Navigating the Fed's Pivotal Policy Meeting: Decoding the Market's Expectations

As the Federal Reserve's two-day policy meeting kicks off today, investors are closely watching for any signals that could shape the future of the economy and financial markets. With the CME's FedWatch tool predicting a 67% chance of a 25 basis point rate cut tomorrow, the stage is set for a pivotal moment that could have far-reaching implications.Unlocking the Potential: Deciphering the Market's Optimism

Bullish Sentiment Amid Economic Indicators

Stock futures are firmly higher this morning, with futures on the Dow Jones Industrial Average (DJIA) and Nasdaq-100 Index (NDX) both up triple digits. This bullish sentiment reflects the market's optimism ahead of the Federal Reserve's policy meeting, as investors anticipate a potential rate cut that could provide a much-needed boost to the economy. However, the retail sales data for August, which showed a modest 0.1% increase, suggests that the economic recovery may not be as robust as some had hoped. Excluding auto sales, the increase fell short of the Dow Jones forecast, indicating that consumer spending may be slowing down.The Fed's Balancing Act: Navigating Inflation and Growth

The Federal Reserve's policy meeting is a crucial event that will be closely watched by investors, economists, and policymakers alike. The central bank faces the delicate task of balancing the need to tame inflation while also supporting economic growth. A rate cut could provide a much-needed stimulus to the economy, but it also carries the risk of fueling further inflationary pressures. The Fed's decision will be heavily influenced by the latest economic data, as well as the ongoing global trade tensions and geopolitical uncertainties.Volatility in the Crypto Sector: Options Traders Remain Unfazed

Despite the volatile nature of the cryptocurrency market, options traders appear to be unfazed. The Cboe Options Exchange (CBOE) saw over 1.8 million call contracts and more than 1 million put contracts exchanged on Monday, indicating a continued interest in the sector. The single-session equity put/call ratio fell to 0.54, while the 21-day moving average remained at 0.65, suggesting that options traders are actively participating in the market.Sector Highlights: Upgrades, Downgrades, and Ongoing Trends

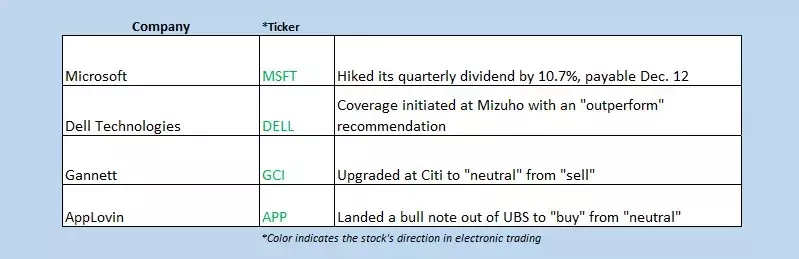

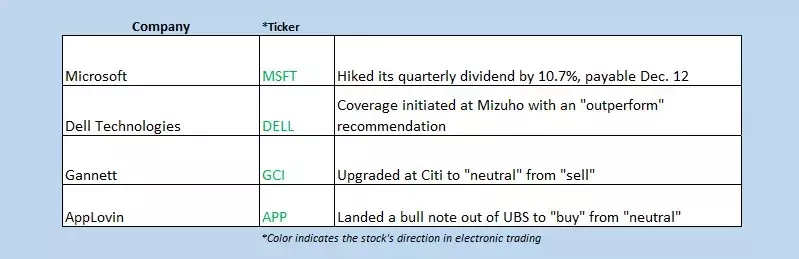

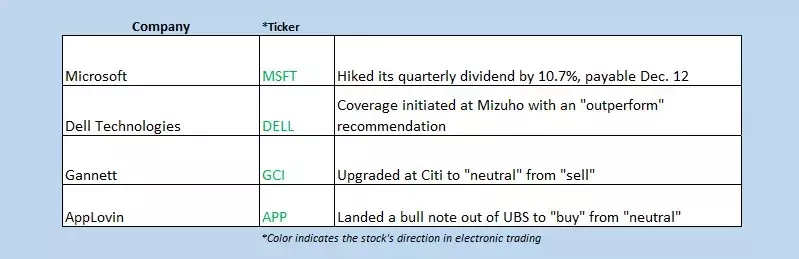

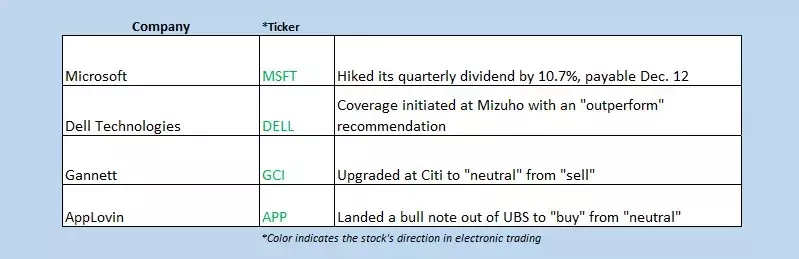

The market is also seeing some notable movements in individual sectors and stocks. SolarEdge Technologies Inc (NASDAQ:SEDG) is down 6.2% premarket after being downgraded by Jefferies to "underperform" from "hold." This comes as the alternative energy stock has already lost 76.5% of its value year-to-date. On the other hand, Intel Corp (NASDAQ:INTC) stock is up 6.9% in electronic trading, extending its previous session's rise, thanks to government funding and the company's announcement of spinning off its foundry business. Meanwhile, Shopify Inc (NYSE:SHOP) is up 3% before the bell, after Redburn upgraded the stock to "buy" from "neutral," citing the continued growth in the e-commerce sector.Global Market Movements: Diverging Trends and Investor Sentiments

The global markets are also showing a mixed picture. In Asia, several indexes closed with varying results, with the Nikkei shedding 1%, the Hang Seng rising 1.4%, the Shanghai Composite falling 0.5%, and the Kospi adding 0.1%. The yen's strength and the anticipation of economic data and inflation news from the U.S. are shaping the regional market dynamics.In Europe, bank stocks are leading the charge, with Commerzbank surging to 12-year highs on the back of a Bloomberg report regarding potential stakeholder approval. Traders are eagerly awaiting the Bank of England's (BoE) upcoming policy decision, while the German economic outlook has dimmed as the region continues to grapple with economic challenges. Overall, the major European indexes, including the FTSE 100, CAC 40, and DAX, are all up by around 0.8%.As the market navigates these complex and ever-evolving dynamics, investors and analysts will be closely monitoring the Federal Reserve's policy meeting for any clues that could shape the future direction of the economy and financial markets.