Parker-Hannifin: Excellence Priced for Perfection

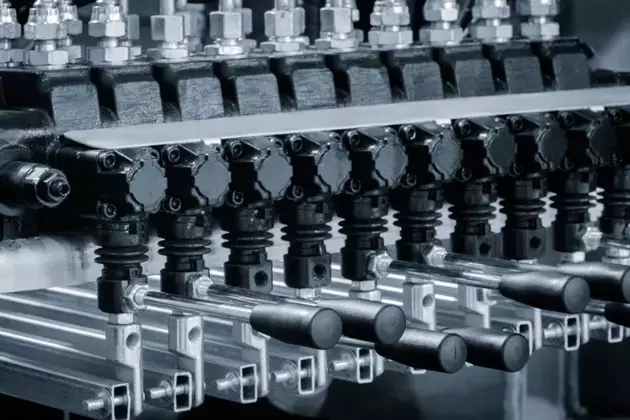

Parker-Hannifin's Market Position and Operational Strength

Parker-Hannifin has consistently demonstrated its position as a leader within the industrial sector. The company's operational efficiency and strategic management have established it as a benchmark for peers. Its ability to generate strong margins and deliver long-term value to shareholders is a testament to its disciplined approach and effective business model.

Aerospace and Industrial Sector Dynamics

The company is currently experiencing significant tailwinds from the booming aerospace industry, which continues to provide a stable and high-growth revenue stream. Concurrently, early signs of recovery in short-cycle industrial markets are contributing positively to its near-term growth prospects. These combined factors underscore Parker-Hannifin's strong market positioning and its capacity to leverage diverse economic drivers.

Valuation Concerns and Future Growth Projections

Despite its exemplary fundamentals, Parker-Hannifin's stock appears to be trading at a premium. A forward price-to-earnings (P/E) ratio of approximately 31x, alongside similar indications from discounted cash flow (DCF) and EBITDA analyses, points to a valuation that is already stretched. This elevated pricing suggests that while the company's quality is undeniable, its potential for significant short-term returns may be constrained. Projected revenue growth for the current year is around 6%, potentially rising to nearly 8% with the inclusion of the Filtration Group. However, at present price levels, the investment upside seems limited, prompting investors to weigh the company's superior quality against its demanding valuation.