Unlocking the Power of Weekly Bitcoin Futures: A Game-Changer for Traders

The introduction of Chicago Mercantile Exchange's (CME) weekly bitcoin (BTC) futures has opened up a new world of opportunities for traders looking to capitalize on key economic data releases. These innovative contracts, designed to be more accessible to retail investors, offer a range of benefits that could revolutionize the way traders approach the cryptocurrency market.Unleashing Targeted Trading Strategies with Weekly Bitcoin Futures

Tailored for News Traders

The weekly bitcoin futures contracts, known as the "BFF" contracts, are ideally suited for news traders who seek to capitalize on the market's reaction to significant economic events. Unlike monthly contracts, which can be influenced by a wide range of factors over a four-week period, the weekly contracts allow investors to more precisely express their views on Bitcoin's performance in response to specific news releases, such as U.S. inflation figures or nonfarm payrolls data.Reduced Basis and Rollover Costs

One of the key advantages of the weekly bitcoin futures is the lower basis, or price differential, compared to the spot market. This reduced premium, coupled with lower rollover costs when moving positions from the impending expiry to the following Friday expiry, can lead to improved profitability for traders. The shorter duration of the weekly contracts helps to limit the gap between futures and spot prices, making the analysis and trading strategies more straightforward for retail investors.Aligning with Spot ETF Pricing

The alignment between the Friday futures expiry and the daily net asset value (NAV) calculation of U.S.-listed spot Bitcoin exchange-traded funds (ETFs) further enhances the market liquidity. These spot ETFs, which often reference the BRRNY (Bitcoin Reference Rate – New York) variant, benefit from the increased liquidity, enabling more efficient price discovery and the execution of large orders at stable prices.Advantages over Perpetual Futures

In contrast to the volatile and unpredictable funding rates associated with perpetual futures on offshore unregulated exchanges, the weekly bitcoin futures offer a more stable and transparent trading environment. This stability can be particularly appealing to retail traders who seek a more predictable and controlled trading experience.Driving Institutional Adoption

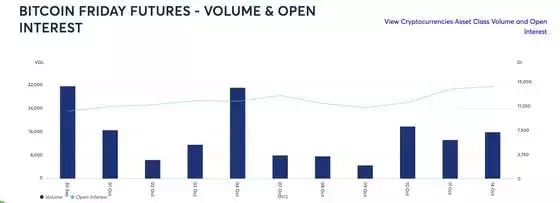

The successful launch of the weekly bitcoin futures, with a first-day trading volume of over 31,000 contracts across two different contract weeks, has positioned CME as a leading player in the cryptocurrency derivatives market. This milestone underscores the growing institutional interest and adoption of Bitcoin as a macro asset, further solidifying its position in the financial landscape.Unlocking New Opportunities for Traders

The introduction of CME's weekly bitcoin futures has the potential to revolutionize the way traders approach the cryptocurrency market. By providing a more targeted and cost-effective trading platform, these contracts offer a compelling alternative to traditional monthly futures and perpetual contracts. As the market continues to evolve, the weekly bitcoin futures could become an increasingly valuable tool for traders seeking to capitalize on the dynamic nature of the cryptocurrency landscape.You May Like