Palantir Technologies (PLTR) has seen remarkable growth, with its stock price more than doubling in 2025 alone. This surge is largely attributed to the company's central role in the artificial intelligence (AI) boom, as it stands out for successfully implementing AI technology in practical applications for both government and commercial clients, consistently generating profits.

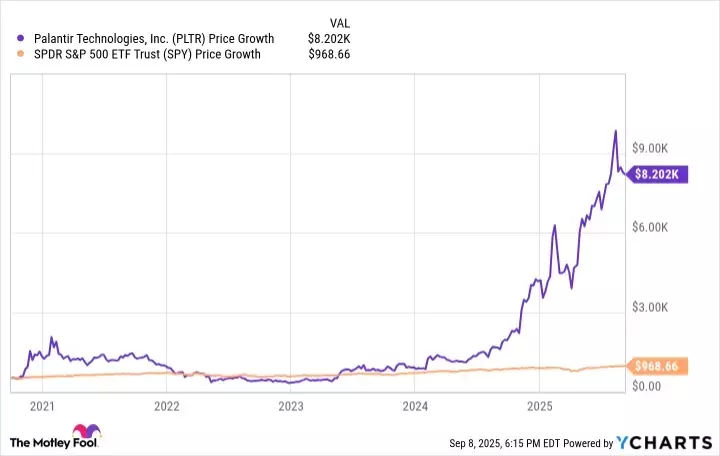

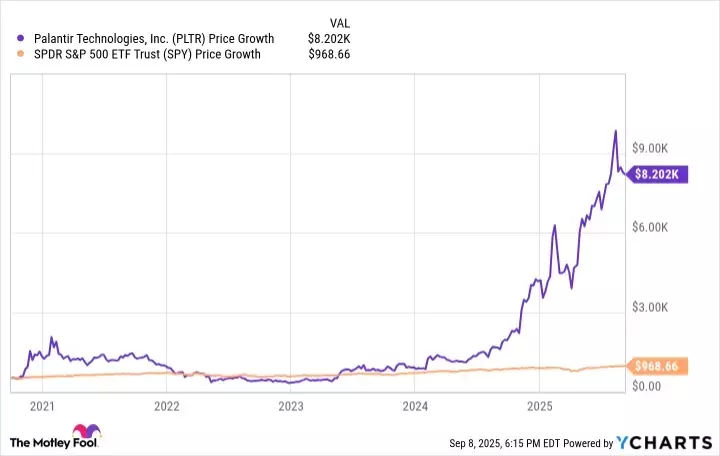

The company's advanced AI solutions are deployed across various federal government departments and a wide array of enterprise customers, demonstrating the versatility and widespread utility of its offerings. This operational success has translated into rapid growth in both its revenue and profit margins, with the stock price following suit. For those who invested at the time of its initial public offering (IPO) in September 2020, the returns have been extraordinary, with the stock appreciating by approximately 1,600%. A hypothetical investment of $500 back then would now be worth around $8,500, illustrating the impressive trajectory of its market performance.

Despite Palantir's impressive performance, concerns arise regarding its current market valuation. While the company demonstrates strong execution and tangible value creation, the stock appears significantly overvalued based on conventional metrics. Trading at nearly 115 times sales and roughly 510 times earnings, its valuation surpasses even highly anticipated private companies like OpenAI, which is valued at $500 billion. Although Palantir is profitable unlike some of its counterparts, such extreme multiples are generally not sustainable in the long term. Therefore, from a financial perspective, it is difficult to recommend the stock at its current price, as a market correction to a more rational valuation level seems inevitable and likely to be considerably lower than present trading levels.

Investing wisely requires a balanced perspective, acknowledging both strong performance and the inherent risks of overvaluation. While Palantir's innovations and impact in the AI sector are undeniable, prudent investors understand the importance of fundamental value. By considering long-term sustainability and avoiding speculative bubbles, individuals can make more informed decisions, ensuring their financial journeys are built on solid ground and a commitment to growth that is both exciting and realistic.