Why Short Interest Matters

Short interest refers to the number of shares that have been sold short but have not yet been covered or closed out. In short selling, traders sell shares of a company they do not own, anticipating a price decline. If the stock price falls, traders make a profit; if it rises, they incur a loss. Tracking short interest is crucial as it serves as an indicator of market sentiment towards a particular stock. An increase in short interest often signals that investors have become more bearish, while a decrease may indicate a more bullish sentiment.Technical Analysis

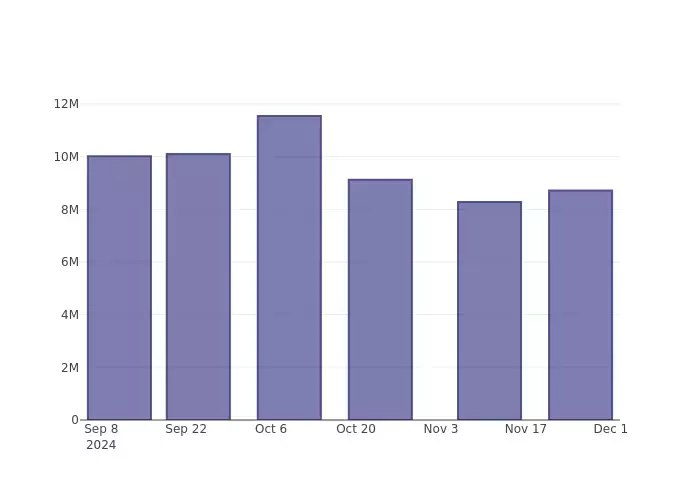

The recent rise in GE HealthCare Techs' short percent of float is a notable development. This indicates that a significant number of shares are currently being sold short. Such a situation can have implications for the stock's future price movement. Analysts closely monitor short interest as it can provide valuable insights into market trends and investor sentiment. For example, if short interest continues to increase, it might suggest that there is a growing belief among investors that the stock price will decline. On the other hand, a decrease in short interest could imply a more optimistic outlook.Looking at the trading volume and the time it takes to cover short positions, it becomes evident that there is a certain level of market activity surrounding GE HealthCare Techs' shares. This activity can be influenced by various factors such as company news, industry trends, and overall market conditions. Traders need to carefully analyze these factors to make informed decisions regarding their short positions.

Financials Analysis

The company's financials play a crucial role in understanding its performance and the implications of short interest. With 8.72 million shares sold short, it represents a certain percentage of the total available shares. This percentage can give an indication of the market's perception of the company's financial health and future prospects. Analysts often compare a company's short interest with that of its peers to gain a better understanding of its relative position in the market.GE HealthCare Techs' short interest as a percentage of float is 2.43%, which is lower than the peer group average of 3.98%. This suggests that the company has less short interest compared to its peers. However, it is important to note that short interest alone is not a definitive indicator of a company's performance. Other factors such as revenue growth, profitability, and debt levels also need to be considered.

Market News and Data

The market news and data surrounding GE HealthCare Techs provide valuable context for understanding the significance of short interest. As seen from the chart, the percentage of shares sold short has grown since the last report. This growth does not necessarily mean that the stock will fall in the near-term, but it does indicate that more shares are being shorted. Traders should be aware of this trend and adjust their strategies accordingly.Market sentiment plays a crucial role in determining stock prices, and short interest is one of the factors that can influence sentiment. An increase in short interest can sometimes lead to a self-fulfilling prophecy if more investors start to believe that the stock will decline. On the other hand, a decrease in short interest can have a positive impact on the stock price as it may indicate a shift in sentiment towards a more bullish outlook.

Benzinga's automated content engine has generated this article and it has been reviewed by an editor. The information provided is for educational purposes only and does not constitute investment advice. Investors should conduct their own research and analysis before making any investment decisions.

© 2024 Benzinga.com. All rights reserved.