Seniors are increasingly embracing artificial intelligence, a trend that challenges common misconceptions about older adults' engagement with advanced technology. Recent surveys reveal a significant uptake of AI tools among individuals aged 50 and above, indicating a proactive approach to integrating these innovations into their daily routines. This adoption is not merely for leisure; many seniors are leveraging AI for practical benefits, including health management, fostering social connections, and enhancing home security. This evolving landscape suggests that AI is becoming an indispensable tool for promoting independence and improving the quality of life for the elderly, aligning their technological adoption patterns with broader societal trends.

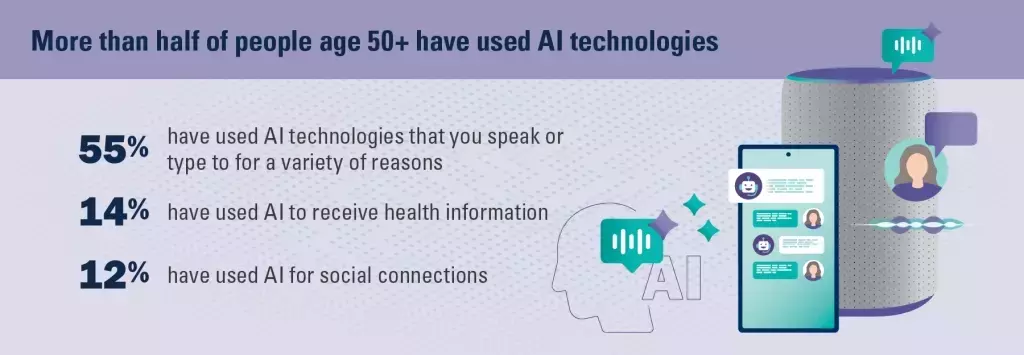

Data from the University of Michigan's National Poll on Healthy Aging highlights a notable shift: 55% of respondents in the 50-plus age bracket have interacted with voice or text-based AI technologies. A substantial portion, approximately one in seven, specifically use these tools to access health-related information or cultivate social interactions. Furthermore, over 90% of those employing AI for smart home functionalities and security purposes report that the technology significantly aids their ability to live safely and autonomously in their residences. This demonstrates AI's concrete benefits in supporting aging in place.

The Washington Post recently underscored this phenomenon by featuring a senior center in Maryland, where classes are offered to educate older adults on various aspects of AI. These courses cover practical applications, such as distinguishing between genuine and AI-generated imagery, effectively communicating with AI chatbots like ChatGPT, and refining AI-produced text to avoid generic phrasing. While AI presents opportunities, it also introduces challenges, notably the increased sophistication of scams and misinformation targeting older individuals. Fraudsters are exploiting AI to replicate voices and mine personal data, making it easier to deceive victims. Despite these risks, some studies, including one by HomeEquity Bank in Canada, suggest that older adults might possess a greater resilience to AI-driven scams than commonly assumed.

The integration of AI also extends to the reverse mortgage sector, where lenders are exploring how these technologies can refine client interactions and operational efficiencies. Bill Packer, Chief Operating Officer at Longbridge Financial, suggests that AI can help mitigate institutional biases, such as those in property appraisals, by offering an objective, data-driven assessment of housing values and historical property data. This approach is perceived as less biased than human judgment, which can be influenced by personal assumptions. Similarly, Andy Peach, Chief Lending Officer for Onity Group, highlighted the company's investment in AI with the launch of LASI, an AI tool designed for text queries and data extraction. LASI enables clients to search documents and pose unstructured questions about their portfolios, streamlining the oversight of serviced loans. These advancements show a clear industry move towards adopting AI for enhanced service delivery and risk management.

The burgeoning role of AI in the lives of seniors and within the reverse mortgage industry necessitates careful consideration of regulatory frameworks. Wendy Lee, a mortgage compliance expert, emphasized the importance of robust compliance measures in the AI era during the HousingWire AI Summit. She noted that Colorado's pioneering legislation to regulate AI system development and deployment is likely to set a precedent for other states. This regulation encompasses not only consumer privacy protection but also a re-evaluation of risk assessment strategies, which differ significantly from pre-AI environments. The evolving regulatory landscape, coupled with the increasing adoption of AI by seniors and its application in financial services, points to a future where technology plays a central role in supporting older populations, albeit with an imperative for ethical development and deployment.

Ultimately, the burgeoning acceptance of AI among the elderly represents a pivotal shift, reshaping their daily experiences and interaction with the world. This demographic's embrace of artificial intelligence underscores the technology's versatile utility, from personal assistance and social engagement to bolstering home security and independence. The proactive adoption by seniors, coupled with the financial industry's innovative applications of AI in areas like reverse mortgages, signals a transformative period. These developments collectively challenge long-held stereotypes, illustrating a dynamic integration of advanced technology into the lives of older adults, thereby enhancing their autonomy and well-being in an increasingly digitized society.