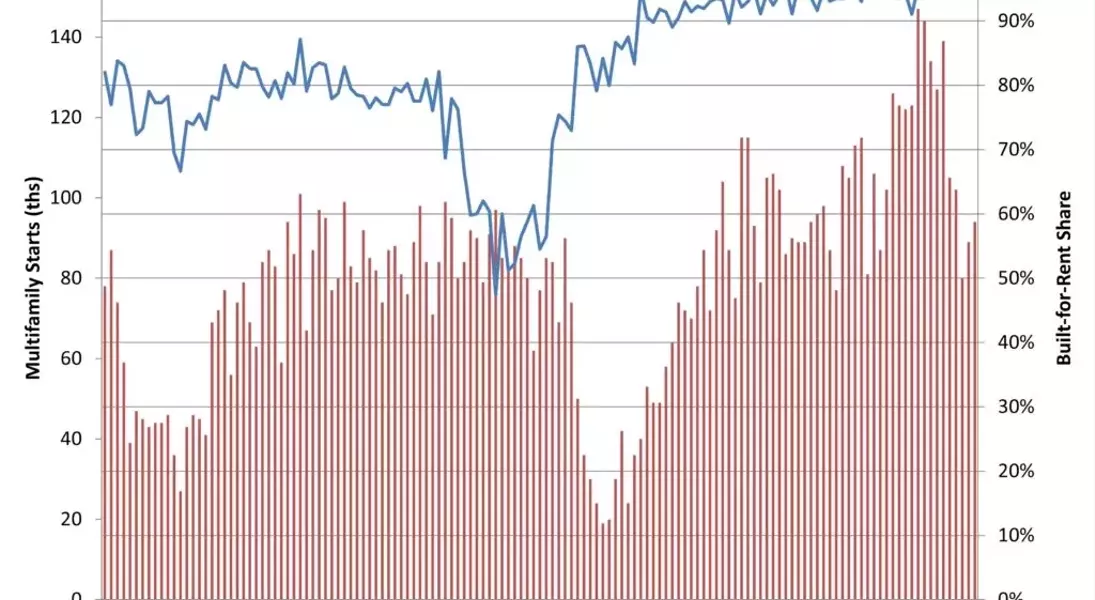

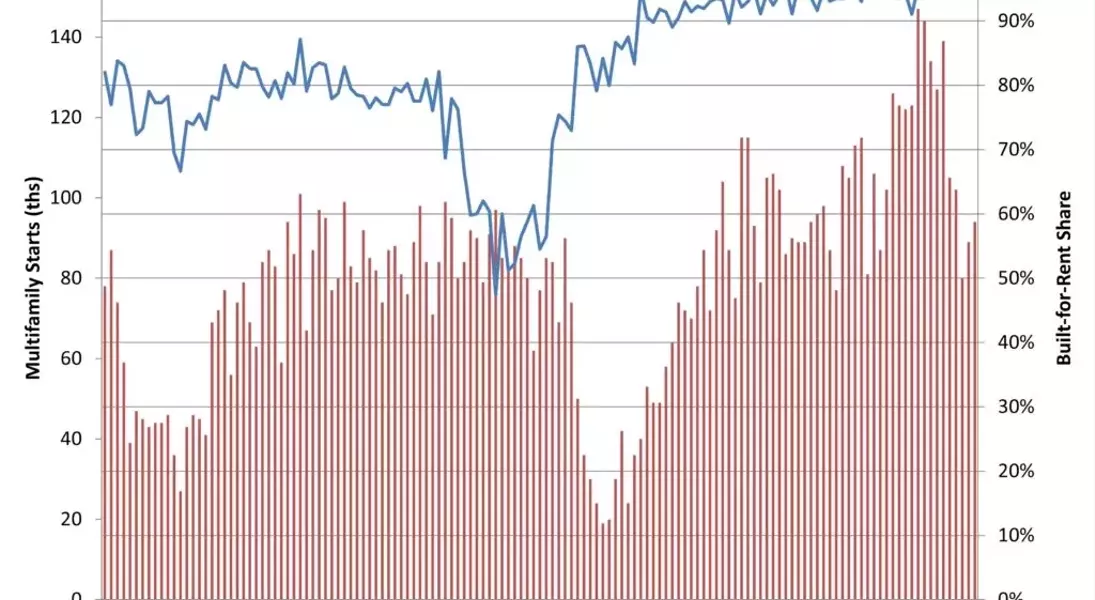

According to a detailed analysis by NAHB of quarterly Census data, it has been observed that the count of multifamily, for-rent housing starts witnessed a significant decline during the third quarter of 2024. In this particular quarter, a total of 94,000 multifamily residences embarked on the construction journey. Out of this substantial number, an impressive 88,000 were built specifically for rent. Strikingly, this figure was almost 14% lower than the corresponding period in 2023.

Market Share Shifts and Historical Trends

The market share of rental units within multifamily construction starts took a downward turn and dropped below 94% in the third quarter. This occurred as the built-for-sale, multifamily condo market witnessed a notable gain. It is interesting to note that the historical low market share of 47% for built-for-rent multifamily construction was set during the third quarter of 2005, a time when the condo building boom was in full swing. On the other hand, an average share of 80% was registered during the 1980-2002 period, highlighting the significant changes in the market over the years.Multifamily Condo Unit Construction Starts

For the third quarter, there was a notable increase in multifamily condo unit construction starts. The count rose from 3,000 a year ago to 6,000. Although still a relatively small market, this represents the highest quarterly count since mid-2022. It showcases the evolving dynamics within the multifamily housing sector.Average and Median Square Footage of Multifamily Construction

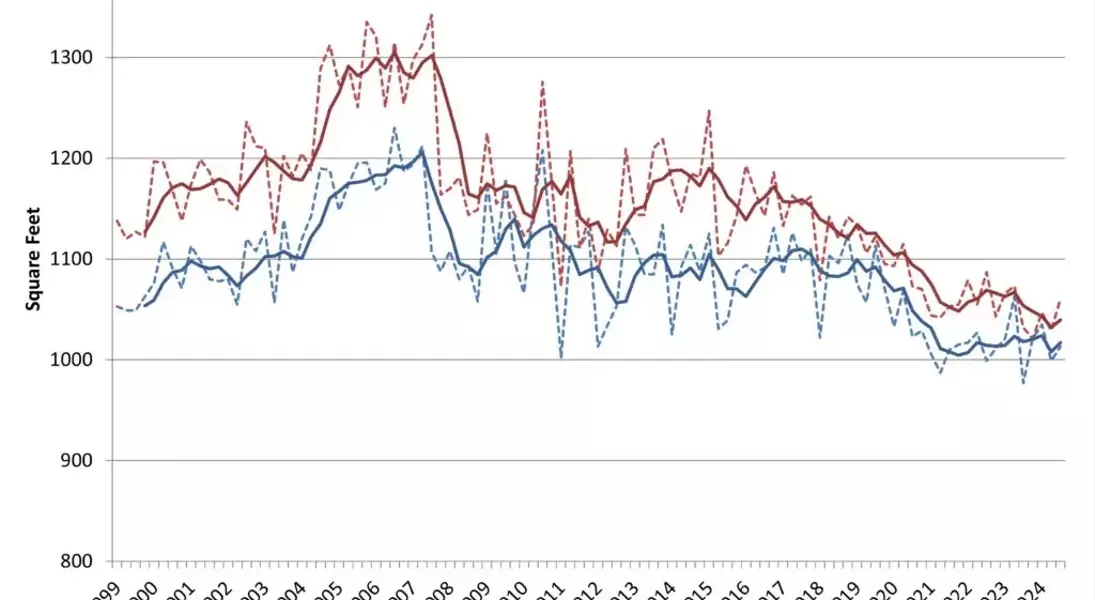

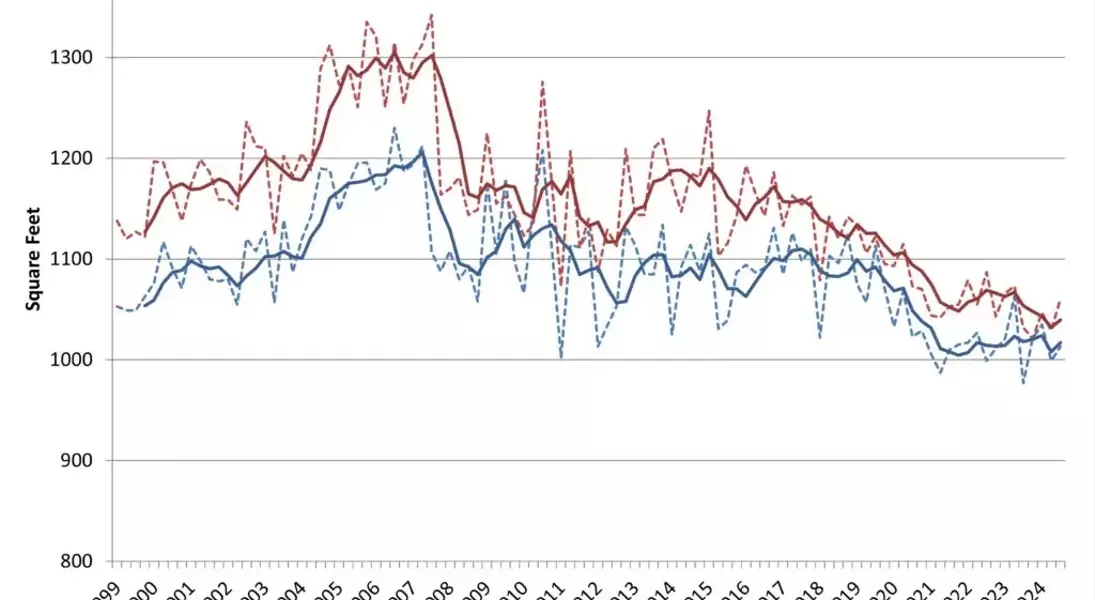

An elevated rental share of multifamily construction is having an impact on the typical apartment size. According to the third quarter 2024 data, the average square footage of multifamily construction starts saw a slight increase and reached 1,061 square feet. Additionally, the median also edged up to 1,013 square feet. These estimates are close to multidecade lows, indicating a shift in the spatial characteristics of multifamily housing.You May Like