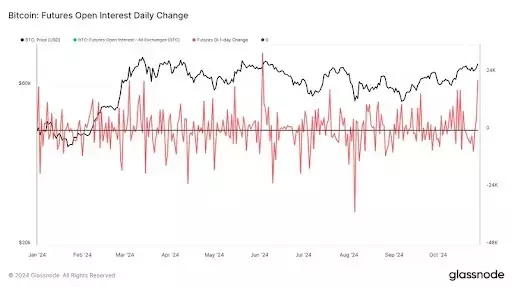

The cryptocurrency market has been abuzz with activity, as evidenced by the recent surge in Bitcoin (BTC) futures open interest (OI) measured in U.S. dollars. This shift reflects a growing appetite among traders and investors for the leading digital asset, suggesting a positive trajectory for Bitcoin's future performance.

Unlocking the Potential of Bitcoin's Bullish Momentum

Record-Breaking Bitcoin Futures Open Interest

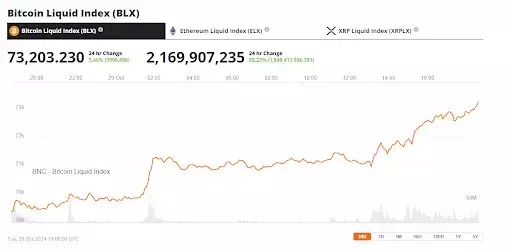

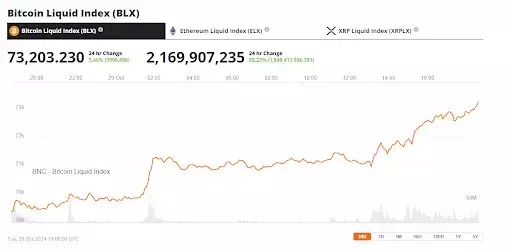

The Bitcoin market has witnessed a remarkable milestone, with the cryptocurrency breaking past the $72,000 mark on October 29, 2024, according to the Brave New Coin's Bitcoin Liquid Index. This surge in price was accompanied by a record-breaking jump in Bitcoin futures open interest, measured in U.S. dollars. The single-day rise in OI on Tuesday, with a boost of over 20,000 BTC or roughly $2.5 billion at current prices, marked a significant shift in the market dynamics. Total OI approached 600,000 BTC, valued at around $42.6 billion, reflecting the intense interest from traders and investors.Volatility and Funding Rates in the Futures Market

While the surge in open interest signals a bullish outlook, it can also drive up volatility, especially as contracts near expiration. Traders may scramble to adjust, roll over, or close positions, triggering price swings. Research from Kaiko indicates that while the futures market attracts strong interest, funding rates for these positions remain below March highs, suggesting that demand may still be cautious despite the increasing OI.Institutional Investors Embrace Bitcoin's Potential

The growing confidence in Bitcoin's future is not limited to the futures market alone. Singapore-based QCP Capital shares a bullish view on the cryptocurrency, projecting continued price increases. In a recent Telegram broadcast, QCP Capital noted that optimism around a potential Trump win could drive both stocks and Bitcoin upward, positioning BTC well for mid-term growth. This view highlights the strong confidence institutional investors hold in Bitcoin's future.CME's Dominance in Bitcoin Futures Trading

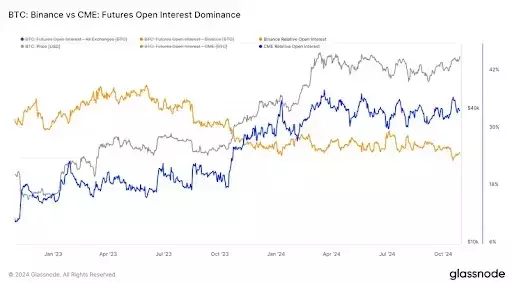

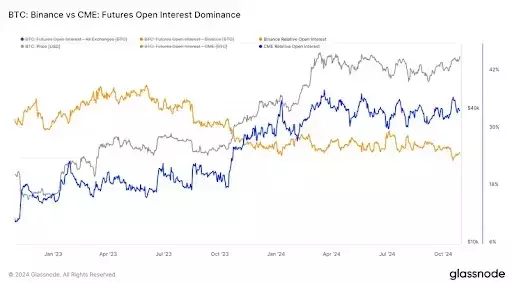

The Chicago Mercantile Exchange (CME) has firmly maintained its leading position in the Bitcoin futures trading landscape. Contracts on the CME recorded a 9% spike in open interest within 24 hours, reaching 171,700 BTC, with a value surpassing $12.22 billion. This rise reinforces CME's dominance, contributing 30% of the total market. Despite occasional shifts, CME remains the top player in Bitcoin futures trading.Surge in ETF Inflows Boosts Bitcoin Momentum

The recent surge in Bitcoin's price has been further bolstered by strong inflows from U.S.-listed spot ETFs. Mid-October saw Bitcoin trading around $67,000, with CME's open interest hitting all-time highs in both notional open interest ($12.4 billion) and Bitcoin-denominated futures contracts (179,930 BTC), according to Glassnode data. This period also marked a shift in the dynamics of Bitcoin trading, driven by the influx of capital into spot ETFs.Since October 16, Bitcoin-denominated futures contracts on CME have decreased by over 6%, contrasting sharply with ETF inflows, which have accumulated a net inflow of $2.7 billion. BlackRock's iShares Bitcoin Trust (IBIT) led this charge, with $2.2 billion in net inflows and a new record of holding over 400,000 Bitcoin in the ETF. This shift indicates a move from institutional basis trades at the start of the year to more bullish, long-directional plays, reflecting growing confidence in Bitcoin's upward trajectory.Divergence Between CME Open Interest and ETF Inflows

Analysts have reported a gap between rising ETF inflows and CME open interest growth. Checkmate, an analyst firm, highlights steady ETF inflows, contrasting with modest increases in CME open interest. Checkmate stated that Grayscale Bitcoin Trust (GBTC) outflows remain minimal, suggesting genuine ETF inflows without significant cash-and-carry trades.Aligning with this trend, Emory University's endowment recently invested in the Grayscale Bitcoin Mini Trust (BTC), reflecting a strategic long position similar to the Wisconsin Pension Fund's approach. Although Emory's $15 million investment may appear small for an institutional player, it marks a significant shift towards direct bullish exposure in Bitcoin.Not all experts share this optimism, however. Andre Dragosch, Bitwise's research head, offers a different perspective, noting rising short positions and increasing CME open interest. He associates this with growing cash-and-carry trades, pointing to a notable uptick in net non-commercial positions on CME since early September. However, the latest open interest data remains limited to weekly CFTC updates through October 22, leaving recent changes unclear.