Navigating the Shifting Tides: A Comprehensive Market Outlook

In the ever-evolving landscape of global markets, investors and traders are closely monitoring the fluctuations in key asset classes, from equities to commodities and currencies. This comprehensive market analysis delves into the latest developments, providing insights and strategies to help navigate the dynamic financial terrain.Unlocking Opportunities Amidst Market Volatility

Equities: Resilience in the Face of Uncertainty

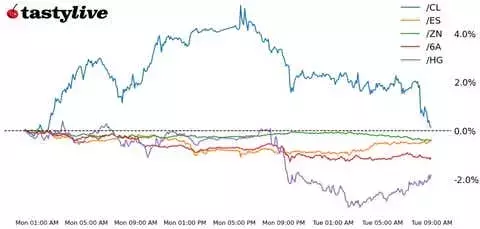

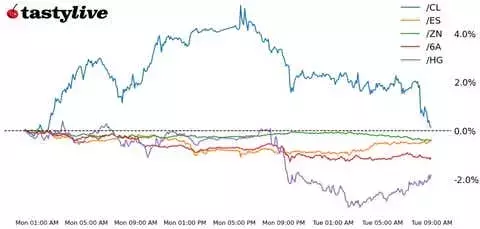

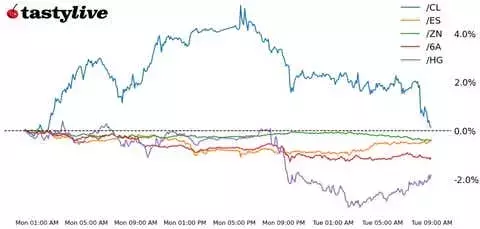

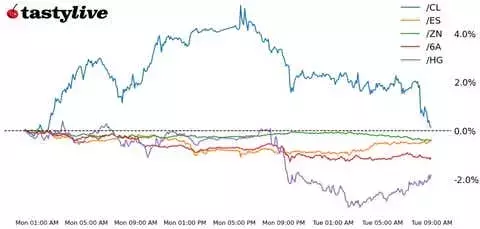

The equity markets have demonstrated a remarkable resilience, shrugging off geopolitical tensions and shifting their focus to the Federal Reserve's policy decisions. S&P 500 futures (/ESZ4) have gained 0.64%, reflecting a renewed appetite for risk assets. This uptick comes after a sluggish start to the week, as traders regain confidence in the market's ability to weather the storm. Key players like PepsiCo (PEP) and Wells Fargo (WFC) have seen notable pre-market movements, underscoring the dynamic nature of the equity landscape.Investors should closely monitor the performance of technology leaders, such as Nvidia (NVDA), which are poised to lead the charge in the equity markets. The strategic positioning of these industry giants can provide valuable insights into the broader market sentiment and potential opportunities for savvy investors.Bonds: Navigating the Shifting Yield Curve

The bond market has experienced a mixed performance, with 10-year T-note futures (/ZNZ4) declining by 0.11%. This movement reflects the ongoing adjustments in the market's expectations regarding the Federal Reserve's monetary policy. Traders are closely watching for any signs of a potential 25-basis-point (bps) rate cut or a hold, as these decisions can significantly impact the bond market's trajectory.The upcoming three-year note auction will be a crucial event to monitor, as it can provide valuable insights into the demand for fixed-income instruments. Investors should carefully analyze the auction results and the subsequent market reactions to identify potential opportunities or risks within the bond market.Commodities: Copper Struggles, Oil Prices Fluctuate

The commodities market has presented a mixed picture, with copper futures (/HGZ4) declining by 1.84% as Chinese traders returned from a week-long holiday. This decline can be attributed to the recent moderation in expectations for fiscal stimulus from Chinese policymakers, which has dampened the demand outlook for the industrial metal.In contrast, crude oil futures (/CLZ4) have experienced a more volatile performance, declining by 4.26%. This movement can be partly attributed to the ongoing geopolitical tensions in the Middle East, as well as the potential disruptions caused by Hurricane Milton in the Gulf of Mexico. The impact of the storm on oil and natural gas exports is likely to be reflected in the upcoming inventory data from the American Petroleum Institute (API) and the government.Investors should closely monitor the developments in the commodities market, as the interplay between supply, demand, and geopolitical factors can create both challenges and opportunities for those seeking to capitalize on these dynamic asset classes.Currencies: Australian Dollar Faces Headwinds

The currency markets have also seen some notable movements, with the Australian dollar futures (/6AZ4) declining by 0.16%. This decline can be attributed to the toned-down rhetoric for fiscal stimulus from China, which has weighed on the Australian currency. Additionally, the dovish tone from the Reserve Bank of Australia (RBA) has contributed to the Australian dollar's recent struggles.Traders should closely monitor the developments in the currency markets, as the interplay between monetary policy, economic indicators, and geopolitical factors can significantly impact the performance of various currency pairs. Identifying potential opportunities or risks within the forex market can be a crucial component of a well-diversified investment strategy.Navigating the Complexities: Strategies for Traders

As the markets continue to navigate the shifting tides, traders and investors must adapt their strategies to capitalize on the evolving landscape. The article presents several options strategies, including iron condors, short strangles, and short put verticals, across various asset classes.These strategies offer a range of risk-reward profiles, allowing traders to tailor their approach based on their risk tolerance and market outlook. By carefully analyzing the potential profit and loss scenarios, as well as the probability of success (POP), traders can make informed decisions and position themselves to potentially benefit from the market's fluctuations.Ultimately, the key to navigating the complexities of the financial markets lies in a comprehensive understanding of the underlying drivers, a disciplined approach to risk management, and a willingness to adapt to the ever-changing market conditions. By staying informed, diversifying their portfolios, and employing strategic options strategies, traders can position themselves to navigate the shifting tides and unlock new opportunities in the dynamic global markets.