Navigating the Shifting Tides: A Comprehensive Market Outlook

As the financial markets brace for the highly anticipated Federal Reserve interest rate decision, investors are closely monitoring a range of asset classes, from equities to bonds and commodities. This comprehensive market analysis delves into the key trends and strategies shaping the investment landscape, providing valuable insights to help navigate the evolving market dynamics.Unlocking Opportunities Amidst Shifting Tides

Equities: Riding the Wave of Resilience

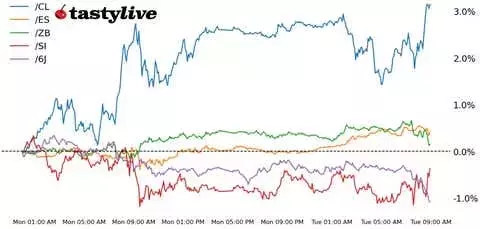

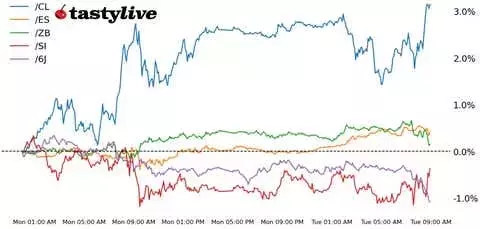

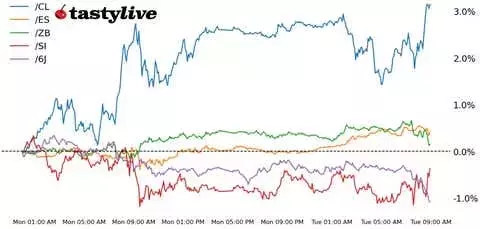

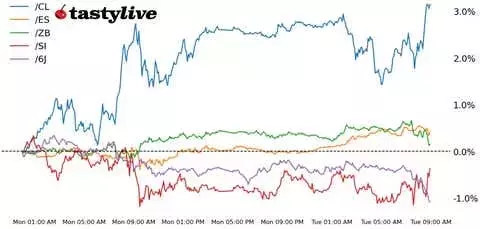

The S&P 500 E-mini futures (/ES) have shown a positive performance, rising by 0.43%, reflecting the market's confidence ahead of the Fed's decision. This optimism is further bolstered by the resilience of the U.S. consumer, as evidenced by the latest retail sales data. Traders appear to be anticipating a 25-basis-point rate cut, which they believe will signal the Fed's confidence in the soft-landing narrative it has been pursuing. Notable movers in the equity space include Intel (INTC), which is up 5% in pre-market trading after announcing plans to spin off its foundry business, and Microsoft (MSFT), which has seen gains following a boost in its quarterly dividend.Bonds: Navigating the Yield Curve

The retail sales data has had a slight impact on the bond market, with yields along the middle- and long-ends of the curve edging lower. The 30-year T-bond futures (/ZB) have risen by 0.15%, as the Fed's anticipated rate cut is not expected to be as aggressive as some had anticipated. The Treasury will be auctioning 20-year bonds today, which could further influence the bond market dynamics.Metals: Balancing Demand and Macroeconomic Factors

Silver futures (/SI) have experienced a slight decline of 0.21%, as the dollar has gained some ground ahead of reaching its August low. The upbeat economic conditions highlighted by the retail sales data have reduced the chances of a more aggressive 50-basis-point rate cut, which could have been beneficial for non-interest-bearing assets like silver. Meanwhile, gold prices (/GC) have also faced some pressure this morning.Energy: Navigating Supply and Demand Dynamics

Crude oil futures (/CL) have risen by 0.51%, continuing a trend higher from the September 10th swing low. However, the market remains cautious, as China's refinery activity has dropped for the fifth consecutive month, keeping traders on edge about the faltering demand story that has plagued the oil market recently. Additionally, about 12% of oil production in the Gulf of Mexico remains shut down after Hurricane Francine moved through Louisiana.Foreign Exchange: Shifting Tides in the Currency Markets

The Japanese yen futures (/6J) have declined by 0.39%, as the reduction in the chances for a larger Fed rate cut has pulled on the Japanese currency. However, the yen is still expected to remain slated for more gains through the year as the policy divergence between the Fed and the Bank of Japan shifts. Traders may find opportunities in buying into yen weakness.Overall, the market is navigating a complex landscape, with various asset classes responding to the evolving macroeconomic conditions and the impending Fed decision. Investors and traders must remain vigilant, analyzing the nuances of each market segment to identify and capitalize on the emerging opportunities amidst the shifting tides.You May Like