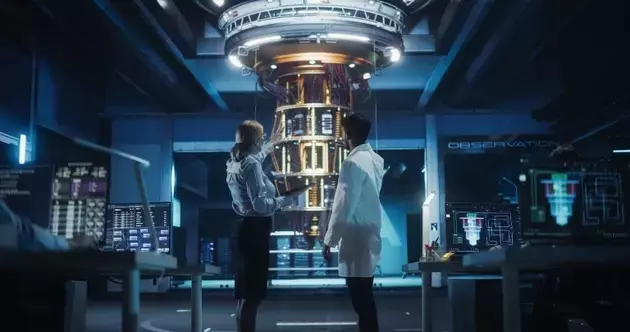

SEALSQ Corp. (LAES) is rapidly expanding, demonstrating a remarkable 66% year-over-year sales increase in fiscal year 2025, a surge primarily fueled by its strategic acquisition of IC'ALPS. This impressive performance has largely gone unnoticed by the market, presenting a compelling investment opportunity. The company's proactive approach to growth extends beyond organic expansion, with plans for significant mergers and acquisitions, including a potential $200 million majority stake in Quobly SAS, a company specializing in quantum-resistant security. This move is indicative of LAES's commitment to securing mission-critical sectors against emerging cyber threats.

With a substantial cash reserve of approximately $425 million, which represents about half of its $850 million market capitalization, LAES is exceptionally well-positioned to fund both its organic growth initiatives and its ambitious acquisition strategy. This strong financial standing provides the company with a significant advantage in a competitive and evolving technological landscape. The focus on quantum-resistant security through Quobly SAS highlights LAES's forward-thinking vision, addressing the critical need for advanced protection in an increasingly digital world. This strategic direction is poised to capitalize on the growing demand for robust cybersecurity solutions, particularly those capable of counteracting the threats posed by quantum computing.

The company's revenue guidance for fiscal year 2026 is equally ambitious, projecting a 50–100% year-over-year growth. Analysts estimate this could translate to revenues between $31.5 million and $37.5 million, with a robust pipeline exceeding $200 million supporting long-term upside potential. This optimistic outlook is grounded in both the successful integration of past acquisitions and the strategic investments being made in cutting-edge technologies like quantum security. The company's ability to consistently deliver strong financial results while simultaneously investing in future growth areas underscores its potential for sustained success.

The current market undervaluation of LAES, despite its significant growth and strategic initiatives, suggests a unique opportunity for investors. The company's commitment to innovation, coupled with its strong financial health and clear vision for expansion in high-demand sectors like quantum technology, positions it as a promising player in the market. As the importance of quantum-resistant security grows, LAES's early and substantial investment in this area is likely to yield considerable returns.

Overall, SEALSQ Corp. is a dynamic entity showcasing impressive growth and strategic foresight. Its strong financial position, aggressive M&A strategy, and focus on high-growth areas like quantum-resistant security indicate a company with significant potential for long-term value creation, making it a compelling consideration for discerning investors.