Unlocking the Potential of Oral Biologics: Rani Therapeutics and Ultra Clean Holdings Poised for Explosive Growth

Investors have plenty to feel positive about as the economy continues to show resilience. Inflation is easing, and the stock market is reaching new highs, with the S&P 500 hitting a record close. Oppenheimer's chief investment strategist, John Stoltzfus, remains bullish on equities, citing economic resilience and opportunities for further gains. In this article, we'll dive into two Oppenheimer picks that are poised to capitalize on these favorable market conditions.Transforming the Biologics Landscape with Rani Therapeutics

Revolutionizing Biologic Drug Delivery

Biologics have revolutionized the treatment of severe and chronic autoimmune, inflammatory, and metabolic diseases, conditions that have historically proven resistant to traditional therapies. However, the delivery of these life-changing drugs has been a significant challenge, as they are typically administered through intravenous (IV) infusion due to their inability to withstand stomach acids. Rani Therapeutics, a pioneering biotech company, has developed a groundbreaking solution to this problem – the RaniPill, an innovative oral delivery system that allows biologic drugs to be absorbed effectively through the small intestine.The RaniPill capsule is designed to navigate the stomach intact, protecting the biologic drug within, and then release the medication in the small intestine, where it can be readily absorbed. This innovative approach not only improves patient comfort and medication compliance but also opens the door to a vast global biologics market, estimated to reach $856 billion by 2031.Promising Pipeline and Partnerships

Rani Therapeutics has leveraged its RaniPill technology to develop a robust pipeline of drug candidates targeting various metabolic and inflammatory conditions. Key pipeline assets include RT-102 for osteoporosis and RT-111 for psoriasis, both of which have shown promising results in early clinical trials. RT-102 is slated to begin a Phase 2 trial in Europe by the end of this year, while RT-111 will be tested at higher doses to further assess its safety and efficacy.In addition, Rani is collaborating with ProGen on the development and commercialization of PG-102, an obesity treatment delivered using the RaniPill. This partnership highlights the versatility of Rani's platform and its potential to address a wide range of unmet medical needs.Unlocking the Biologics Market Potential

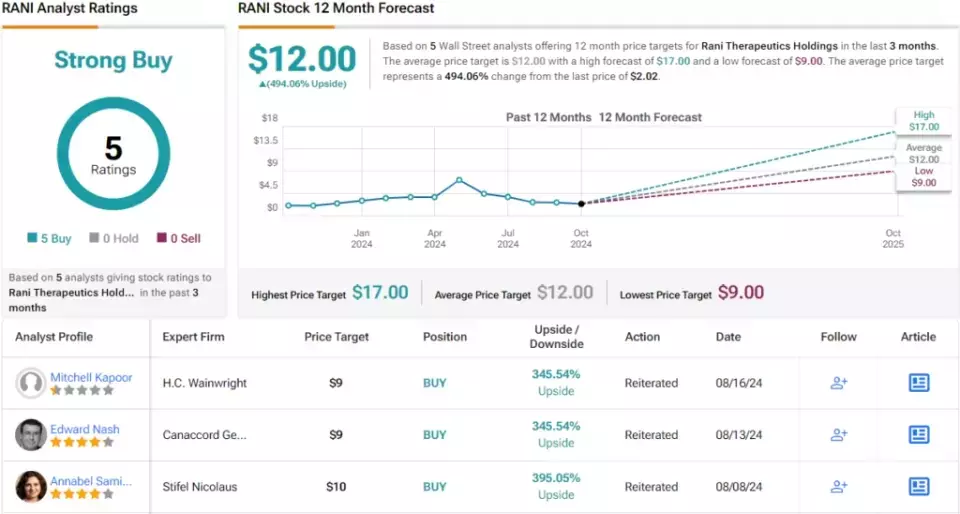

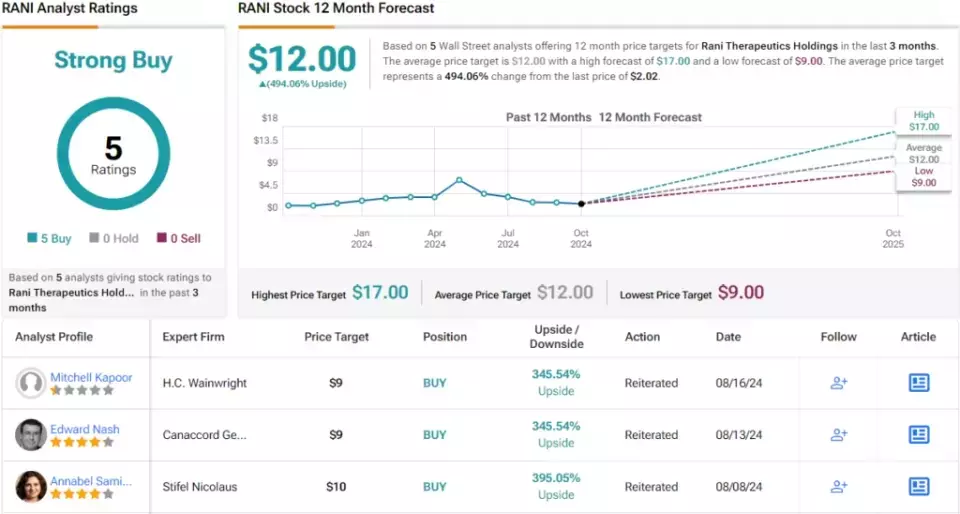

Oppenheimer analyst Andreas Argyrides is highly optimistic about Rani Therapeutics' prospects, noting that the company's innovative RaniPill technology could open the door to the global biologics market, which was valued at $516 billion in 2022. Argyrides estimates that Rani's pipeline could generate $1.1 billion in total product revenue, underscoring the significant upside potential.The analyst considers Rani Therapeutics a "compelling investment opportunity" due to the RaniPill's ability to achieve bioavailability comparable to or better than subcutaneous injections, while eliminating the discomfort and inconvenience associated with needle-based delivery. With strong intellectual property protection covering the RaniPill, RaniPill HC, and the delivery of various biologics and large molecules, Rani is well-positioned as a pioneer in the oral biologics space.Investing in the Future of Biologics

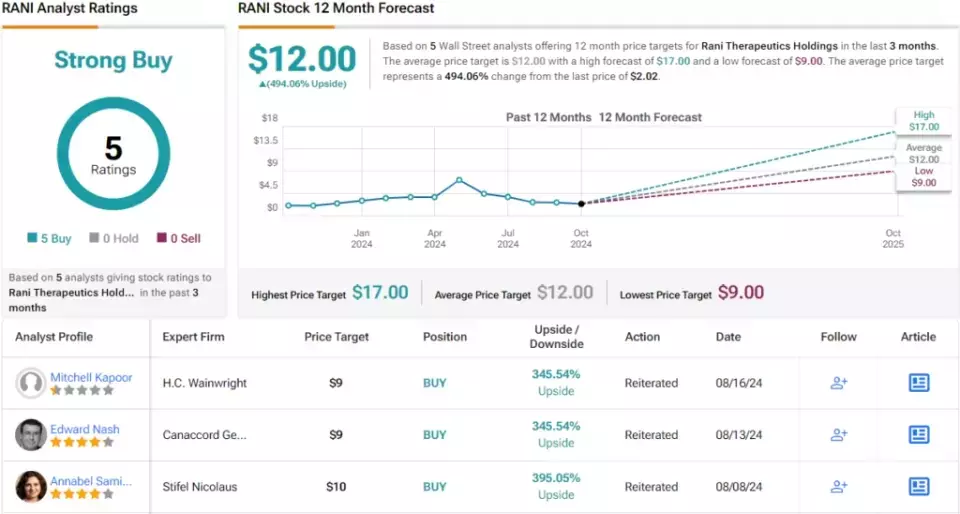

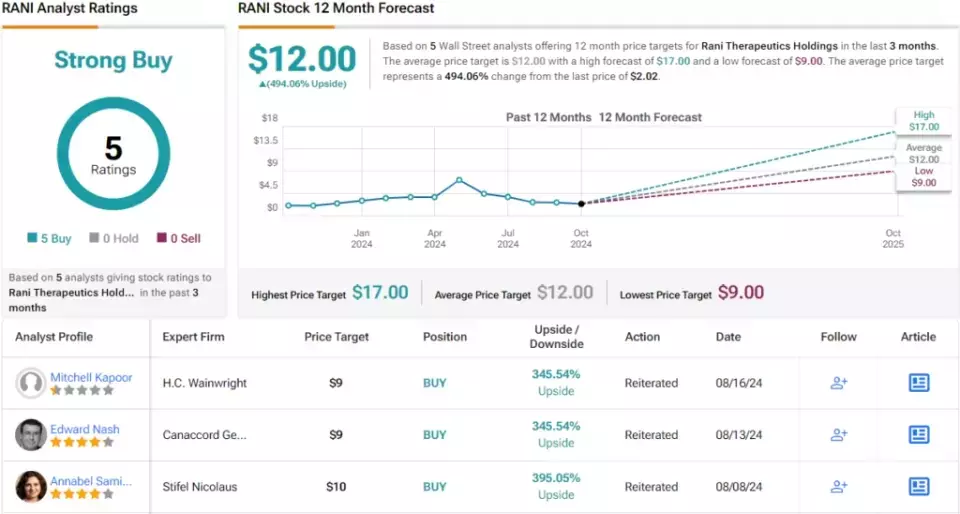

Despite the stock's recent underperformance, Argyrides sees an opportunity for Rani Therapeutics to recover as the company initiates a Phase 2 study with RT-102 in osteoporosis in Europe this year, followed by an Investigational New Drug (IND) application in the United States. Positive Phase 1 results from RT-111 in psoriasis and from ProGen's PG-102 further highlight the potential to address significant unmet needs across various therapeutic areas, including metabolic and inflammatory diseases.With a Buy rating and a price target of $17, implying a robust one-year upside potential of approximately 740%, Argyrides is confident in Rani Therapeutics' ability to capitalize on the growing biologics market and deliver substantial returns for investors.Powering the Semiconductor Chip Industry: Ultra Clean Holdings

Enabling the Semiconductor Chip Revolution

The semiconductor industry is at the forefront of technological innovation, driving advancements in artificial intelligence (AI), high-performance computing, and a wide range of other cutting-edge applications. As the demand for these technologies continues to soar, the need for the critical subsystems, components, and high-purity cleaning services necessary to manufacture microchips has become increasingly crucial.Enter Ultra Clean Holdings, a tech firm that provides essential tools and services to the semiconductor chip industry. The company's two divisions – Products and Services – work in tandem to deliver solutions that are vital for the production of these advanced microchips.Addressing the Semiconductor Supply Challenge

Oppenheimer analyst Edward Yang highlights the growing supply challenge in the semiconductor industry, noting that AI compute demand is doubling every six months, while hardware advancements, limited by Moore's Law, only improve every two years. This disparity has led to a chronic shortage of advanced semiconductors and the tools required to produce them.Yang considers Ultra Clean Holdings a "picks-and-shovels" investment that is well-positioned to address this growing supply challenge. The company's strong local presence in China, coupled with its ability to supply rising Chinese equipment makers, uniquely hedges it against the ongoing "Chips War" between the United States and China.Poised for Upward Momentum

In its recent Q2 2024 earnings report, Ultra Clean Holdings delivered impressive results, with revenue of $516.1 million, representing a 22% year-over-year growth and exceeding expectations by over $26 million. The company's non-GAAP earnings of 32 cents per share also beat forecasts by 6 cents.Looking ahead, Ultra Clean has projected revenues in the range of $490 million to $540 million for Q3, with a midpoint of $515 million – comfortably above the consensus estimate of $490.5 million. This strong performance and forward guidance suggest that the company is well on its way to reclaiming its prior peak levels, despite being down 20% in quarterly revenue and gross margin, with operating margin and stock price halved.Unlocking Upside Potential

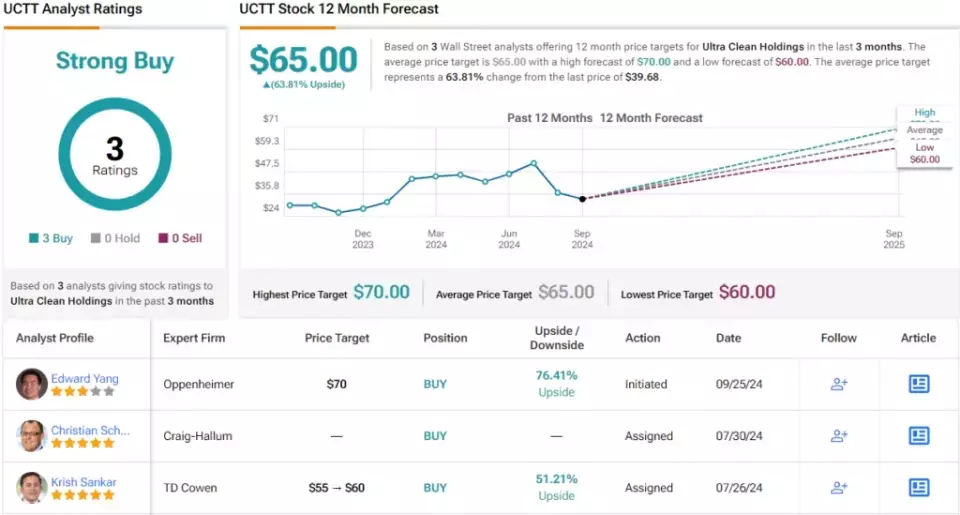

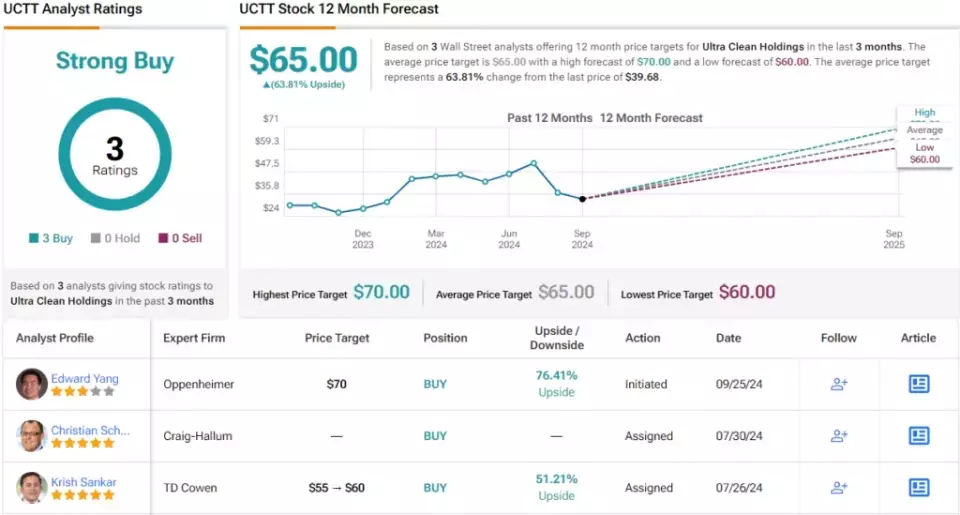

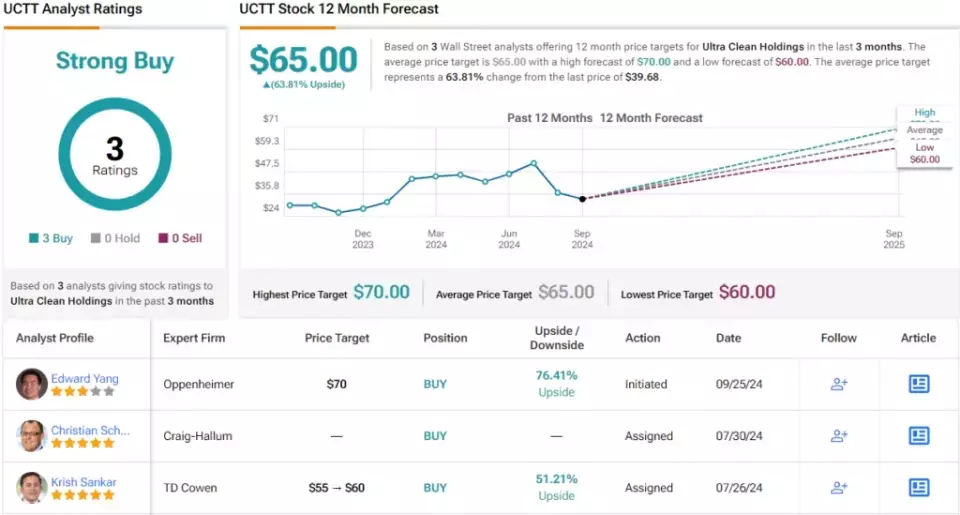

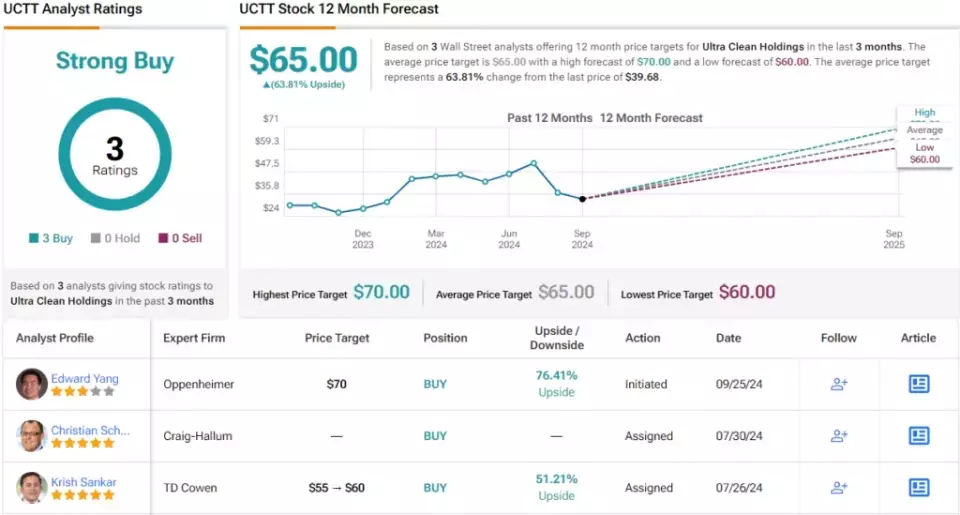

Oppenheimer's Edward Yang sees several factors that could lead Ultra Clean Holdings to surpass expectations. The company's strong positioning in AI growth areas, including high-bandwidth memory (HBM), advanced packaging, and vacuum-based EUV tools, all with leading Western original equipment manufacturers (OEMs), positions it well to capitalize on the growing demand for advanced semiconductors.Yang rates UCTT shares as Outperform (i.e., Buy) with a price target of $70, indicating a potential 76% upside within the next year. The analyst's confidence in Ultra Clean's ability to reclaim its prior peak levels and the stock's current discounted valuation make it a "coiled spring poised for upward movement."With a unanimous Strong Buy consensus rating from analysts and an average price target implying a one-year upside potential of 64%, Ultra Clean Holdings appears to be a compelling investment opportunity in the semiconductor industry.