Opendoor Technologies recently saw its stock value climb dramatically, largely due to a surge of interest from retail investors using social media platforms. This phenomenon occurred despite the company's persistent financial struggles in a difficult real estate landscape. The unique business model of directly acquiring and reselling homes, while efficient in booming markets, poses considerable risks during economic slowdowns, leading to significant monetary losses for Opendoor. The company's future stock performance heavily relies on a substantial improvement in its underlying business health, which remains uncertain.

Opendoor Technologies' Volatile Journey: From Record Lows to Social Media-Fueled Surge Amidst Housing Market Woes

In a significant financial development, Opendoor Technologies (NASDAQ: OPEN) witnessed an extraordinary 1,370% increase in its stock value, soaring from a record low of $0.51 in June to $7.50. This surge, observed on October 14, 2025, at 4:23 AM, was largely attributed to a coordinated buying frenzy by retail investors, primarily orchestrated through social media platforms. Despite this impressive rally, the company's fundamentals indicate ongoing challenges within the real estate sector.

Opendoor operates on a direct home-buying model, acquiring properties from sellers and aiming to resell them for profit. While this approach offers convenience to sellers, enabling quick transactions within two weeks or longer if needed, it carries inherent risks, particularly in a volatile market. The company's inventory of thousands of homes could lead to substantial losses if property values decline. This risk was highlighted by the withdrawal of other major players like Zillow and Redfin from the direct buying business after the 2021 housing boom, citing unprofitability and financial instability.

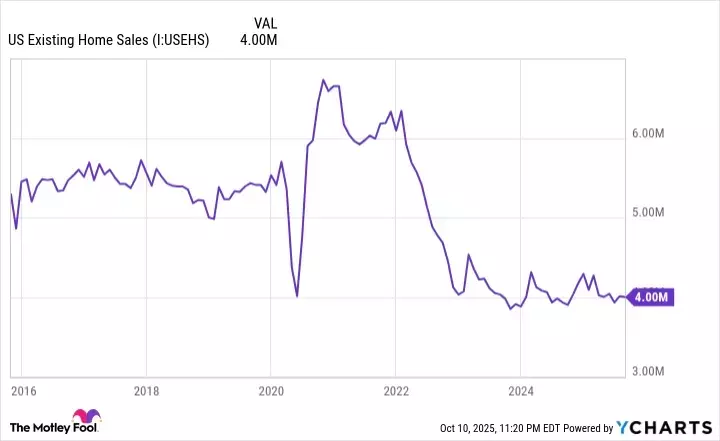

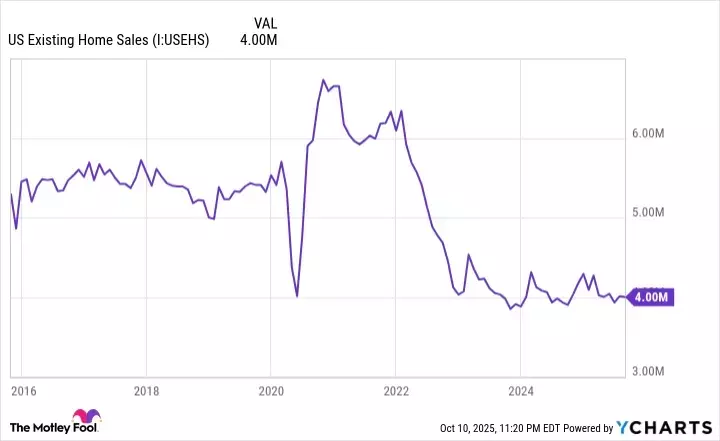

The current U.S. housing market is experiencing a downturn, with existing home sales at a five-year low. This slump is driven by elevated interest rates and pervasive economic uncertainty. Opendoor CEO Carrie Wheeler acknowledged these grim conditions in August, expressing little expectation for a near-term recovery. In the second quarter of 2025, Opendoor sold 4,299 homes but acquired only 1,757, reflecting a cautious stance on market conditions. The company reported $1.6 billion in revenue for the quarter, a modest 5% increase year-over-year.

However, profitability remains a significant concern. Opendoor incurred a GAAP net loss of $114 million in the first half of 2025, following losses of $392 million in 2024 and $275 million in 2023. The company's low gross profit margin of 8.3% on home sales is a primary contributor to its financial struggles, making it difficult to achieve profitability even with modest operating costs. As of June 30, Opendoor had $789 million in liquidity, bolstered by a $325 million convertible debt issuance in May, which may provide a buffer for a couple of years, contingent on a housing market improvement.

Looking ahead, the U.S. Federal Reserve's interest rate cuts in late 2024 and September 2025, with more anticipated, could provide a long-term tailwind for the real estate market by boosting consumer borrowing power. However, industry analysts and the article's author, Anthony Di Pizio, remain skeptical about Opendoor's ability to fundamentally overcome the inherent challenges of its business model. The comparison to other meme stocks like GameStop and AMC, which saw their values crash after speculative frenzies subsided, serves as a cautionary tale. Without tangible improvements in its financial performance, Opendoor's recent gains are unlikely to be sustained.

The recent surge in Opendoor's stock, driven by social media, serves as a powerful reminder of the speculative forces at play in today's market. While the allure of quick gains can be strong, this situation highlights the critical importance of evaluating a company's fundamental health and long-term viability. Investors should exercise caution and conduct thorough due diligence, rather than relying solely on social media trends, especially when a company's core business model faces significant, proven challenges. The experience of Opendoor, much like GameStop and AMC before it, underscores that speculative rallies are often fleeting, and sustainable growth ultimately depends on robust financial performance and a sound business strategy, not just internet buzz.