In recent years, construction "megaprojects," typically defined as those costing $1 billion or more, have been on the rise. Industry sources highlight this trend as sectors ranging from technology to manufacturing undertake increasingly large endeavors. These projects bring with them a host of challenges, particularly in the realm of large-scale risk management and insurance. Completing large insurance placements while grappling with increased input costs poses significant difficulties.

Unraveling the Challenges and Growth of Construction Megaprojects

Project Multiplication and Industry Impact

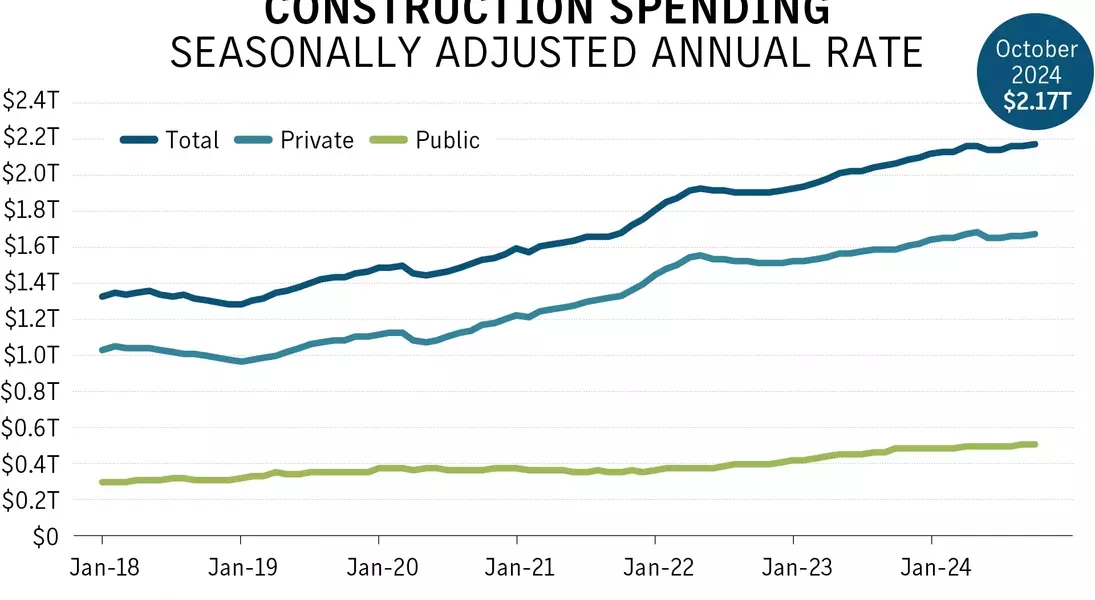

The number and frequency of $1 billion-plus construction projects have witnessed a significant multiplication. Just a few years ago, large-scale construction projects occurred at a rate of four or five per year. Now, across industries like technology and manufacturing, we see three to four such projects per quarter. Data centers, for instance, are huge undertakings. With the added cost of technology hardware and cooling equipment necessary for these facilities, they reach the billion-dollar mark surprisingly quickly. The automotive, aerospace, and chip manufacturing sectors are also actively involved in large building projects. Patrick McBride, the Dallas-based head of construction property for Zurich North America, states that we are seeing a record number of billion-dollar projects. In fact, we probably see one a week, if not every two weeks.In addition to data centers, the manufacturing sector, including electric vehicle manufacturers, electric vehicle battery manufacturers, and the broader semiconductor sector, along with the demand for artificial intelligence and cloud computing, is driving this growth. As per the U.S Census Bureau, construction spending in October was estimated at a seasonally adjusted annual rate of $2.174 trillion, 0.4% above the revised September estimate and 5% above the October 2023 estimate. During the first 10 months of this year, construction spending totaled $1.815 trillion, up 7.2% from the same period in 2023.Rising Costs and Inflation's Impact

Rob McDonough, the New York-based U.S. construction practice leader for Marsh LLC, notes that we have definitely seen an increase in megaprojects. He points to the onshoring initiative with chip manufacturing facilities, as well as the electric vehicle sector and large infrastructure projects like airports and rail. In addition to physically larger and more complex projects, inflation and input costs have driven up the value of many larger projects. Since February 2020, construction costs have risen almost 40%. The values of projects are getting larger due to inflation; labor and other input prices are simply more expensive. A job that might have been $700 million in the past is now well over a billion.Insurance Challenges and Market Responses

As the projects get larger, individual lines of coverage extended by insurers have shrunk. Sometimes, they have reduced from as much as $25 million to as little as $10 million, leaving more work for brokers to put together ever-larger coverage towers. However, sources emphasize that there is enough capacity in the marketplace for project owners and others to complete placements, albeit with more effort. Ed Totten, the Philadelphia-based profit center head, excess liability construction for Axa XL, a unit of Axa SA, states that it's definitely more work to stitch together the towers, but there is plenty of capacity. Years ago, you could put up $25 million chunks, but now those have been cut down to $10 million chunks. So, a $100 million tower will require more participants. There is a certain strain, and brokers are doing more to complete coverage towers, in some cases tapping global capacity from London or Bermuda markets for the largest projects.Data and analytics also play a crucial role. Zurich's Mr. McBride mentions that some project owners opt to purchase insurance limits based on projected maximum losses rather than a project's total value. This is because estimated maximum loss scenarios are often less than the total insurable value.