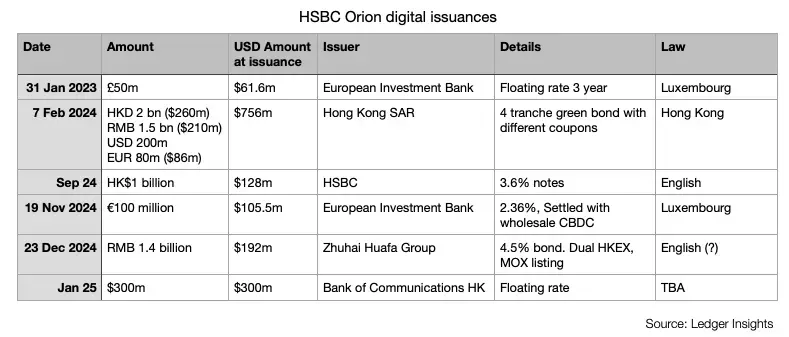

The Bank of Communications (BoCom) Hong Kong has launched a $300 million unsecured floating rate digital bond with a three-year term. This issuance is significant as it represents the first digitally native bond from a Chinese bank, utilizing HSBC's Orion platform and cleared through CMU. Moody’s assigned an A2 preliminary rating to this bond, aligning it with similar conventional issuances and BoCom’s long-term deposit rating. Despite being state-owned, Moody’s maintains a negative outlook on China’s sovereign rating. The bond carries no specific blockchain risks due to the private permissioned nature of HSBC Orion and off-chain cash transactions. Furthermore, the platform has been successfully used in several high-profile bond issuances, including a $756 million four-currency sovereign green bond for Hong Kong. Increased activity in recent months suggests growing confidence in digital bonds, supported by Hong Kong’s grant scheme covering up to half the issuance costs.

Pioneering Digital Transformation in Chinese Banking

The issuance of a $300 million unsecured floating rate digital bond by BoCom Hong Kong marks a pivotal moment for Chinese banking institutions. This innovative approach leverages advanced technology to streamline financial processes and enhance efficiency. By adopting HSBC’s Orion platform, BoCom demonstrates its commitment to embracing digital transformation. The bond’s structure and terms are designed to attract both institutional and retail investors, offering competitive returns within a secure framework. Moody’s A2 rating underscores the bond’s credibility and reliability, ensuring it meets international standards despite the current geopolitical climate. The integration with CMU ensures robust clearing and settlement mechanisms, further solidifying the transaction’s integrity.

This groundbreaking issuance sets a new benchmark for Chinese banks venturing into digital finance. Utilizing a privately permissioned blockchain, HSBC Orion mitigates potential risks associated with blockchain technology. Off-chain cash transactions ensure that payment processes remain unaffected by any platform outages, providing a seamless experience for investors. Additionally, comprehensive business continuity arrangements and backup records held by CMU guarantee legal accuracy and investor protection. The success of this bond issuance not only highlights BoCom’s leadership in innovation but also paves the way for future digital initiatives in the banking sector. As more institutions adopt similar technologies, the landscape of global finance is poised to undergo significant changes.

Building Confidence in Digital Bonds

The rise in digital bond issuances reflects a growing acceptance of blockchain technology in the financial world. Recent months have seen a surge in activity, with several notable issuances leveraging platforms like HSBC Orion. These advancements are bolstered by supportive government policies, such as Hong Kong’s grant scheme that covers up to 50% of issuance costs. This financial incentive encourages more institutions to explore digital bonds, fostering innovation and competition. The successful execution of BoCom’s $300 million bond issuance serves as a testament to the reliability and efficiency of digital platforms in facilitating complex financial transactions.

Hong Kong’s strategic position as a global financial hub plays a crucial role in driving the adoption of digital bonds. The city’s robust infrastructure and regulatory environment provide a fertile ground for technological advancements. HSBC Orion, built on Digital Asset’s Canton/DAML blockchain and Hyperledger Fabric, exemplifies the cutting-edge solutions available today. Its use in high-profile issuances, including a $756 million four-currency sovereign green bond, demonstrates the platform’s versatility and dependability. As more countries introduce similar grant schemes, the global momentum towards digital finance continues to build. Singapore’s recent announcement of a comparable program underscores the international recognition of digital bonds’ potential to revolutionize financial markets.