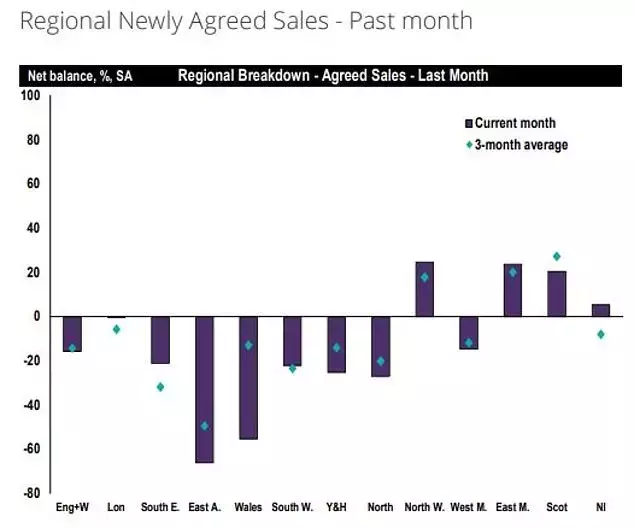

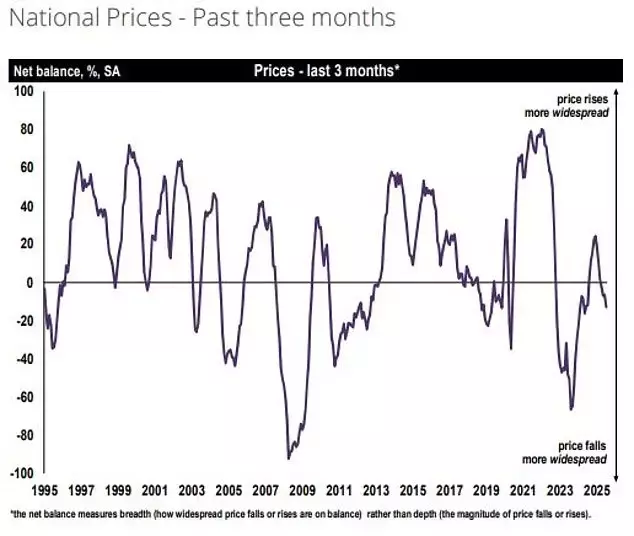

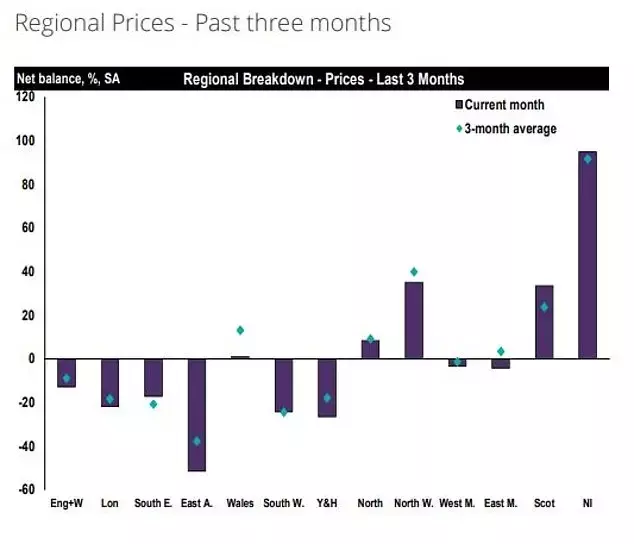

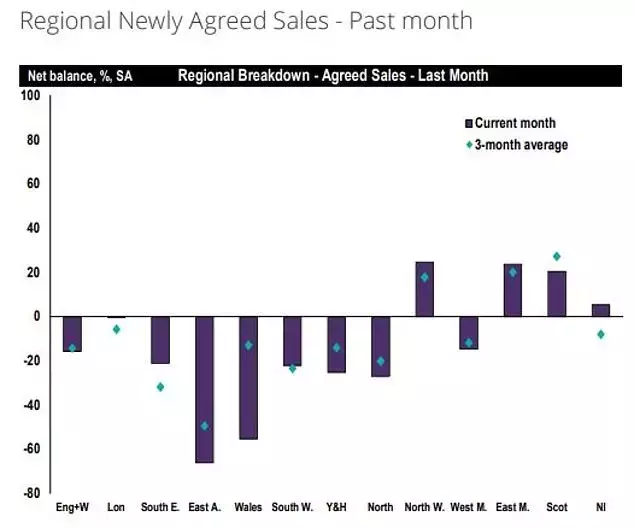

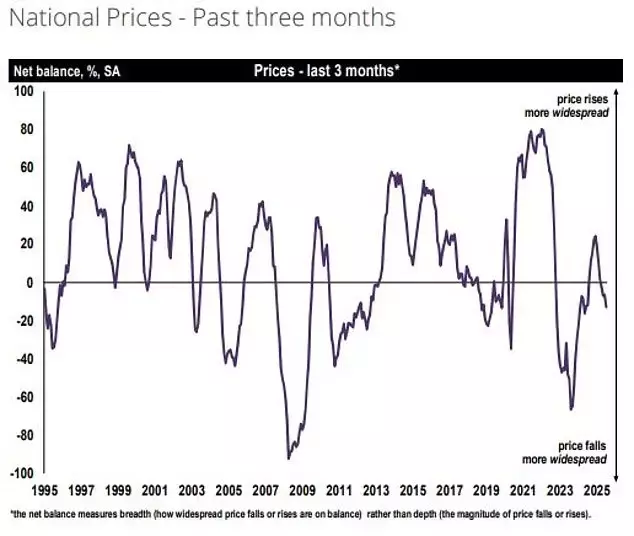

Recent data from the Royal Institution of Chartered Surveyors (RICS) paints a complex picture of the British property market, highlighting a prevailing sentiment among estate agents and surveyors that house prices are generally on a downward trend. This assessment, gleaned from their comprehensive monthly survey, indicates that a greater number of RICS members are observing price reductions in their respective areas compared to those reporting gains. This downturn is particularly evident in regions such as East Anglia, where buyer commitment is low, influenced by rising living costs and high interest rates. Similarly, London, the South East, the South West, and Yorkshire and Humber are also experiencing price falls, often characterized by an overabundance of properties and vendors struggling to adjust their price expectations, especially for smaller flats and larger homes.

Despite the broader national decline, the market exhibits significant regional disparities. In stark contrast to the trends seen in parts of England, Northern Ireland and Scotland are witnessing continued price increases, coupled with a surge in buyer inquiries. This upward movement in these regions suggests a localized injection of confidence, potentially spurred by recent interest rate adjustments. Looking forward, while a majority of RICS members anticipate further price decreases in the immediate three months, a more optimistic outlook prevails for the longer term, with most expecting price appreciation over the next year. However, the market remains sensitive to external factors, including interest rate decisions and the upcoming autumn budget, which continue to influence buyer behavior and overall market stability.

This period of adjustment in the housing sector underscores the dynamic nature of economic forces and regional resilience. As some areas face the challenges of price corrections and reduced buyer activity, others demonstrate growth, driven by unique local conditions and shifting investor confidence. This mixed market environment necessitates adaptability from both sellers and buyers, emphasizing the importance of understanding specific regional dynamics and broader economic indicators to navigate the property landscape effectively. Ultimately, the market's ability to rebound and sustain growth will depend on a delicate balance of economic stability, accessible financing, and the restoration of robust consumer confidence across all regions.