Nasdaq-100 Futures Plummet as Chip Makers Reel from ASML's Guidance Cut

The technology sector was rocked by a surprise announcement from ASML Holding NV, a leading semiconductor equipment manufacturer, as it lowered its 2025 guidance. This news triggered a massive selloff in Nasdaq-100 futures, with traders exiting positions at the fastest pace seen this year.Navigating the Turbulent Semiconductor Landscape

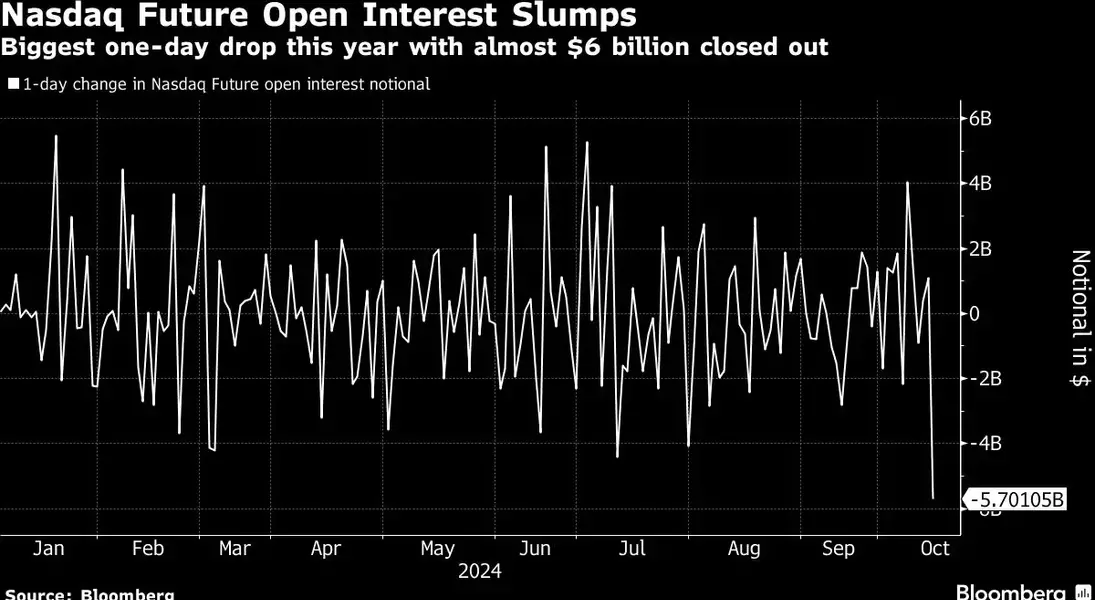

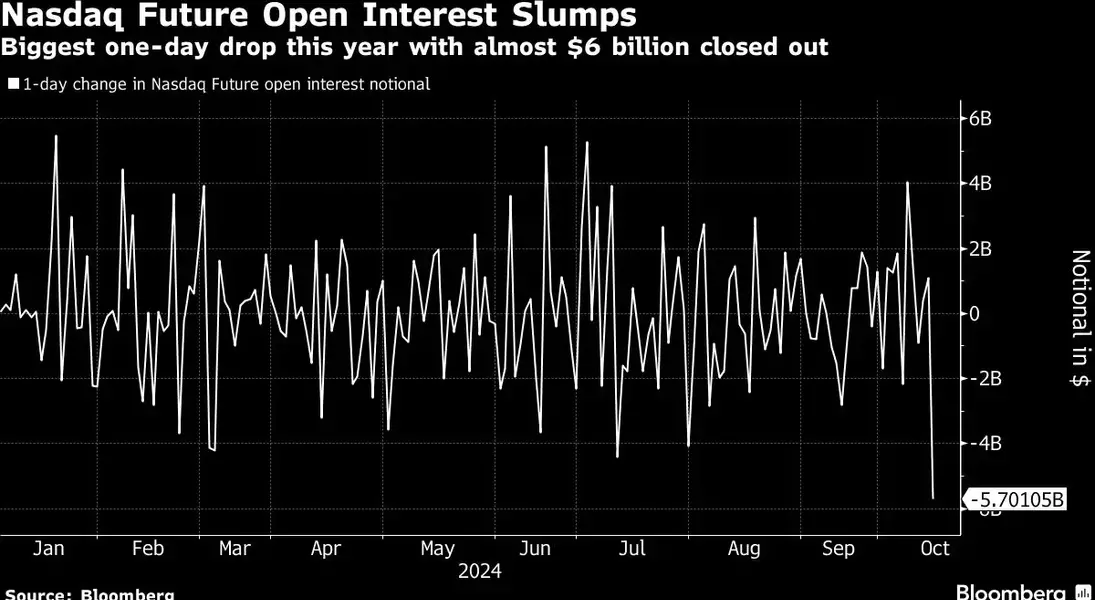

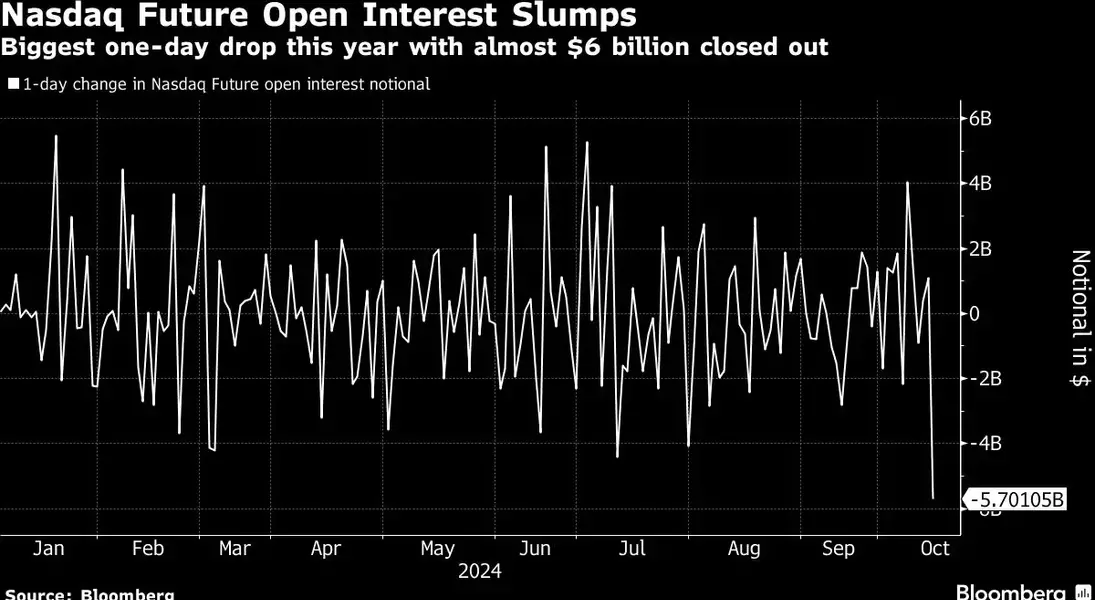

Exodus from Nasdaq-100 Futures

The open interest, or the size of outstanding positions, in Nasdaq-100 futures plummeted by a staggering $5.7 billion in notional value on Tuesday. This marked the biggest drop in 2024, dwarfing the average daily change. Despite the volume remaining relatively high at 524,000 contracts, just above the 20-day average, traders were clearly fleeing the broader technology space as ASML's early report reverberated across the semiconductor industry.Semiconductor Stocks Plunge Globally

The impact of ASML's guidance cut was felt globally, with chip makers losing a collective $420 billion in value. The Philadelphia Semiconductor Index, a key barometer for the industry, dropped a significant 5.3% on Tuesday, the largest decline since early September. Industry giants like Nvidia Corp. were caught up in the selloff, underscoring the widespread ripple effects of ASML's announcement.Navigating the Uncertainty

The semiconductor industry has long been a bellwether for the broader technology sector, and the recent turmoil has left investors and analysts grappling with the implications. As the dust settles, industry experts will be closely monitoring the market's response and the potential long-term impact on the semiconductor ecosystem. Navigating this volatile landscape will require a keen understanding of the industry's dynamics and the ability to adapt to rapidly changing market conditions.Implications for the Tech Sector

The semiconductor industry's woes have far-reaching consequences for the broader technology sector. As chip makers struggle, the ripple effects can be felt across a wide range of industries, from consumer electronics to enterprise software. Investors and industry stakeholders will need to closely monitor the situation and adjust their strategies accordingly to mitigate the potential risks and capitalize on any emerging opportunities.Weathering the Storm

The semiconductor industry has faced its fair share of challenges in the past, and the current turmoil is yet another test of its resilience. Companies that can navigate the uncertainty, adapt to changing market dynamics, and invest in innovative technologies are likely to emerge stronger from this downturn. The ability to weather the storm and seize new opportunities will be crucial for the industry's long-term success.You May Like