Robinhood Markets, a disruptive force in the financial industry, is poised for significant future expansion. Currently valued at $112 billion, the company aims to join the elite trillion-dollar market capitalization club within the next two decades. This ambitious goal requires a compound annual growth rate of 11.6%, which, though challenging, appears within reach given Robinhood's unique position and burgeoning popularity among a new generation of investors.

Robinhood's Ascent: Redefining Financial Engagement for a New Generation

Founded on the principle of democratizing financial services, Robinhood has spearheaded innovations such as commission-free trading, fractional share ownership, and the elimination of minimum balance requirements. These offerings have resonated strongly with younger demographics, particularly millennials and Gen Z, who favor mobile-first platforms and harbor a different relationship with traditional financial institutions. This strategic alignment with evolving investor preferences has been a key driver of Robinhood's recent success, evidenced by its substantial growth in revenue and stock performance over the past two years.

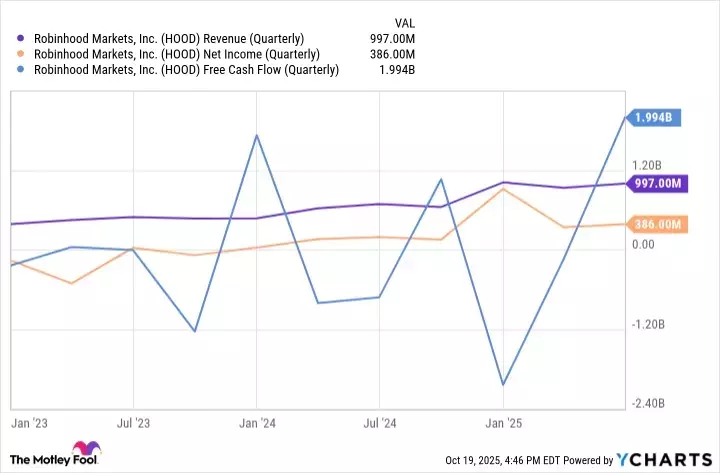

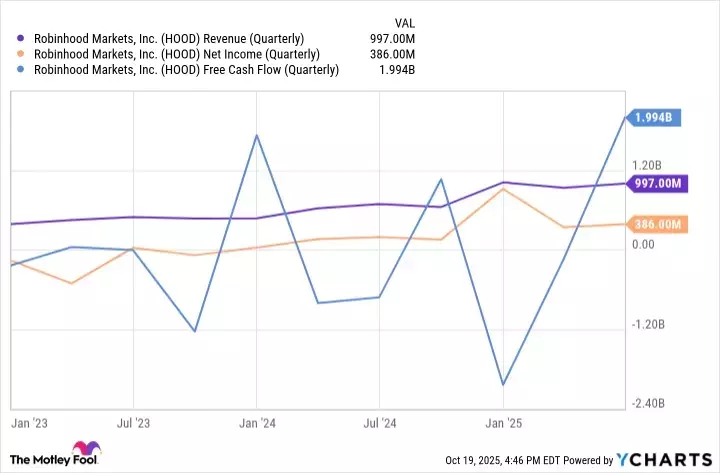

As of the second quarter, Robinhood reported an impressive $279 billion in total platform assets, nearly doubling year-over-year. The number of funded customer accounts surged by 10% to 26.5 million, while its premium Gold service subscriptions climbed by 76% to 3.5 million. These figures underscore the platform's expanding ecosystem and its increasing penetration into the investment landscape. As younger generations mature into their peak earning years, their continued engagement with Robinhood's diverse range of services, including stock trading, retirement accounts, and other financial products, is expected to fuel sustained long-term growth.

Despite facing competition from established banks that have adopted similar modern trading models, Robinhood maintains distinct competitive advantages. Its brand name has become synonymous with accessible, commission-free trading, making it a primary choice for new investors. Furthermore, as users increasingly integrate various financial plans into their Robinhood accounts, the platform benefits from high switching costs, fostering customer loyalty. While some critics point to the company's high forward earnings multiple of 71 times, significantly above the financial industry average, proponents argue that this valuation reflects Robinhood's transformative role in the financial sector and its immense future potential. The company's innovative approach and deep connection with its user base position it favorably to achieve its trillion-dollar aspiration by 2045.

The journey of Robinhood Markets offers a compelling case study in market disruption and adaptation. Its success highlights the power of understanding and catering to the evolving needs of consumers, particularly in a sector as traditionally conservative as finance. The company's commitment to accessibility and user-friendly technology has not only reshaped the investment landscape but also demonstrated the significant economic influence of younger generations. This narrative underscores a crucial insight: businesses that can effectively bridge the gap between complex industries and modern consumer expectations are best positioned for exponential growth and long-term relevance. Robinhood's trajectory provides valuable lessons for aspiring innovators and established players alike, emphasizing the importance of foresight, adaptability, and a customer-centric approach in navigating the future market. The financial world is undoubtedly changing, and Robinhood is at the forefront of this transformation.