Oil Volatility Surges as Geopolitical Tensions Rattle Markets

The oil market has been on a wild ride in recent weeks, with futures posting their largest gain in more than a year. The frenzy has been even more pronounced in the options market, as traders scramble to position themselves for a potential price spike.Navigating the Turbulent Oil Landscape

Shifting Sentiment and Volatility Spikes

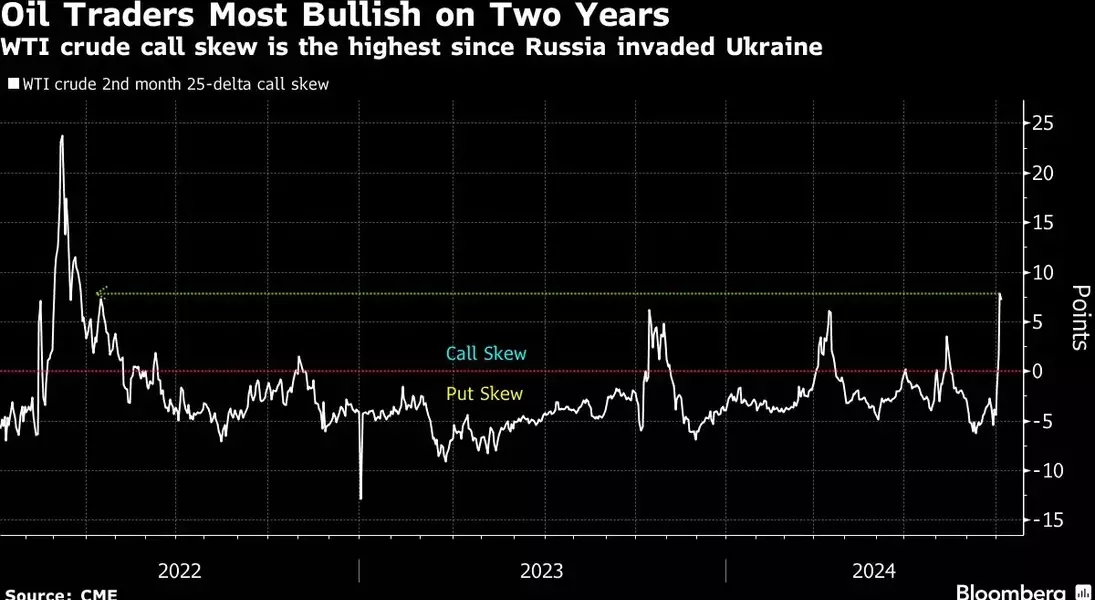

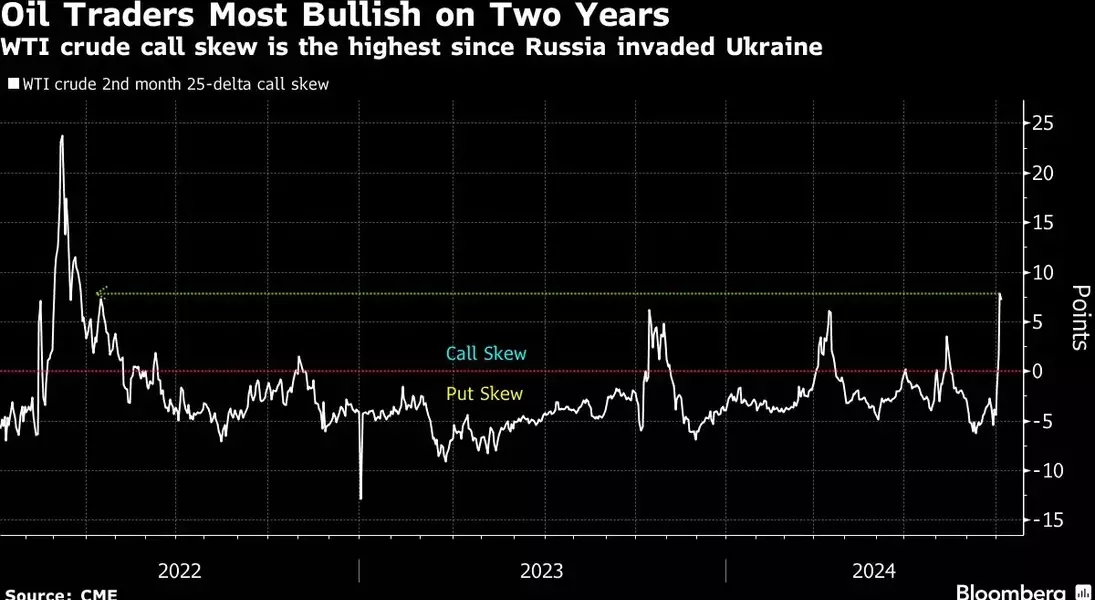

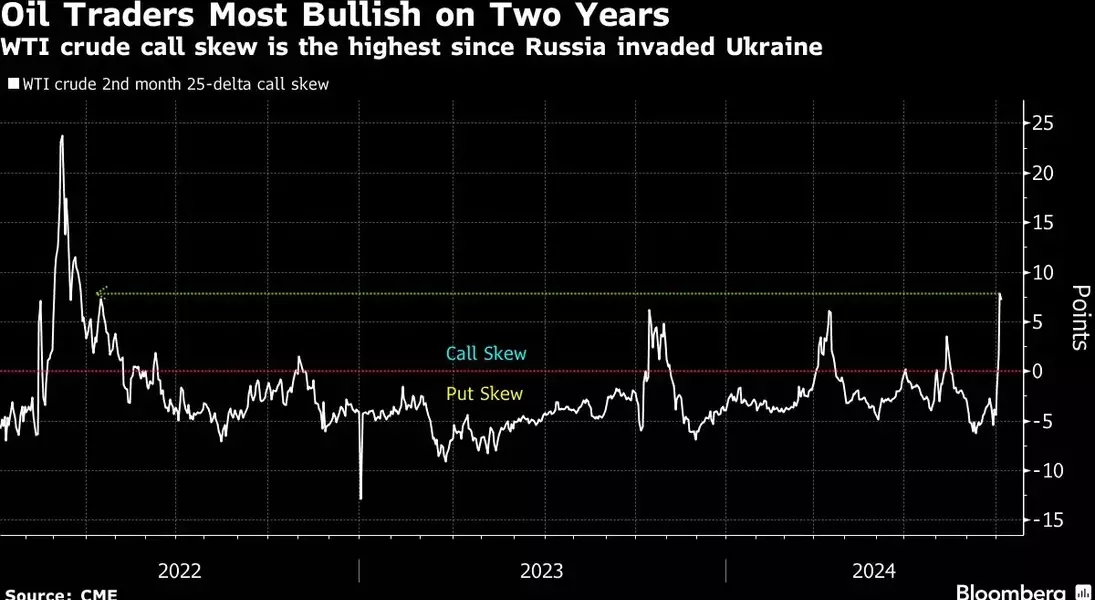

The oil market has experienced a stunning turnaround in recent weeks. Just a few weeks ago, hedge funds, commodity trading advisors, and other money managers had turned bearish on crude, concerned that slower economic growth in China and elsewhere would crimp demand just as OPEC+ producers were set to boost supply. However, the escalation of tensions in the Middle East has changed the landscape entirely.Traders are now racing to reverse their positions and buy insurance against a surge in prices. The call skew on second-month West Texas Intermediate futures has jumped to the highest level since March 2022, when Russia's invasion of Ukraine sparked concerns about supply disruptions. Implied volatility has also surpassed a high from October of last year, reflecting the heightened uncertainty in the market.Bullish Bets and Outlandish Wagers

The frenzy in the options market has been particularly pronounced. Traders have been snapping up December calls on Brent crude, betting on oil reaching $100 or higher. In fact, aggregate call volume hit a record on Wednesday last week. WTI futures also surged as much as 11% amid concerns that Israel might strike oil facilities in retaliation for Iran's missile attack, raising fears of a Middle East supply disruption.The bullishness has extended beyond just outright crude prices. Traders have also been placing outlandish bets on the futures curve structure rallying heavily. More than 5 million barrels wagering on the nearest Brent spread hitting $3 a barrel traded last week, a significant jump from the 62 cents level seen on Friday.Shifting Dynamics and Investor Sentiment

The stress on the market has been most evident in short-dated contracts, with the term structure for 25-delta options showing a spike in bullish trading in recent days. Implied volatility for December calls climbed more than 30 points last week, more than triple the increase for puts, while there was almost no change for either bullish or bearish positions for July contracts and onward.The bullishness for the commodity has exceeded that for producers, which are likely to see a benefit only if prices remain higher for longer. Volatility and call skew in one-month options on the US Oil Fund LP exchange-traded fund both surged more than for the SPDR S&P Oil & Gas Exploration & Production ETF, suggesting that investors are more focused on the potential for a price spike than on the long-term fundamentals of the industry.Navigating the Uncertainty

The escalation in the Middle East has sparked a massive amount of short covering in crude oil, as commodity trading advisors have flipped from short to neutral positions. However, fundamental energy investors remain fairly sour on the long-term outlook, using call options as a way to get upside exposure to a potential supply disruption without chasing the rally in crude.As the market continues to grapple with the uncertainty, traders and investors will need to carefully navigate the turbulent landscape. The potential for further geopolitical tensions and supply disruptions could continue to drive volatility in the oil market, making it crucial for market participants to stay informed and nimble in their approach.You May Like