Patient Capital Management's Opportunity Equity Strategy concluded 2025 with an impressive 26.1% gain, outperforming the S&P 500 by 840 basis points. This robust performance, the second-best three-year record for the strategy, reflects a compounding rate of 29.5% against the S&P 500's 23.0%. The firm attributes its success to a disciplined investment philosophy centered on identifying and investing in companies whose market prices do not accurately reflect their intrinsic fundamental values. This approach has proven resilient in a market where 73% of active equity funds trailed their benchmarks, emphasizing the importance of skill and a refined investment process.

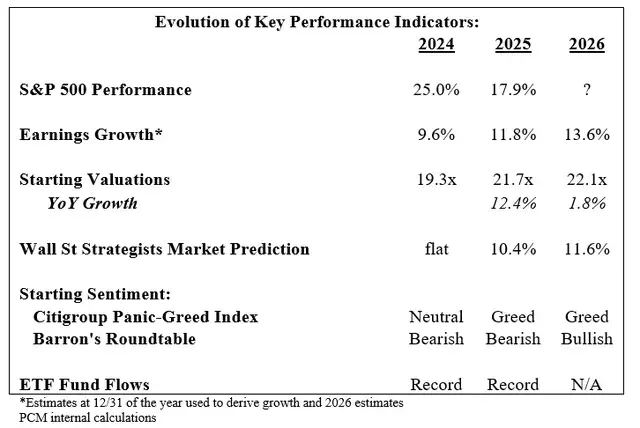

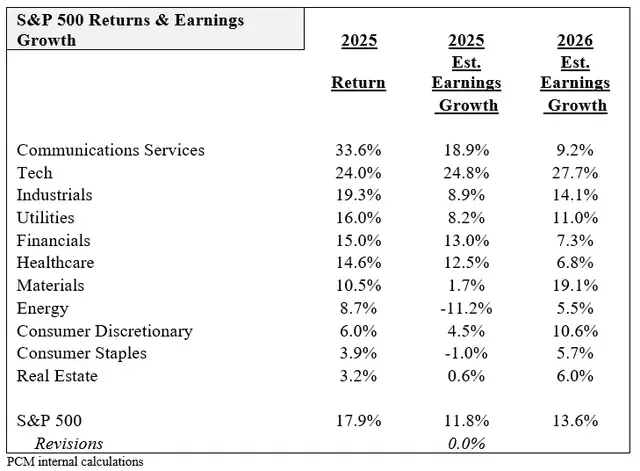

In 2025, the S&P 500 delivered a commendable 17.7% return, marking a third consecutive year of significant growth. This period followed two years (2023 and 2024) where returns exceeded 25%, signaling a buoyant market environment. Corporate earnings growth has been a key driver, with a 9.6% increase in 2024 and an 11.8% rise in 2025, significantly exceeding initial expectations. Sectors like technology (+25%) and communication services (+19%) led this expansion, supported by solid contributions from healthcare and financials. This sustained earnings momentum has fueled market optimism, leading to elevated valuations and a shift from a climate of pessimism to one of "greed," as indicated by market sentiment indices.

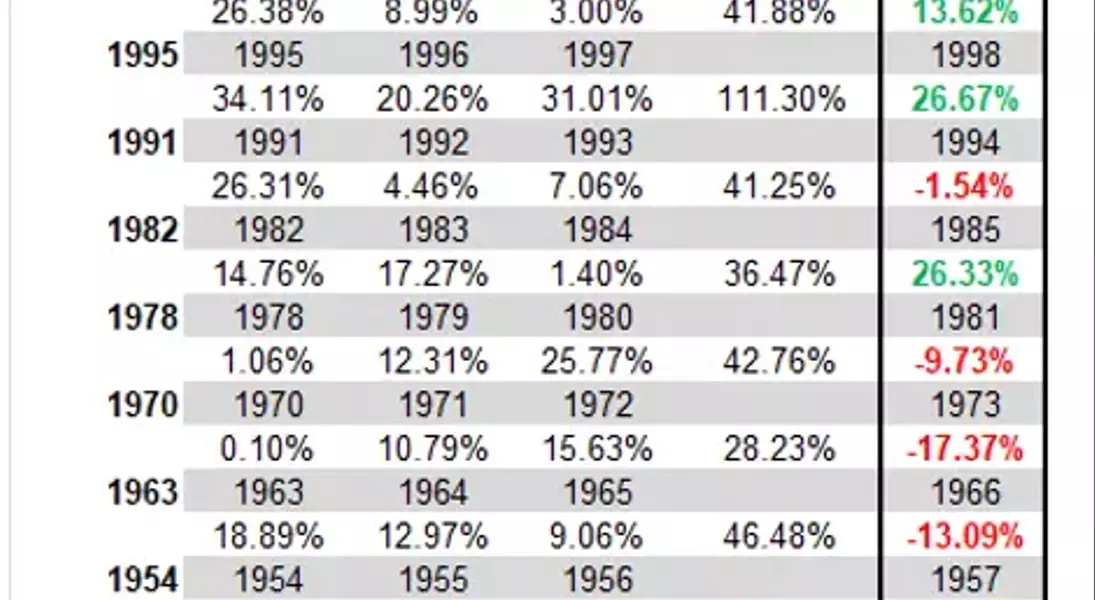

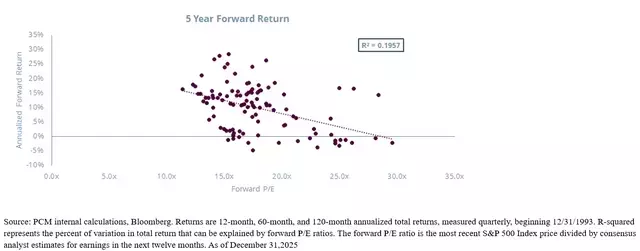

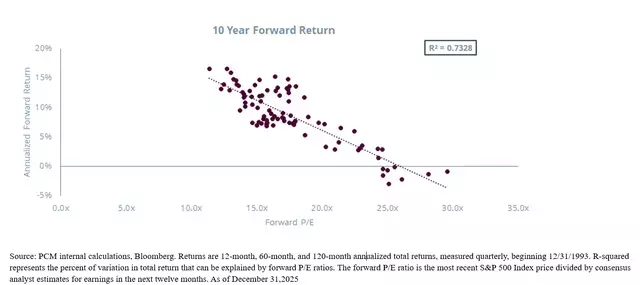

The market's current state, characterized by high valuations and widespread bullish sentiment, presents both opportunities and risks. With the S&P 500 trading at 22 times its 2026 earnings, valuations are at the higher end of historical ranges. Historically, such periods of elevated expectations can precede more moderated future returns, particularly over longer horizons. The firm draws parallels to the late 1990s tech boom, noting that while short-term gains can be substantial, longer-term returns may be subdued. Despite these broader market considerations, Patient Capital Management remains committed to its contrarian, long-term investment strategy.

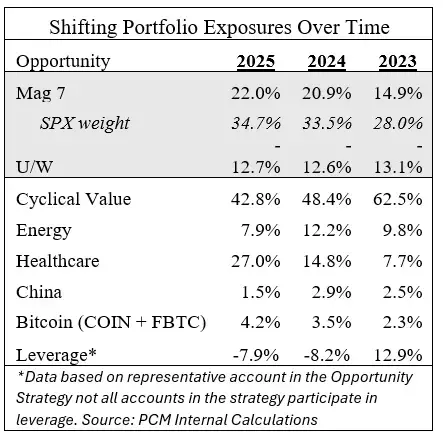

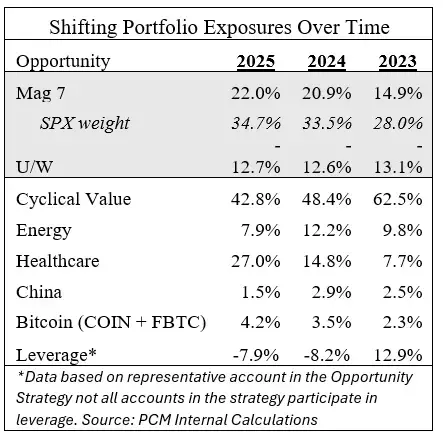

To navigate the evolving market landscape, Patient Capital Management has strategically adjusted its portfolio. Recognizing that "as values normalize, you're paid less to take risk," the firm has reduced its exposure to cyclicals and significantly increased its allocation to healthcare, which had reached 50-year relative valuation lows. This defensive shift aims to enhance portfolio resilience by investing in sectors with less sensitivity to economic fluctuations and attractive valuations. The portfolio remains highly concentrated, with the top ten holdings accounting for approximately half of the total assets, and the top twenty comprising around 80%. This concentrated approach reflects strong conviction in selected companies, while also maintaining a diversified "longer tail" of exposures to perform well across various market scenarios.

The firm continues to identify attractive investment opportunities, albeit fewer than in previous years. Key holdings expected to drive future performance include Amazon, anticipated to rebound after underperforming in 2025; QXO, positioned for further growth through strategic deals; Citigroup, continuing its turnaround; and UnitedHealthcare, with expected improvements. Additionally, Royalty Pharma, Norwegian Cruise Lines, Coinbase, and Crocs remain favored investments. With an internally calculated strategy upside of 62%, the firm projects that its portfolio can compound at low double-digit rates, consistently outperforming the broader market by leveraging a deep understanding of intrinsic value and a flexible, risk-aware positioning.

Ultimately, while no one can definitively predict the future, Patient Capital Management emphasizes a rigorous, bottom-up analysis to construct portfolios that can perform strongly across a spectrum of outcomes. Their commitment to a contrarian and long-term perspective, often divergent from conventional market behavior, continues to define their opportunity set. The firm’s meticulous focus on fundamentals and valuation, paired with adaptive portfolio adjustments, aims to deliver robust returns and navigate market complexities effectively.