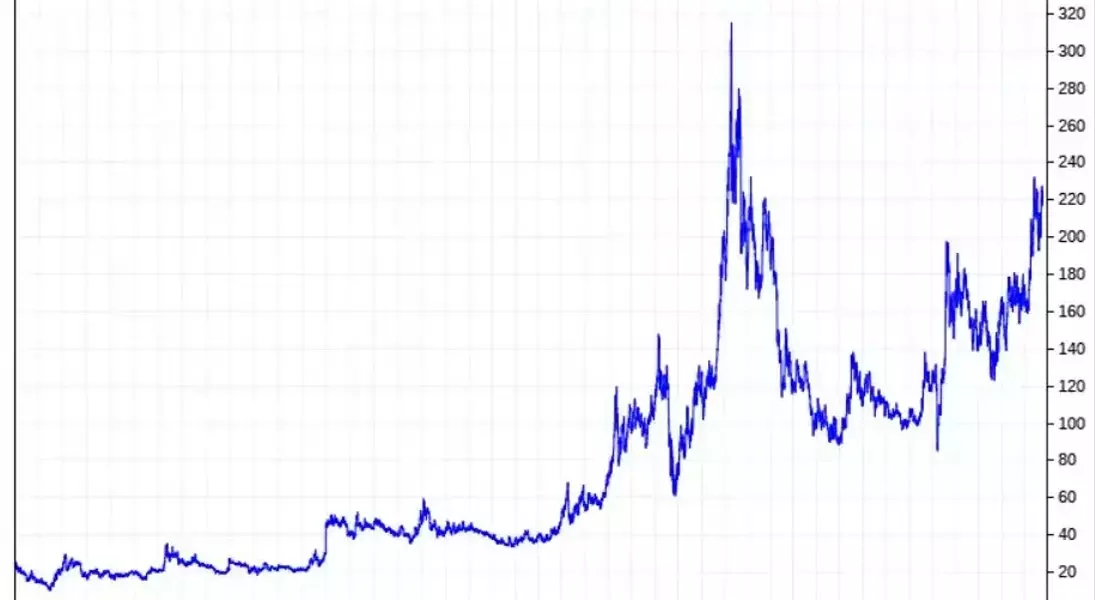

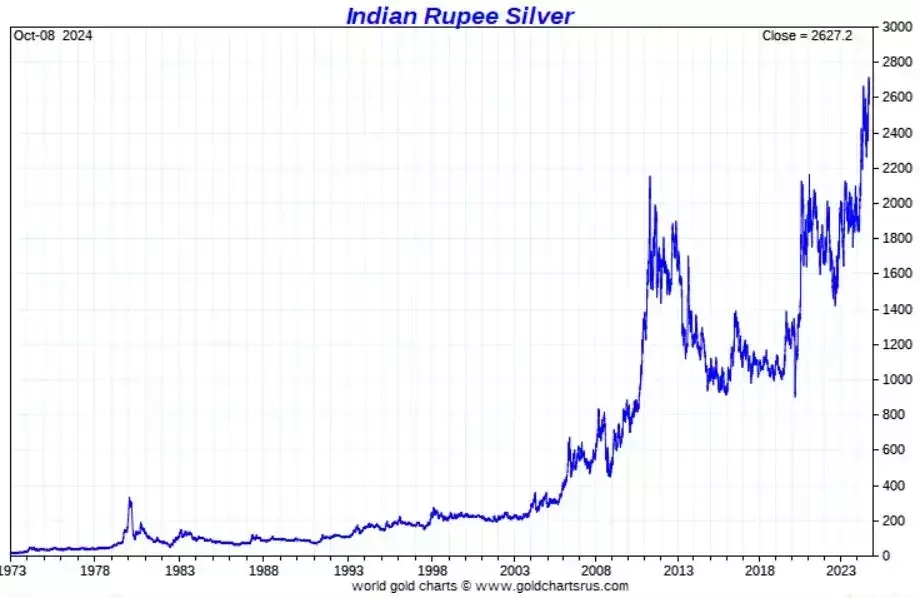

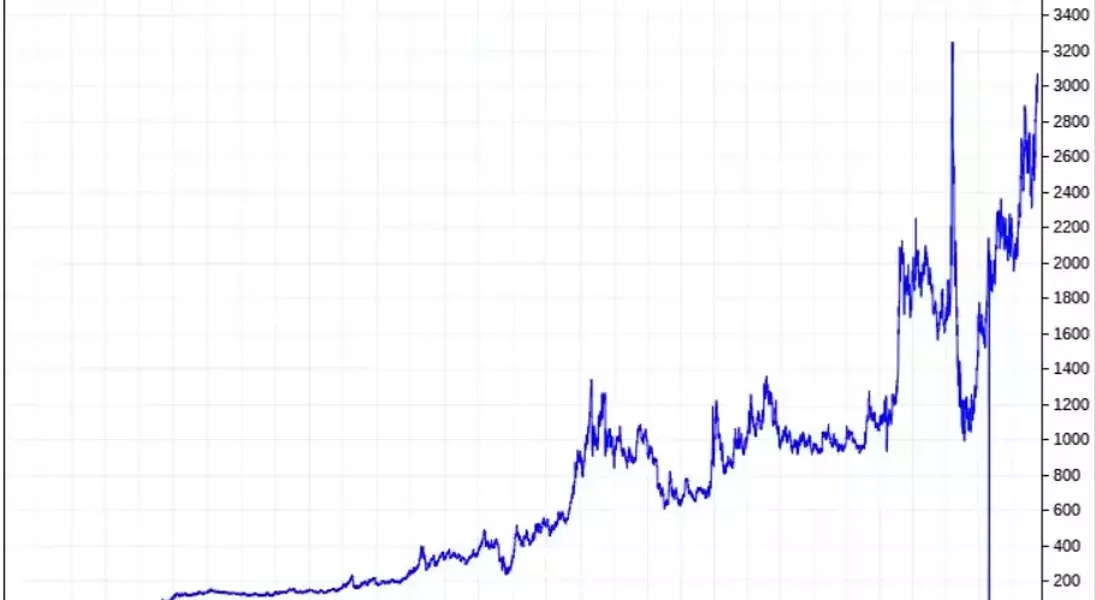

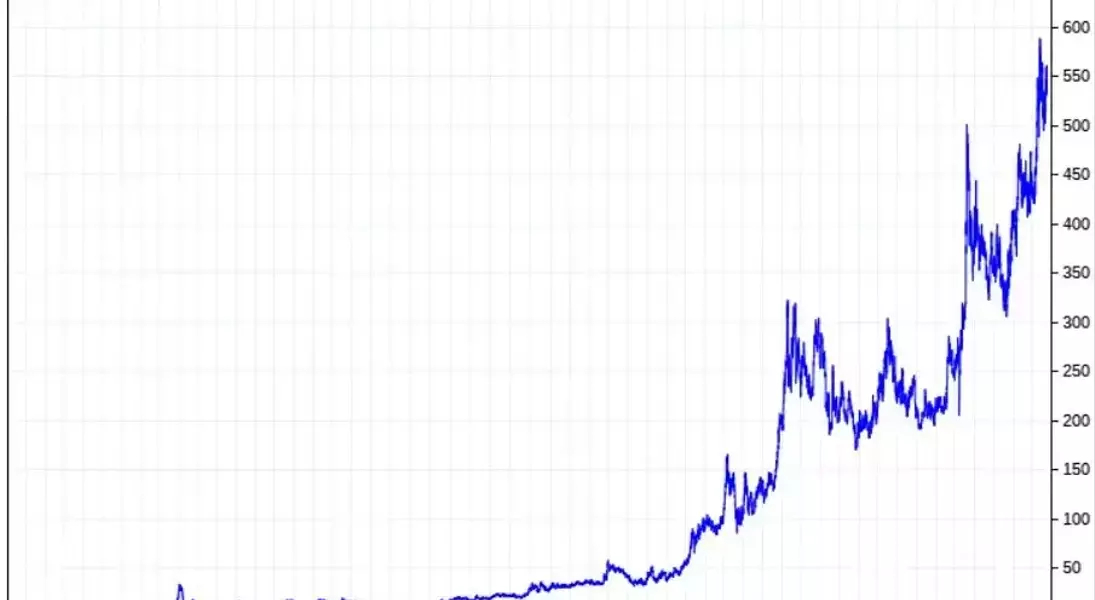

Delving deeper into the international landscape, we uncover remarkable stories of silver's ascent. In India, silver priced in the local currency, the Indian Rupee, has been hitting a series of new all-time highs in 2024, driven by robust retail and investor demand for physical silver. Similarly, silver in the Russian Ruble has been printing a succession of higher highs, with the exception of a temporary and short-lived spike in 2022. Across the globe, from Australia to Africa, silver is breaking new ground, showcasing its universal appeal and resilience.Closing the Gap: Silver's Imminent Triumph in Developed Markets

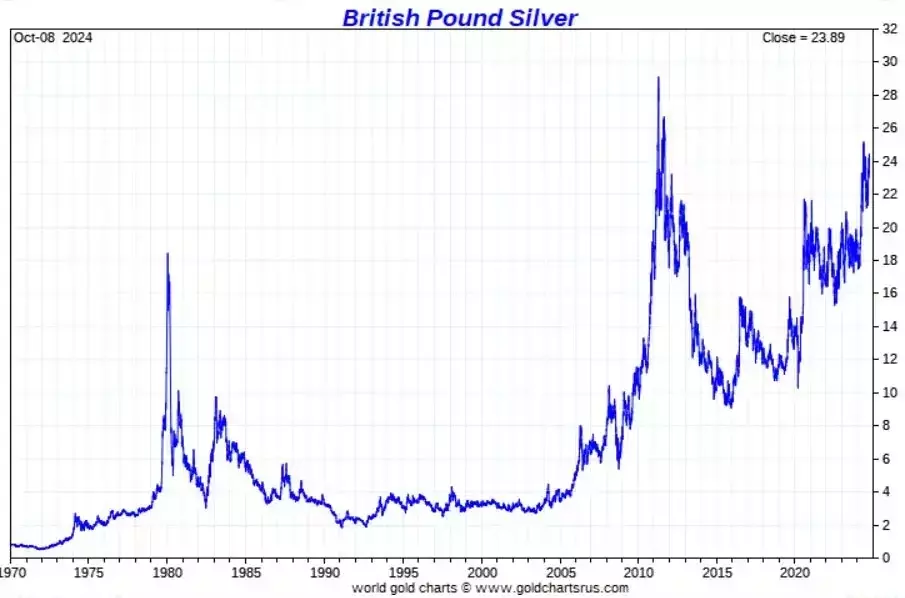

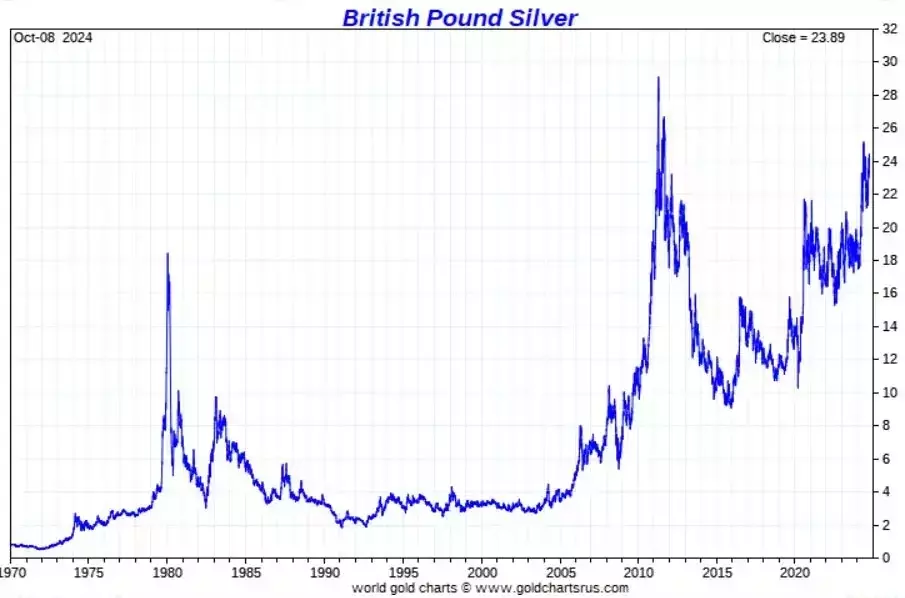

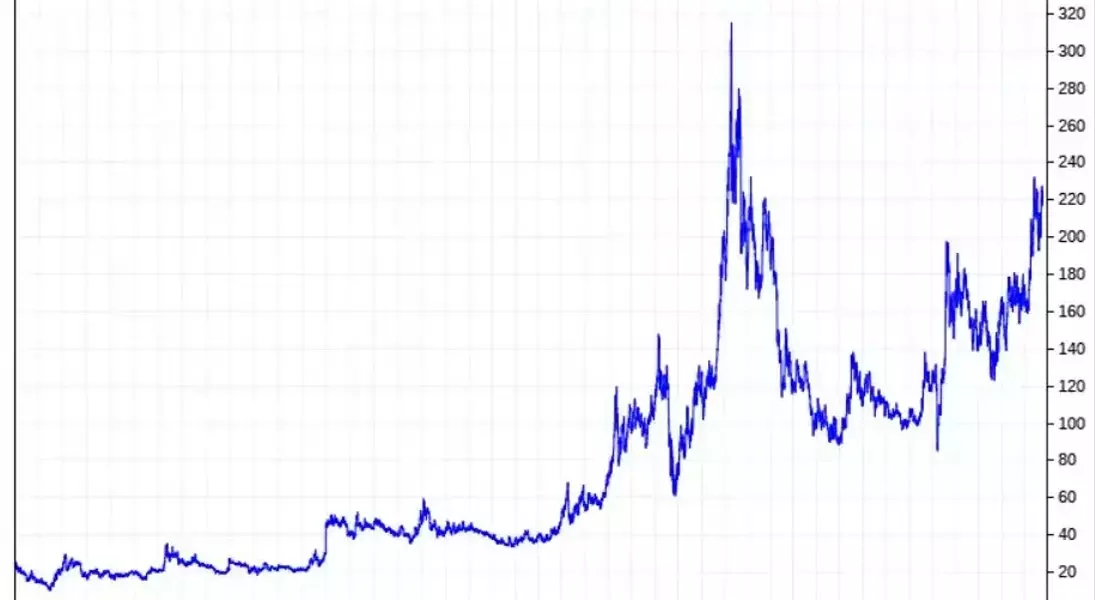

The global silver narrative extends beyond emerging markets, as we observe silver's steady march towards new all-time highs in developed economies as well. In Canada, silver priced in the Canadian Dollar is mere inches away from surpassing its previous peak, while in the Eurozone, silver in Euros is poised to eclipse its 2011 high. In the United Kingdom, silver in British Pounds is also nearing its former all-time high, with a breakout expected in the coming months. These trends underscore the broad-based strength of the silver market, transcending geographical boundaries.The Outlier: Silver's Unique Dynamics in Specific Currencies

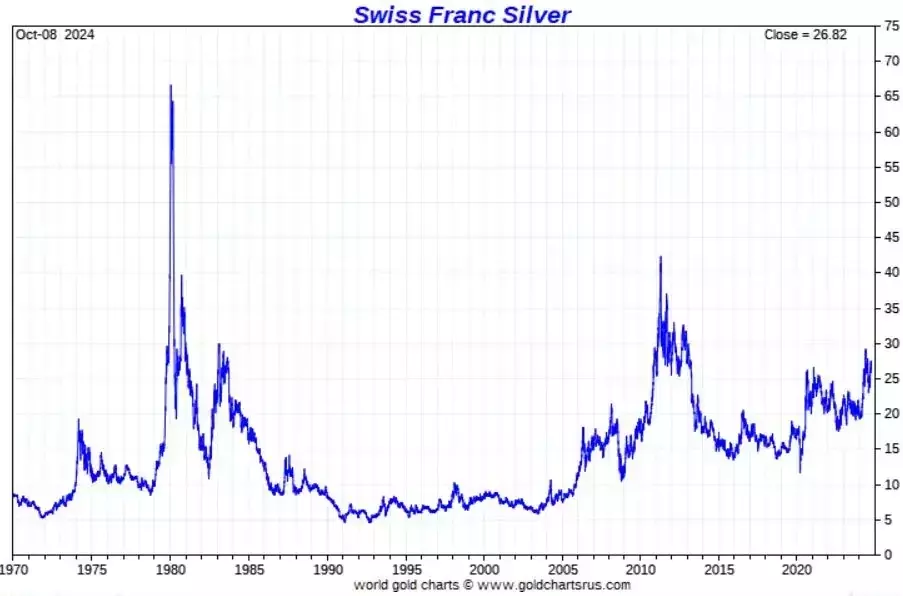

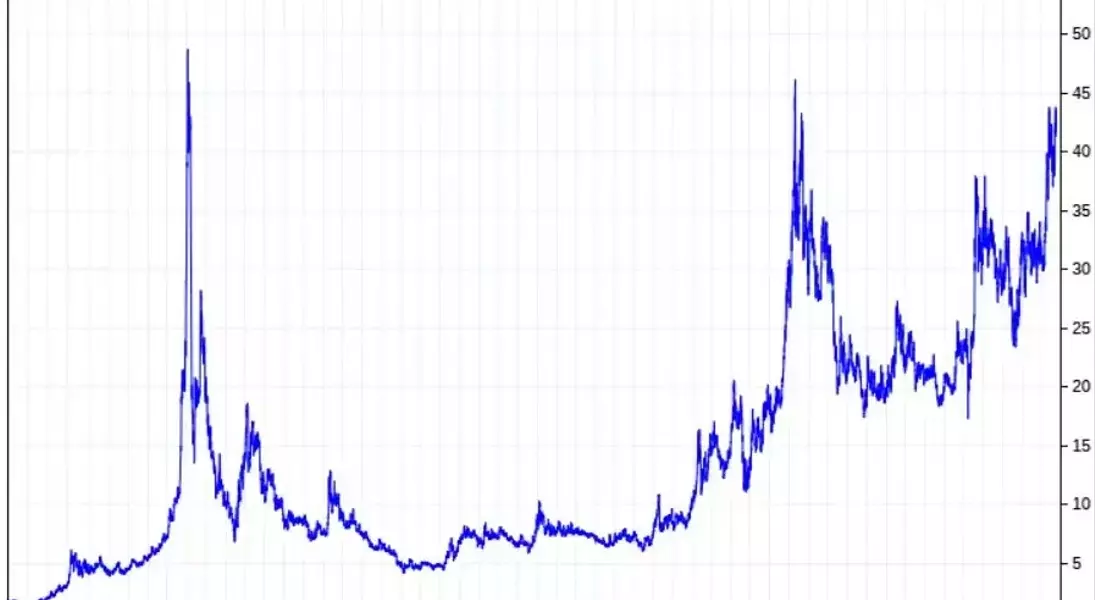

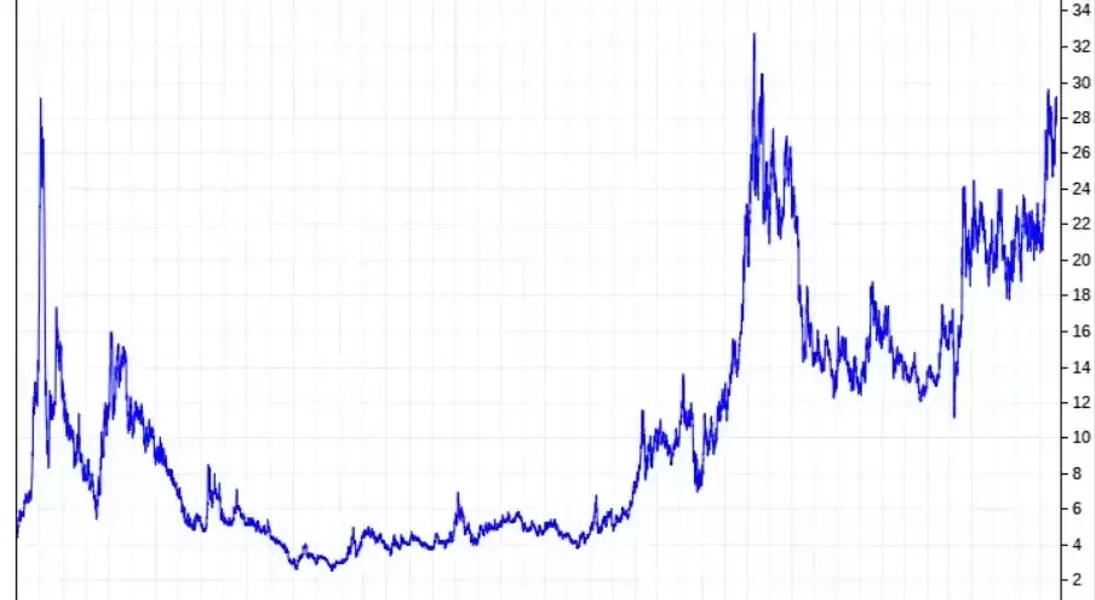

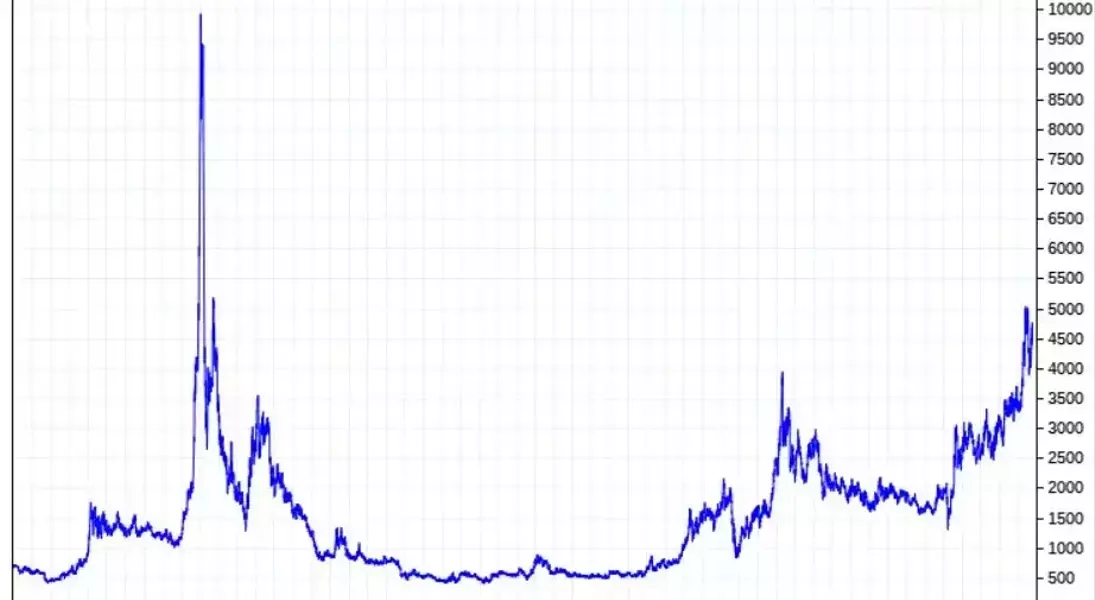

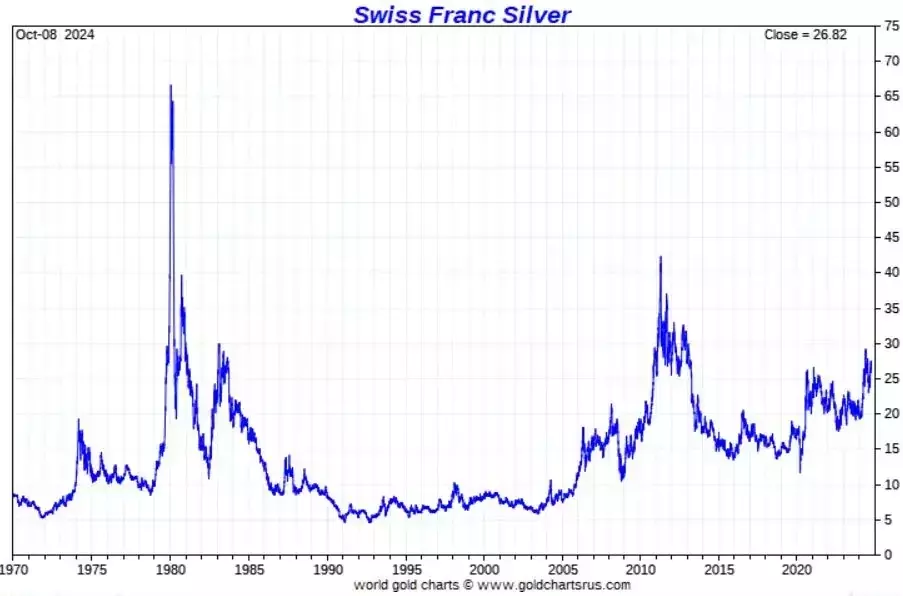

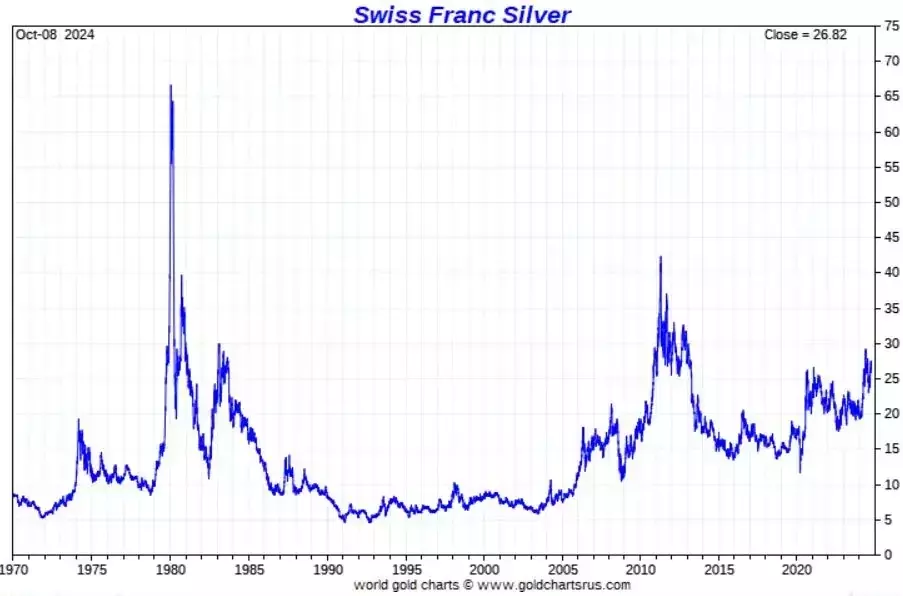

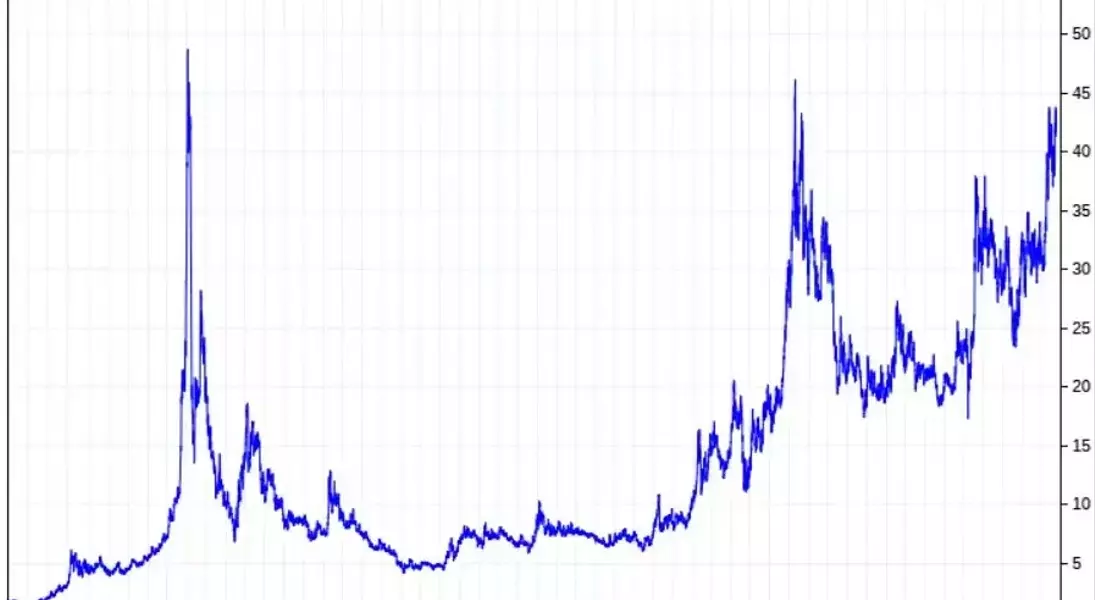

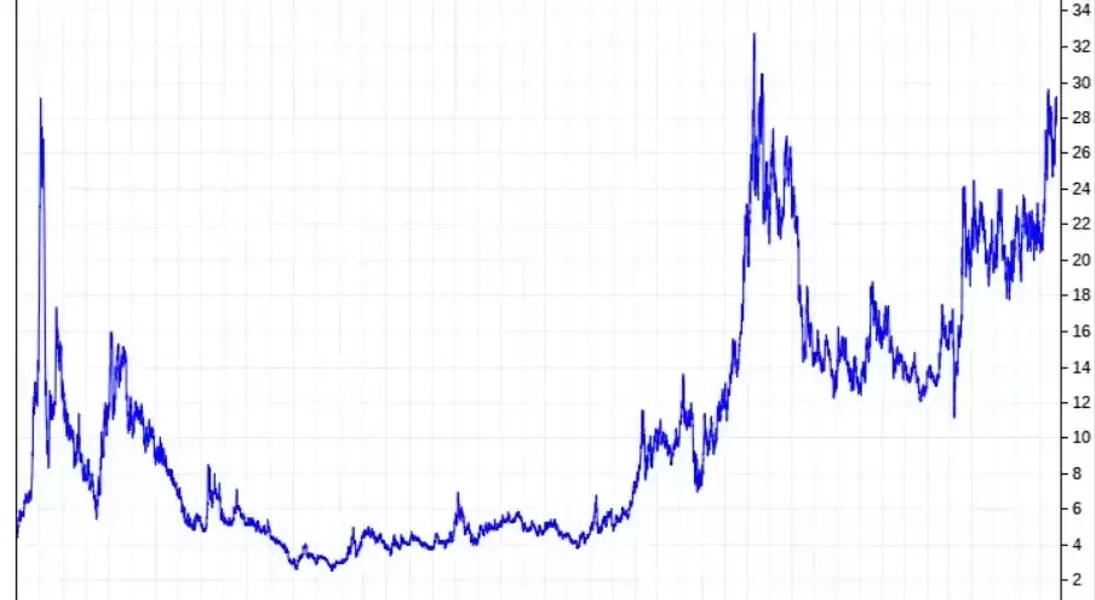

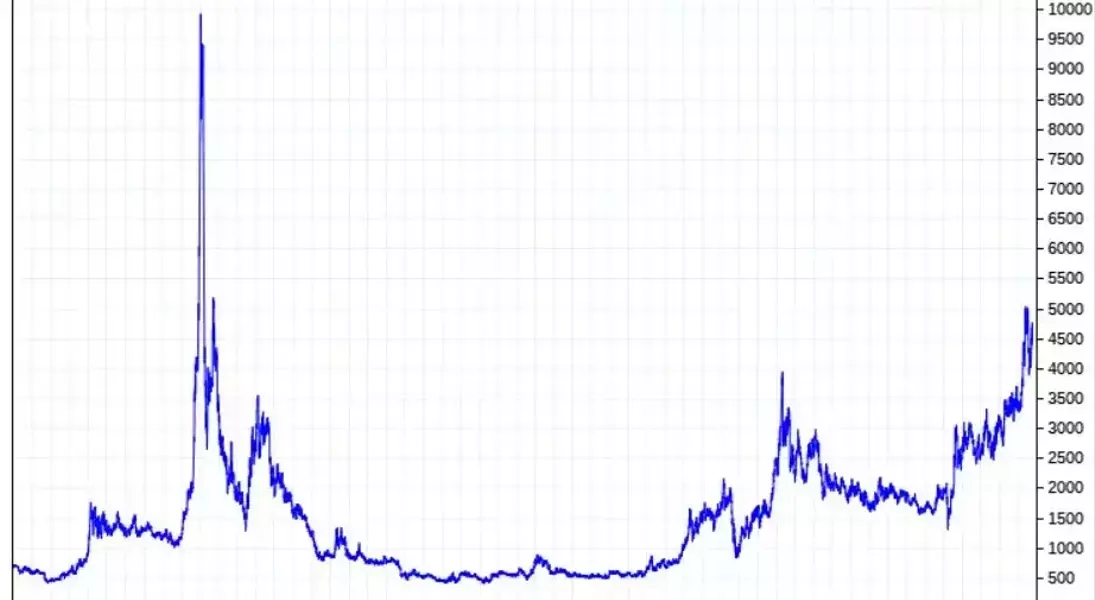

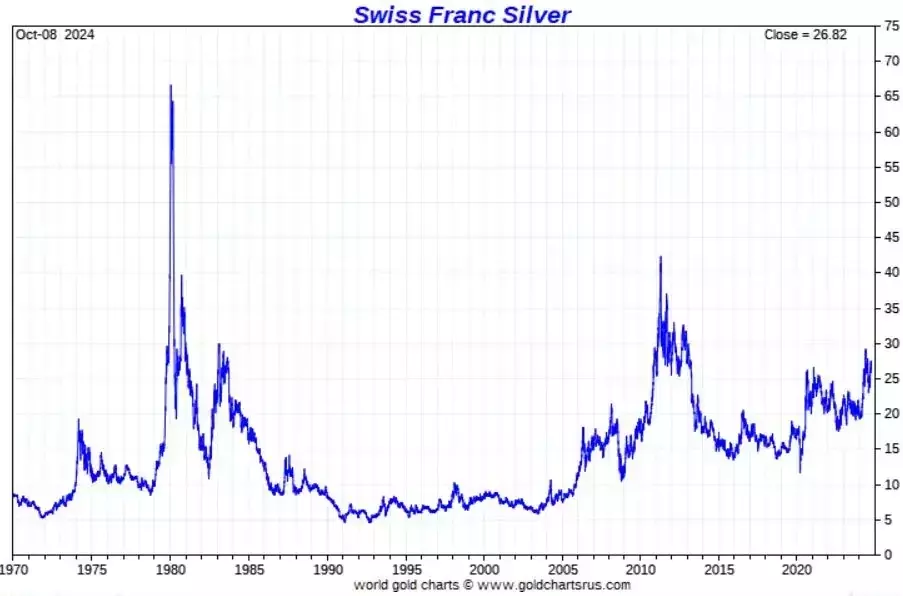

While the majority of global silver markets are experiencing a bullish resurgence, there are a few exceptions worth noting. In the case of silver priced in the Japanese Yen, the chart displays a unique dynamic, with a short-lived but enormous spike in January 1980 that skews the long-term perspective. Excluding this outlier, silver in Yen is nonetheless approaching its 1981 highs, a testament to its enduring appeal. Similarly, silver in the Swiss Franc, while exhibiting an extremely bullish chart setup, remains well below its all-time high, presenting a potential opportunity for investors attuned to the nuances of this market.The Global Silver Narrative: Implications and Opportunities

The comprehensive analysis of silver's performance across multiple global currencies paints a compelling picture of a robust and widespread bull market. While the silver price in US dollars may not have reached new highs, the global trend is undeniably bullish, with silver setting new records in a significant number of international markets. This global perspective underscores the resilience and universal appeal of silver, transcending the constraints of any single currency.For investors, this global silver narrative presents a unique opportunity to diversify their portfolios and capitalize on the broader market dynamics. By considering silver's performance across various currencies, investors can uncover hidden pockets of value and position themselves to benefit from the silver bull market, regardless of the US dollar's fluctuations. The stage is set for silver to shine brightly on the global stage, and savvy investors would be wise to take note.