Unlocking Tomorrow's Potential: IonQ's Vision for Quantum Accessibility

The Dawn of a New Era: Quantum Computing's Emergence and IonQ's Unique Stance

A new sector within artificial intelligence is capturing the attention of investors: quantum computing. Unlike the traditional focus on chip design, data center development, or advanced software, this evolving domain represents a significant leap forward. While large technology companies continue to dominate headlines, smaller innovators are now making their mark. Businesses such as Rigetti Computing, D-Wave Quantum, and Quantum Computing Inc. have all experienced market fluctuations as analysts weigh their long-term viability. Amidst these new entrants, IonQ distinguishes itself with a particularly novel strategy.

IonQ's Integration Strategy: A Game-Changer in Quantum Access

IonQ has cultivated a subtle yet powerful competitive advantage. Instead of emphasizing technical metrics like qubit counts or error correction rates, which often lack immediate practical utility, IonQ prioritizes widespread access and ease of use. The company has opted for a \"quantum-as-a-service\" model, integrating its systems directly into prominent cloud infrastructures, including Microsoft Azure, Amazon Web Services, and Google Cloud Platform. This approach stands in contrast to rivals who offer access through more limited cloud pathways or hardware-specific solutions. IonQ's innovative strategy allows developers already operating within these major cloud ecosystems to effortlessly explore quantum tools, circumventing the substantial capital expenditures typically associated with hardware development. By focusing on practical application rather than theoretical advancements, IonQ is redefining quantum technology as a readily available service within existing enterprise AI frameworks.

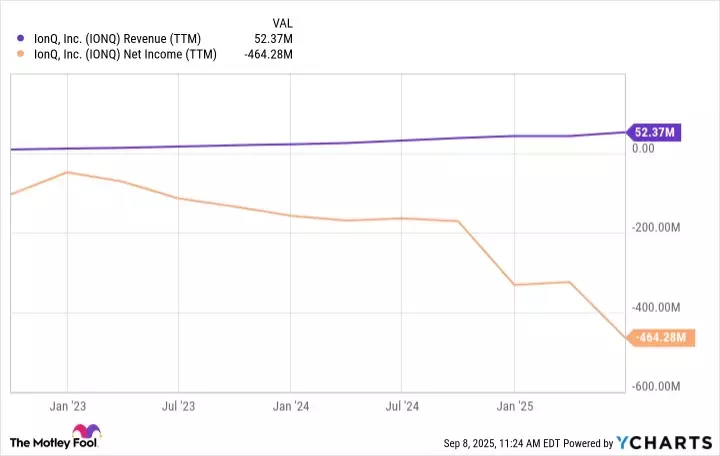

Navigating the Uncertainties: IonQ's Commercial Journey and Market Position

A significant challenge facing the quantum computing sector is the limited real-world application of its technology. Most current uses serve as conceptual validations rather than tangible solutions driving business efficiency. For IonQ, this translates to a scarcity of major commercial contracts, making near-term revenue and profit generation difficult to predict. While integrating with hyperscaler platforms has extended IonQ's market reach, long-term risks persist. Should Amazon, Microsoft, or Alphabet develop their own integrated quantum solutions, IonQ's market presence could be severely impacted or even eliminated, creating considerable hurdles for its growth trajectory.

Investment Considerations: Is IonQ a Prudent Choice?

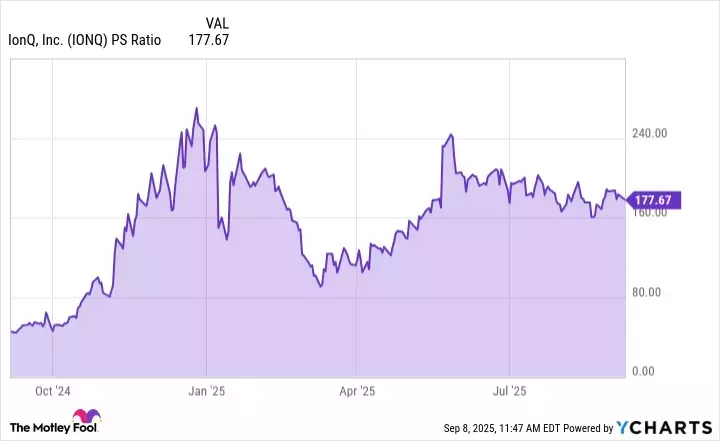

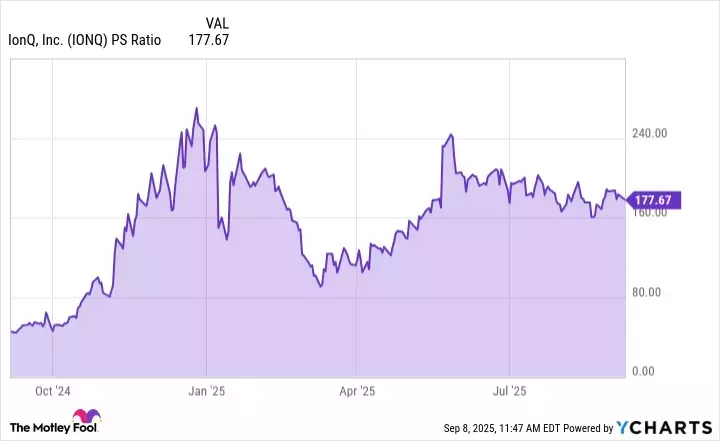

IonQ's integration-first strategy remains a key differentiator. By engaging developers within their existing AI development environments, the company effectively lowers adoption barriers and streamlines the process of quantum implementation. This practical approach gives IonQ an edge over competitors still grappling with theoretical breakthroughs and the prolonged, expensive timelines required for commercialization. However, IonQ operates in an industry characterized by inherent uncertainties across technological, competitive, and financial dimensions. Although its unique distribution channels are noteworthy, investing in IonQ is a high-risk proposition within a sector yet to achieve widespread adoption. While significant upside potential exists, so does considerable volatility. The company's valuation further exacerbates this risk, as it currently trades at levels surpassing those observed in previous stock market bubbles. Justifying or growing into these valuations may take years, possibly even decades, given the slow pace of enterprise adoption for quantum applications. For most investors, a cautious and patient approach is advisable. A small, speculative allocation might be considered by those comfortable with high volatility, provided they acknowledge paying a premium for a technology far from broad commercialization.