Despite the recent stratospheric surge in the valuations of quantum computing pure-play companies such as IonQ, Rigetti Computing, D-Wave Quantum, and Quantum Computing Inc., a critical examination of historical market trends suggests that investors should approach these high-flying stocks with caution. While analysts foresee further upside, the early stage of this groundbreaking technology's commercial viability and the absence of consistent profitability across these firms raise significant concerns about the long-term sustainability of their current market capitalizations.

The Quantum Leap: Analyst Optimism Meets Historical Skepticism

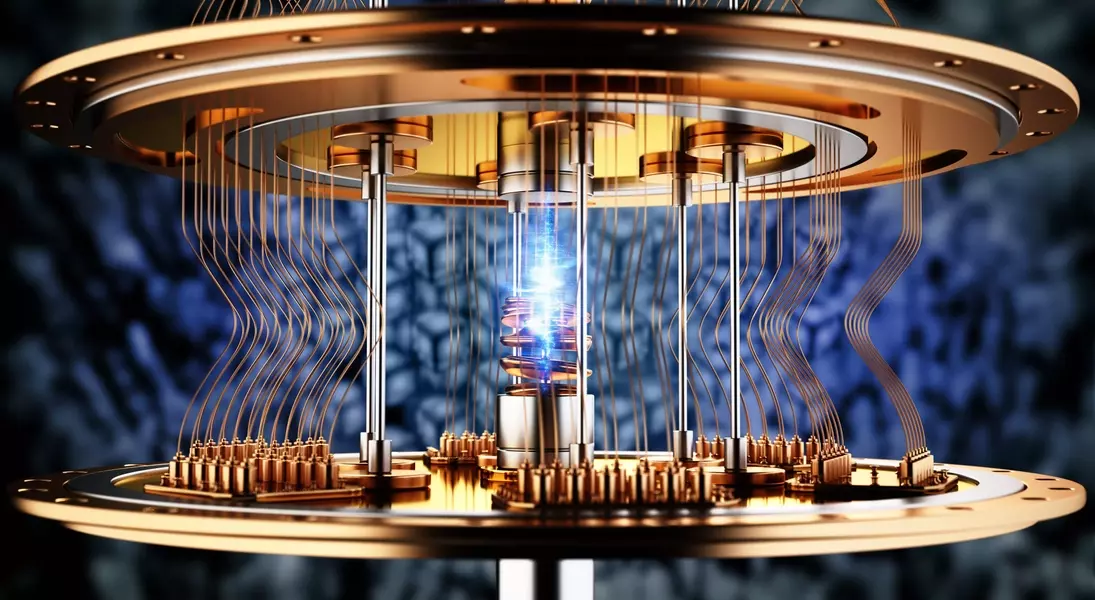

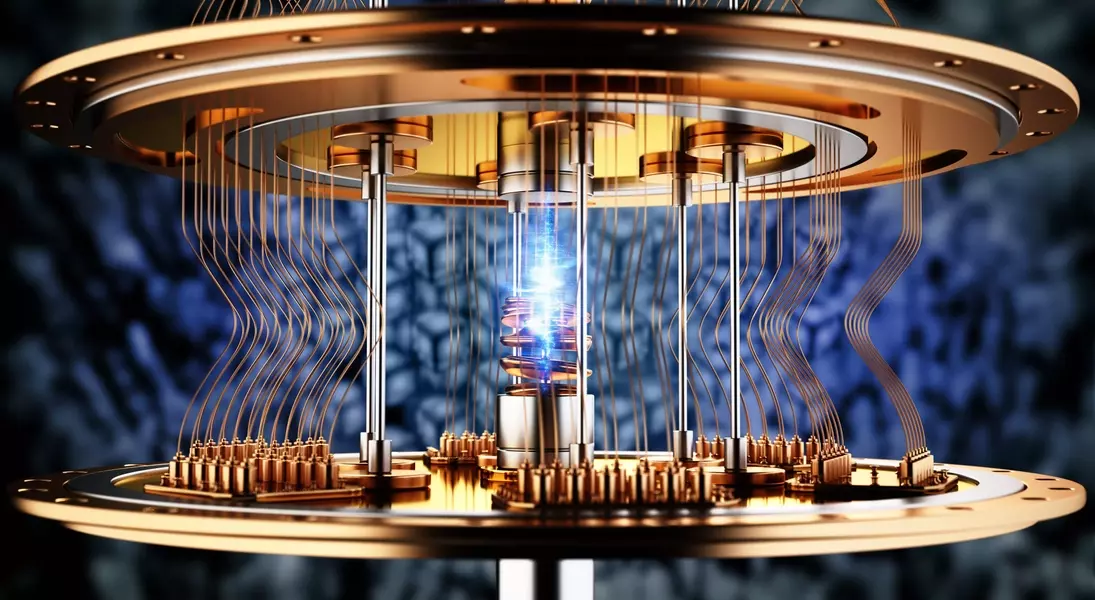

In the vibrant landscape of technological innovation, quantum computing has recently emerged as a beacon of high potential, captivating the attention of investors and Wall Street analysts alike. Companies solely focused on this revolutionary field, including IonQ, Rigetti Computing, D-Wave Quantum, and Quantum Computing Inc., have witnessed extraordinary growth over the past year, with their stock prices ascending by as much as 4,940% by October 17. This impressive performance has fueled an optimistic outlook from several prominent analysts, who believe these companies are merely at the genesis of their growth trajectory. For instance, Riley Securities' Craig Ellis has set a formidable $100 price target for IonQ, signaling a 59% potential increase. Similarly, Benchmark's David Williams raised Rigetti Computing's target to $50, citing operational achievements and initial contract acquisitions. Roth Capital's Suji Desilva projected a 30% upside for D-Wave Quantum, attributing it to new European customer agreements, while Ascendiant Capital's Edward Woo envisioned an astounding 118% rally for Quantum Computing Inc., driven by anticipated sales growth and product commercialization.

However, this bullish sentiment is tempered by historical precedents that caution against overly enthusiastic investments in nascent technologies. The past three decades have consistently shown that disruptive technological trends, despite their immense promise, often experience market bubbles that eventually deflate. While quantum computing undeniably offers transformative potential across various sectors such as drug discovery, meteorological predictions, and cybersecurity, its widespread commercial application and sustained profitability appear to be years, if not decades, away. Furthermore, none of these pure-play quantum computing firms have demonstrated consistent profitability, with some not expected to achieve it until the close of the current decade or beyond. The current price-to-sales ratios of these companies stand at historically unsustainable levels, significantly exceeding the benchmarks observed during the dot-com era's peak for game-changing technologies. This disparity suggests that despite the compelling vision of quantum computing's future, its current market valuations may be more speculative than grounded in immediate economic realities.

This situation underscores a perennial challenge for investors: distinguishing between genuine long-term potential and short-term market exuberance. While the allure of investing in the next big technological wave is strong, a measured approach, informed by historical market behavior and a clear understanding of commercialization timelines, is crucial. The current narrative around quantum computing stocks serves as a vivid reminder that even the most revolutionary technologies must eventually prove their economic value to sustain their extraordinary market capitalizations.