Navigating the Shifting Tides: US Yields and Global Currency Dynamics

The global financial landscape is in a state of flux, with the US dollar index experiencing a rollercoaster ride and yields on US Treasuries marching higher. This article delves into the intricate dynamics shaping the currency markets, exploring the implications for investors and policymakers alike.Charting the Course: Analyzing the Ebb and Flow of the US Dollar

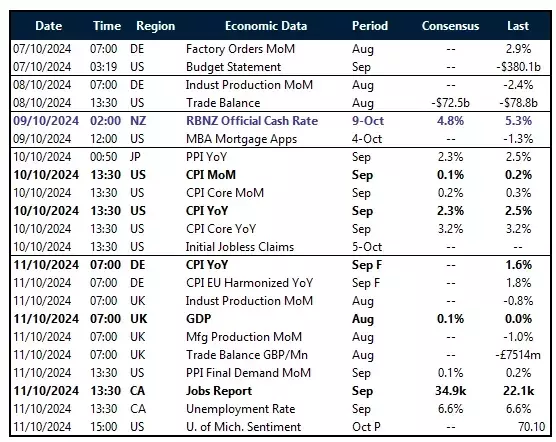

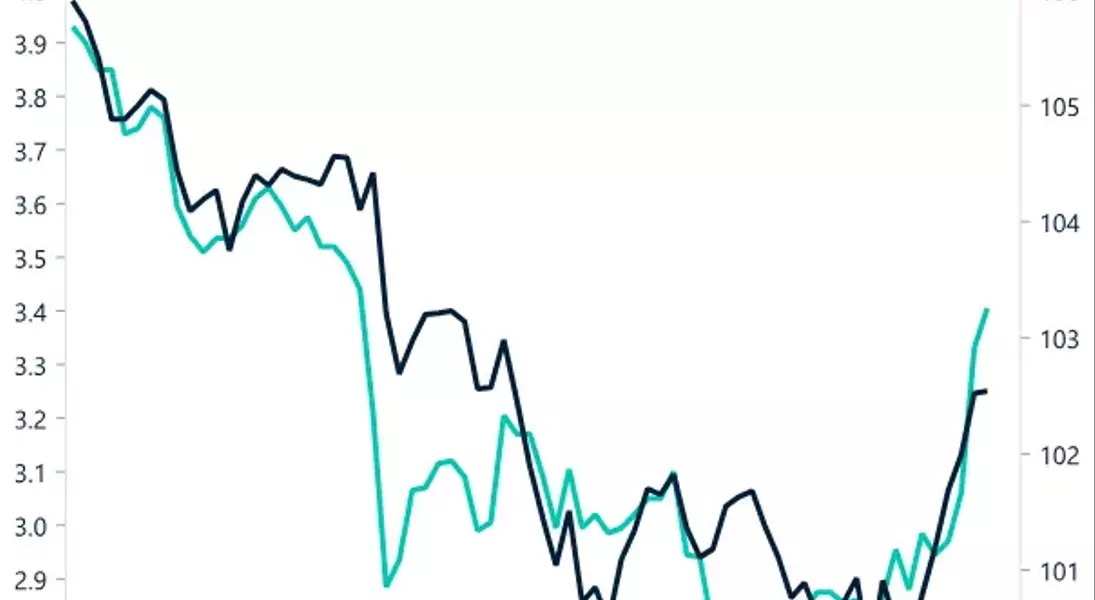

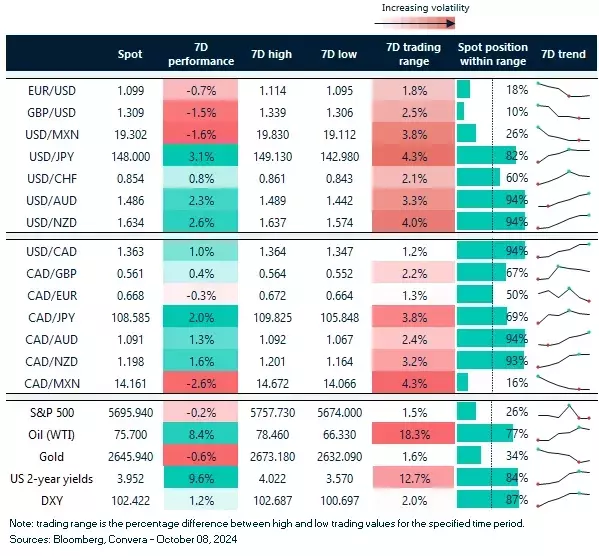

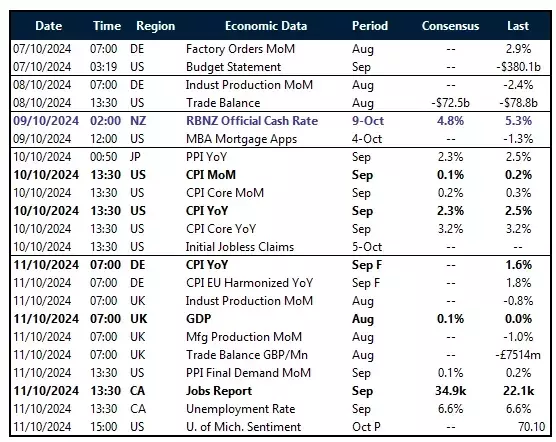

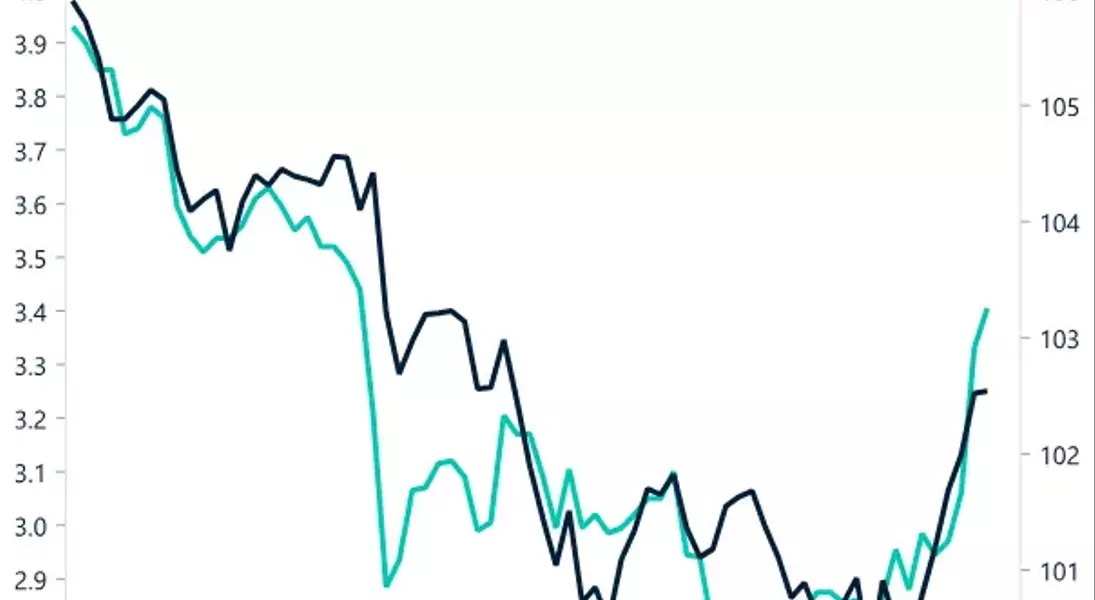

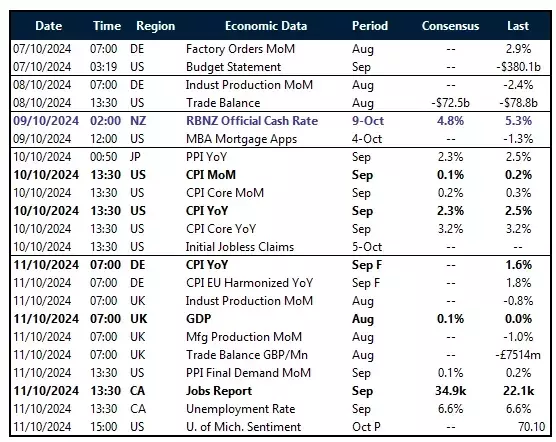

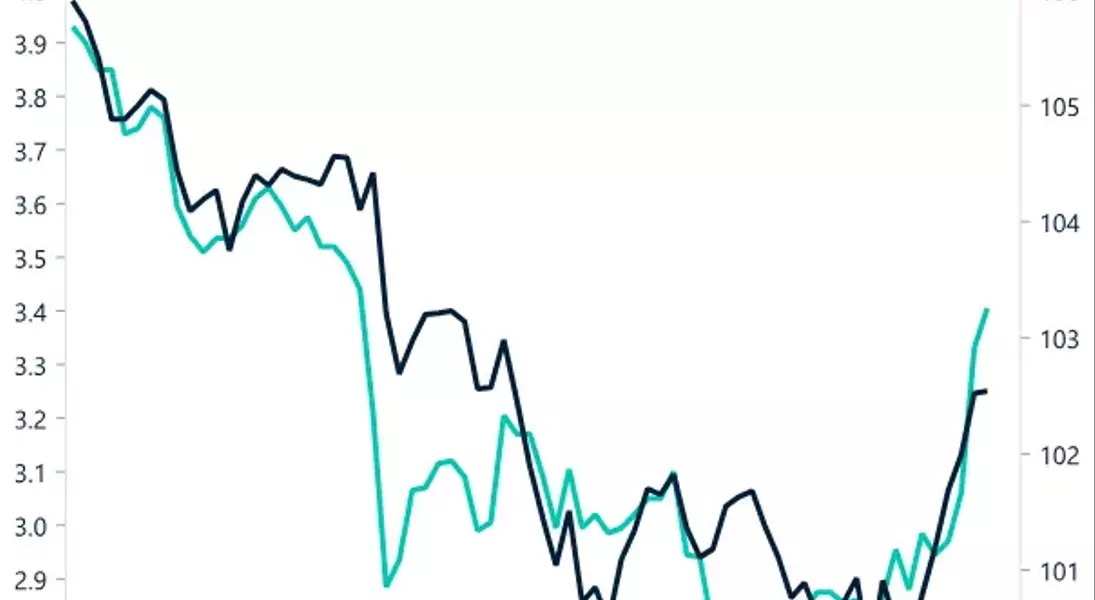

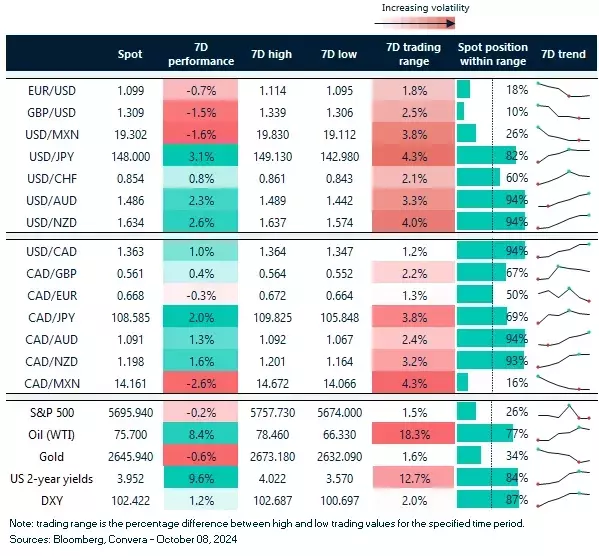

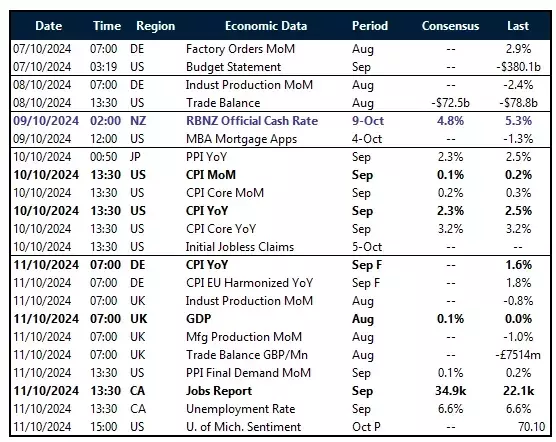

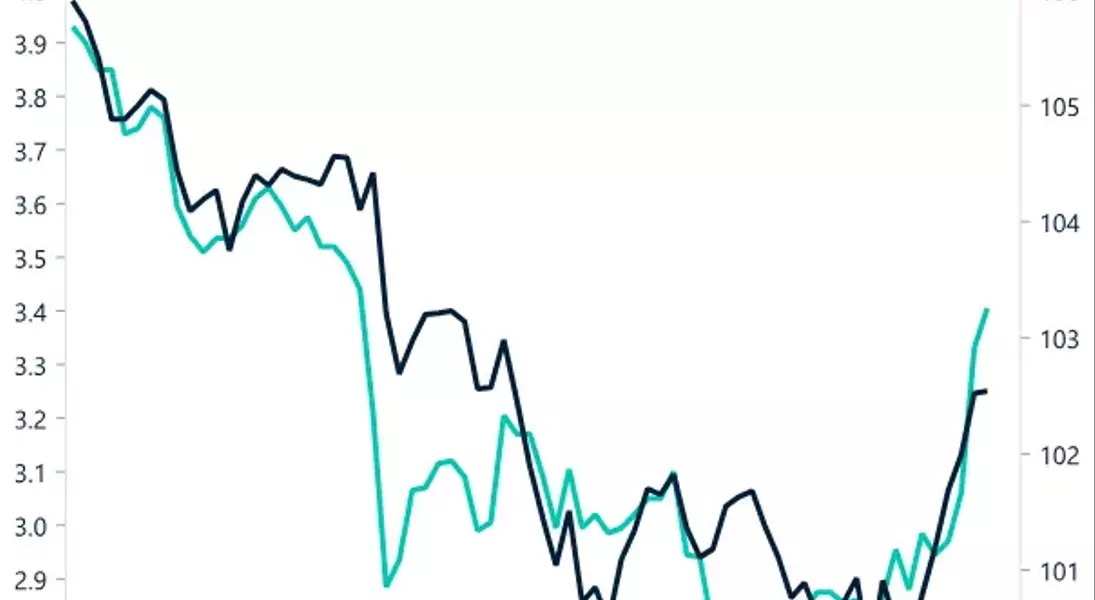

The US dollar index, a measure of the greenback's strength against a basket of major currencies, has been on a wild ride lately. After its best week in over two years, the index snapped a five-day winning streak on Monday, with the dollar's greatest losses seen against its safe-haven peers, the Swiss franc and Japanese yen. However, risk-sensitive currencies like the British pound, Australian dollar, and New Zealand dollar still underperformed against the USD, falling in line with equities as traders trim their bets on Federal Reserve (Fed) rate cuts.The driving force behind this volatility is the yield on the benchmark 10-year US Treasury, which has surged back to the 4% level, a level not seen since August. This sharp rise in yields was prompted by the stronger-than-expected jobs report on Friday, which prompted traders to reassess the outlook for US monetary policy. The market is now grappling with a "no landing" scenario, where the US economy continues to grow, inflation starts to resurface, and the Fed has little room to cut interest rates.As a result, markets have now priced out any chance of another 50-basis point rate cut from the Fed in November, while assigning an 85% probability of a more modest 25 basis point reduction. This shift in expectations has been a key factor behind the dollar's recent strength. However, the dovish shift from other major central banks has also made their respective currencies less appealing, further bolstering the dollar's position.Looking ahead, an extended dollar bounce is increasingly feasible if incoming US data continues to support a more hawkish Fed repricing. Importantly, if US Treasury yields continue to rise sharply on a relative basis to G10 peers, this would be another positive factor for the US currency. Moreover, a lack of fiscal stimulus announcements from China, causing a stir in equity markets, could provide the dollar with a safe-haven tailwind as well.The Pound's Struggle for Support

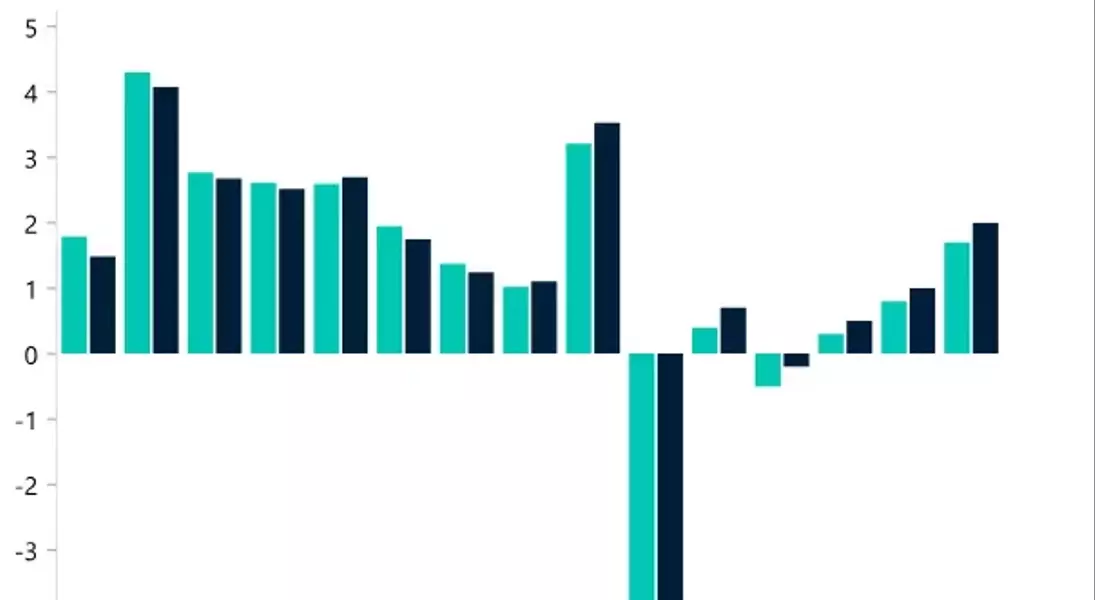

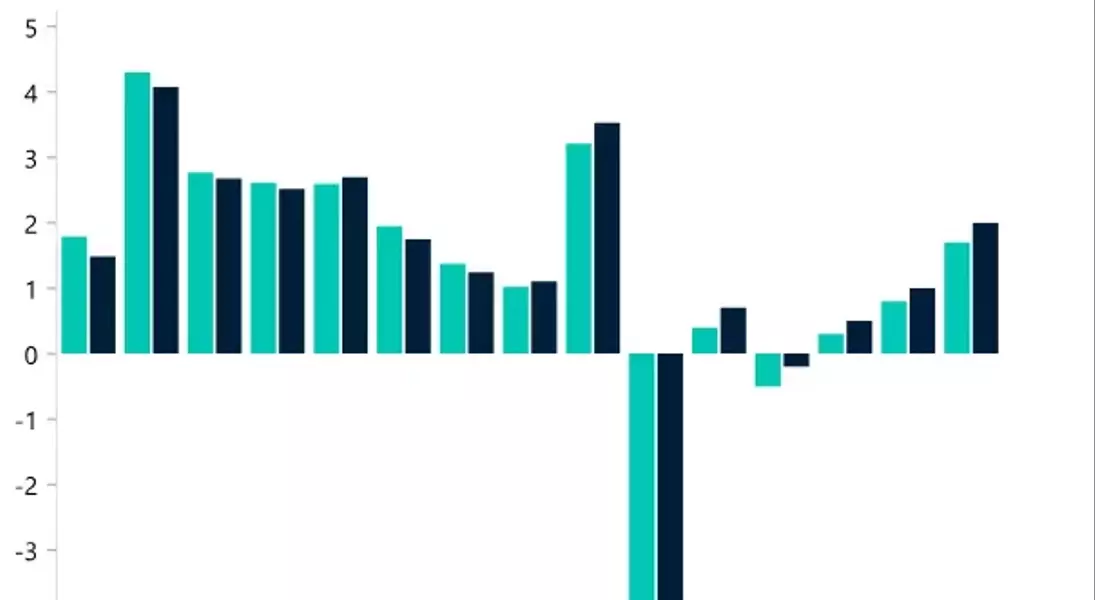

The British pound remains on the defensive this week, falling to its lowest level in almost a month against the US dollar on Monday. GBP/USD broke below $1.31, while GBP/EUR slumped closer to €1.19 despite the fact that UK yields are on the rise. The somewhat risk-off mood during the Asian session due to the lack of Chinese stimulus announcements hasn't helped the risk-sensitive pound.Data published yesterday showed UK salaries increased at the slowest pace in three-and-a half years in September, a fresh sign that the labor market is loosening. The increased number of candidates and reduced demand for staff limited pay growth for permanent hires to the weakest since February 2021. This supports growing expectations of more aggressive rate cuts by the Bank of England (BoE).However, in line with US yields rising after the strong US jobs report, UK gilt yields have spiked to multi-month highs across the curve, offering the pound some support. Meanwhile, data this morning showed retail sales in the UK rose 1.7% on a like-for-like basis in September from a year ago, the fastest pace of growth in six months, indicating a busy festive season ahead.With the pound still the best-performing currency year-to-date, up over 3% against the dollar, and with speculative traders still net-bullish GBP, this may give traders reason to take profit into year-end, especially as the upcoming UK Budget and the US presidential election bring an element of near-term uncertainty.The Euro's Struggle for Stability

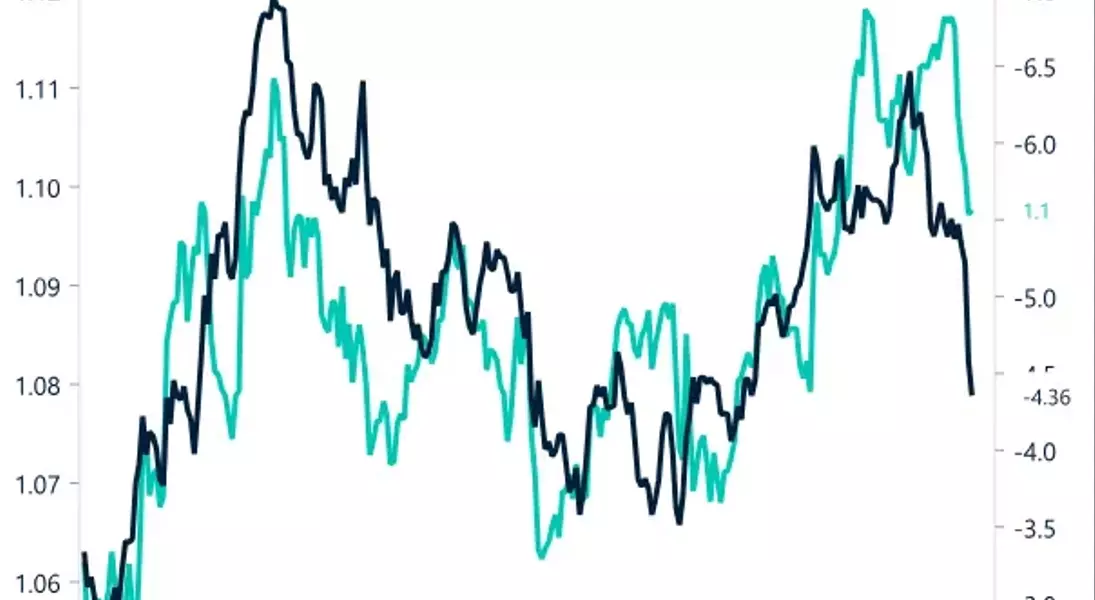

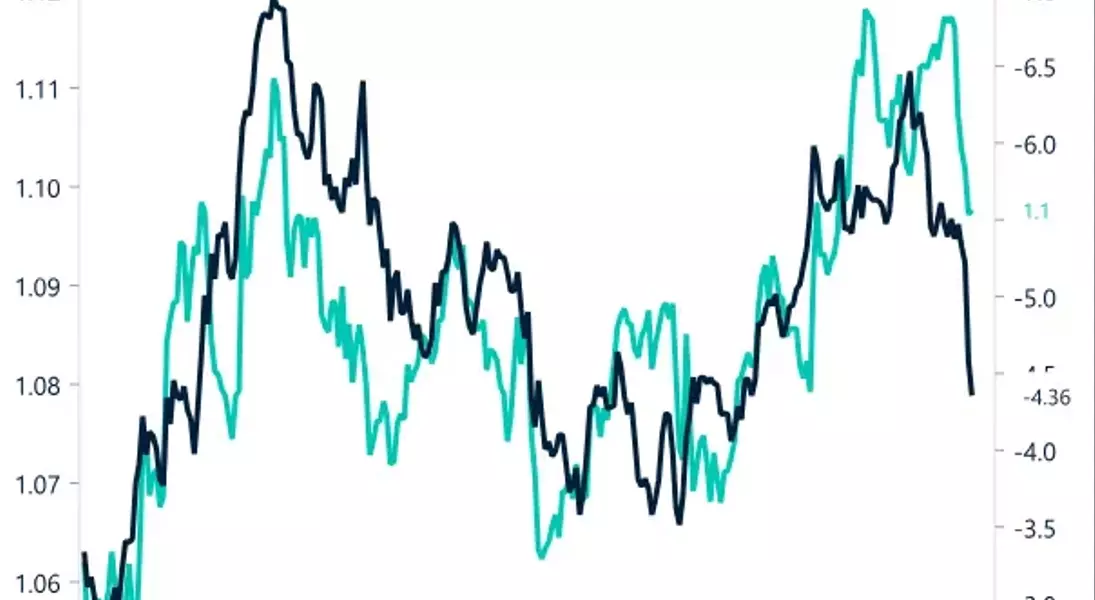

The euro continues to trade below the $1.10 mark this morning as European equities are expected to open the trading session lower. Chinese markets lost some momentum as well and underperformed their peers since Friday. Oil prices are on the rise as Brent oil topped the $80 a barrel mark for the first time in six weeks, with geopolitical uncertainty surrounding the tensions between Iran and Israel weighing somewhat on pro-cyclical currencies.However, the main drag on the euro remains the downside revision of Fed cuts this year and the continued weakness of the German economy. German factory orders declined by 5.8% in August, the largest fall since January 2024. Inflation in most large economies of the Eurozone has fallen below 2% as well, raising the prospects of the European Central Bank (ECB) cutting interest rates by 25 basis points next week.Recent speeches from policymakers have tried to prepare the markets for this shift, which should have pushed down yields on the short end. However, the repricing of US Treasury yields higher in reaction to better economic data has stopped the fall in Bund yields. The convergence between the ECB and Fed has naturally put pressure on EUR/USD as the currency pair fell from $1.12 to sub $1.10 last week.A Shift in the Global Risk Landscape

The current market environment is characterized by a risk-off sentiment, with high-beta currencies like the British pound, Australian dollar, and New Zealand dollar slumping against the US dollar. This shift in sentiment can be attributed to a combination of factors, including the repricing of Fed rate cuts, the continued weakness in the German economy, and the lack of fiscal stimulus announcements from China.The Hang Seng index, for example, is tumbling toward its worst day since 2008, down more than 7%, while China's CSI300 index is heading for a gain of 5%. This divergence in performance between the two major Chinese indices highlights the uncertainty and volatility that is currently gripping global markets.As investors navigate this shifting landscape, it will be crucial to closely monitor the developments in the US Treasury market, the actions of major central banks, and the geopolitical tensions that are shaping the global risk environment. The coming weeks and months are likely to be marked by continued volatility and uncertainty, underscoring the importance of a well-diversified investment strategy and a keen understanding of the underlying drivers of currency and asset price movements.