Palantir Technologies, a leader in artificial intelligence software, has seen its market capitalization soar to an impressive $425 billion. This surge, fueled by rapid expansion and widespread adoption of its AI platforms across government and commercial sectors, positions the company as a significant player in the global market. However, a closer examination of its current valuation metrics reveals that a substantial portion of its anticipated future success may already be reflected in its stock price, prompting a cautious outlook on its journey towards a trillion-dollar valuation.

Palantir's Market Dynamics and Future Prospects

Founded on its robust AI-powered data analytics software, Palantir (NASDAQ: PLTR) initially gained traction through government contracts, leveraging its capability to process vast quantities of real-time data for informed decision-making. The company subsequently broadened its reach into the commercial sector, where the rise of generative AI technologies further propelled the demand for its offerings, particularly its Artificial Intelligence Platform (AIP). This platform facilitates AI-driven assistance and automation, contributing significantly to Palantir's financial achievements. In the second quarter, the company reported a remarkable 48% year-over-year increase in overall revenue, exceeding $1 billion. Notably, the U.S. commercial segment demonstrated exceptional growth of 93%, while government revenue, still comprising over half of the total, climbed by 49%, with U.S. government spending being particularly strong at a 53% growth rate. The international commercial sector, though currently a weaker area, represents a potential future growth catalyst if global AI adoption accelerates.

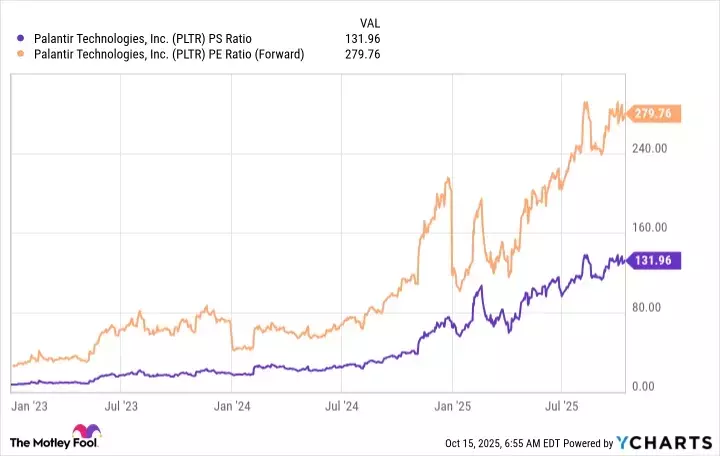

Despite its compelling growth trajectory, Palantir's stock has seen an extraordinary increase of 2,700% since early 2023, while its revenue has only risen by 80%. This disparity suggests a valuation that may be overly optimistic, with the stock trading at more than 130 times sales and nearly 280 times forward earnings. Such elevated multiples imply that investors have already priced in aggressive future growth. For instance, even with a highly ambitious compound annual growth rate of 50% over the next five years, leading to an projected revenue of $31.1 billion by 2030, and assuming a 35% profit margin, Palantir's earnings would amount to $10.9 billion. If the company were then valued at a more conservative, albeit still aggressive, multiple of 40 times earnings, comparable to major tech companies like Nvidia, Alphabet, and Microsoft, its market capitalization would reach approximately $436 billion. This figure falls considerably short of the $1 trillion target, indicating that the market may have prematurely incorporated several years of growth into Palantir's current stock price. Consequently, investors should temper expectations regarding its short-to-medium term market outperformance.

The journey of Palantir Technologies underscores a critical lesson for investors: market enthusiasm, especially in burgeoning sectors like AI, can lead to valuations that outpace fundamental business growth. While Palantir's innovative technology and expanding client base are undeniable strengths, the current stock price appears to reflect an ambitious future rather than current realities. This situation highlights the importance of scrutinizing valuation metrics, even for high-growth companies, to ensure that investment decisions are grounded in sustainable potential rather than speculative fervor. For Palantir to truly reach the trillion-dollar milestone, it will not only need to sustain its impressive operational growth but also demonstrate a path toward more normalized valuation multiples, a challenge that will test the resilience and strategic acumen of its leadership in the years to come.