Chip Stocks Soar as Tech Titans Defy Economic Headwinds

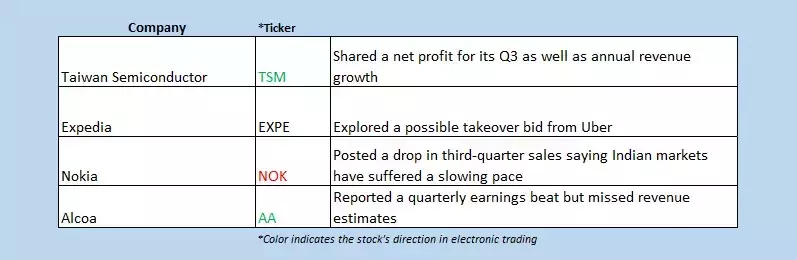

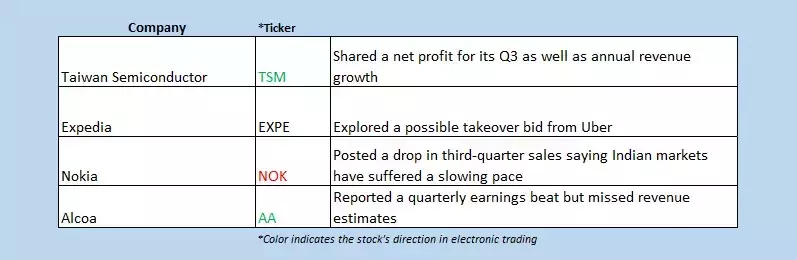

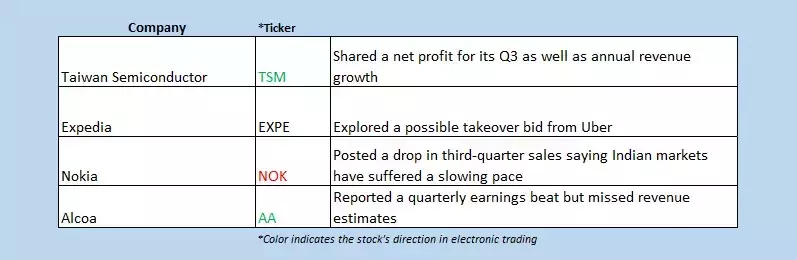

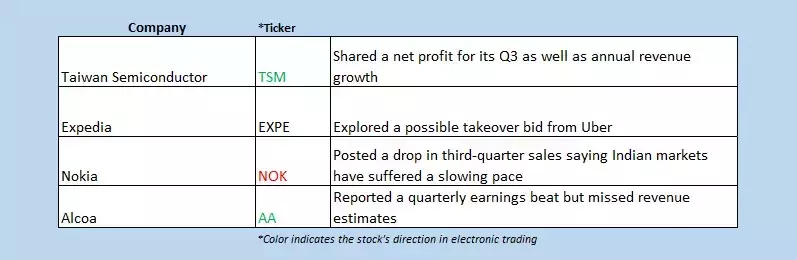

The tech sector is leading the charge in the stock market, with chip stocks emerging as the standout performers. A strong earnings report from Taiwan Semiconductor (TSM) has ignited a rally in the chip industry, while investors are also buoyed by the European Central Bank's (ECB) latest interest rate cut. Stateside, robust retail sales data for September has further fueled the optimism, setting the stage for a potentially strong trading session.Unlocking the Potential of Semiconductor Stocks

Taiwan Semiconductor's Triumphant Quarter

Taiwan Semiconductor, a global leader in semiconductor manufacturing, has delivered a third-quarter report that has the industry buzzing. The company's better-than-expected financial results and optimistic guidance have sent a clear signal that the chip sector is poised for continued growth, even in the face of broader economic challenges. Investors are eagerly anticipating the potential rally in semiconductor stocks, as the industry's resilience and technological advancements continue to drive investor interest.The ECB's Rate Cut: Boosting Global Equities

The European Central Bank's decision to slash its key interest rate by 25 basis points to 3.25% has provided a tailwind for global equities. This move, the third rate cut by the ECB this year, is aimed at stimulating the European economy and supporting financial stability. The positive sentiment generated by this decision has rippled across international markets, with European bourses leading the charge. Investors are closely monitoring the impact of this policy shift, as it could have far-reaching implications for the global financial landscape.Retail Sales Surge: A Bright Spot in the Economy

The latest retail sales data from the United States has provided a welcome boost to investor confidence. The 0.4% increase in September, surpassing the 0.3% consensus, suggests that consumer spending remains resilient despite broader economic headwinds. This robust performance in the retail sector is a testament to the strength of the American consumer, and it could have a positive spillover effect on various industries, including technology and e-commerce. Investors are closely watching this trend, as it could signal a more favorable outlook for the overall economy.Navigating the Volatility: Opportunities Abound

The current market landscape is characterized by a mix of challenges and opportunities. While some sectors, such as electric vehicles, have experienced sell-offs, others, like the insurance industry, have continued to thrive. Investors must navigate this volatile environment with a keen eye, identifying the sectors and companies that are poised to capitalize on the changing economic dynamics. By staying informed and adaptable, investors can position themselves to take advantage of the potential upside in the tech-driven market rally.The Road Ahead: Preparing for the Future

As the tech sector continues to lead the charge, investors must remain vigilant and proactive in their approach. The housing market, a crucial indicator of economic health, is expected to be a focal point in the coming days, as investors seek to gauge the broader trends shaping the economy. Additionally, the ongoing developments in the chip industry, the resilience of the retail sector, and the impact of the ECB's policy decisions will all play a crucial role in determining the trajectory of the markets. By staying attuned to these key factors, investors can position themselves to capitalize on the emerging opportunities and navigate the complexities of the ever-evolving financial landscape.You May Like