In a bold move to revolutionize the futures trading landscape, BGC Group, the renowned brokerage and financial technology firm, is setting its sights on unprecedented growth and market dominance with the launch of its innovative FMX Futures Exchange. With a relentless focus on innovation, superior pricing, and unparalleled capital efficiencies, the exchange is poised to disrupt the status quo and redefine the futures trading experience for its clients.

Unlocking Unprecedented Opportunities in the Futures Market

Rapid Expansion and Onboarding of Leading FCMs

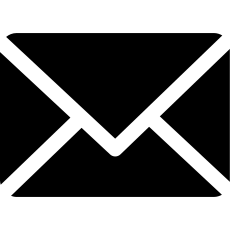

BGC Group's FMX Futures Exchange has already made significant strides, launching on September 23, 2024, with SOFR futures and five leading futures commission merchants (FCMs) – Goldman Sachs, JP Morgan, Marex, RBC, and Wells Fargo. The firm's chairman and CEO, Howard Lutnick, has expressed immense confidence in the exchange's growth trajectory, stating that it is expected to far exceed the success of the company's FMX US Treasury business.Lutnick revealed that the firm is actively onboarding additional FCMs, with plans to connect an impressive five to 10 of the largest FCMs for the launch of US Treasury futures in the first quarter of 2025. This rapid expansion underscores the exchange's ability to attract and retain the industry's most prominent players, a testament to the value it offers.Overcoming Teething Pains and Streamlining Connectivity

While the launch of the FMX Futures Exchange has not been without its challenges, BGC Group is proactively addressing the "teething pains" associated with the new venue. Lutnick acknowledged the firm's efforts to make it smoother for FCMs to connect to the exchange and its clearinghouse, the London Stock Exchange's LCH."I would expect much of that to sort its way out through the end of this year," Lutnick stated, expressing confidence that the new exchange will be in "excellent shape going forward" as these initial hurdles are overcome.Capitalizing on Cross-Margining Opportunities

One of the key advantages of the FMX Futures Exchange is its partnership with LCH, a derivatives clearing organization fully approved by the US Commodity Futures Trading Commission. LCH boasts an impressive $225 billion in collateral securing its clearing of interest rate swaps, largely in US dollars. This presents a significant opportunity for FMX Futures Exchange clients to achieve dramatic capital efficiencies through cross-margining against eligible US interest rate futures.This innovative approach to clearing and collateral management sets the FMX Futures Exchange apart, offering clients a distinct competitive edge in the futures trading landscape.Unfazed by Incumbent Dominance: Challenging the CME Group

Despite the formidable presence of the CME Group, the industry's long-standing leader, BGC Group remains undeterred. The company's CEO, Terry Duffy, has acknowledged the record volumes achieved by the CME Group for both SOFR futures and Treasuries contracts in the third quarter of 2024, without resorting to fee reductions or new incentive programs.However, Duffy has expressed concerns about the clearing of US Treasury futures under foreign jurisdiction, a practice that has never before been approved in the US and is not allowed by any other major country. This presents a potential opportunity for the FMX Futures Exchange to capitalize on the growing unease surrounding the CME Group's clearing arrangements.Diversifying and Strengthening the BGC Group Portfolio

The FMX Futures Exchange is just one component of BGC Group's comprehensive strategy to expand its financial technology and brokerage offerings. The company has recently agreed to acquire OTC Global Holdings, a leading independent institutional energy and commodities broker, as well as Sage Energy Partners.These strategic acquisitions are expected to be immediately accretive, adding more than $450 million in annual revenue to the BGC Group portfolio. The group's chief operating officer, Sean Windeatt, expressed excitement about the synergies these acquisitions will bring to the company's energy, commodities, and shipping (ECS) business, further strengthening its position in these critical sectors.Delivering Record Financial Performance

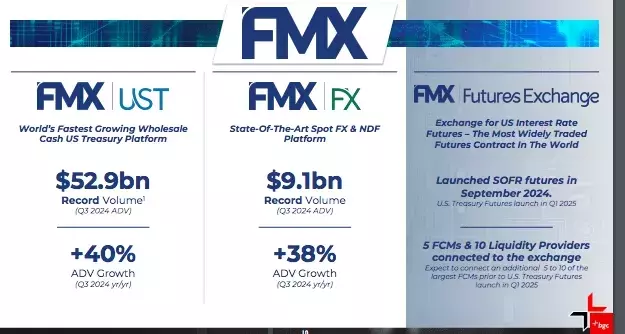

The FMX Futures Exchange's promising trajectory is reflected in BGC Group's overall financial performance. The company reported record third-quarter revenues of $561 million, a 16% year-on-year increase, with growth across every asset class and region.Notably, the group's American revenues increased by 19% in the quarter, while Europe, Middle East, and Africa revenues rose by 16.5% and Asia Pacific revenues went up by 8.3%. This robust financial performance underscores the strength and resilience of BGC Group's diversified business model, positioning the company for continued success in the years to come.As the FMX Futures Exchange continues to gain momentum and attract a growing number of market participants, BGC Group's vision of revolutionizing the futures trading landscape is becoming a reality. With its unwavering commitment to innovation, superior pricing, and unparalleled capital efficiencies, the exchange is poised to redefine the industry and cement the company's position as a trailblazer in the financial technology and brokerage sectors.