Sorting out the Details

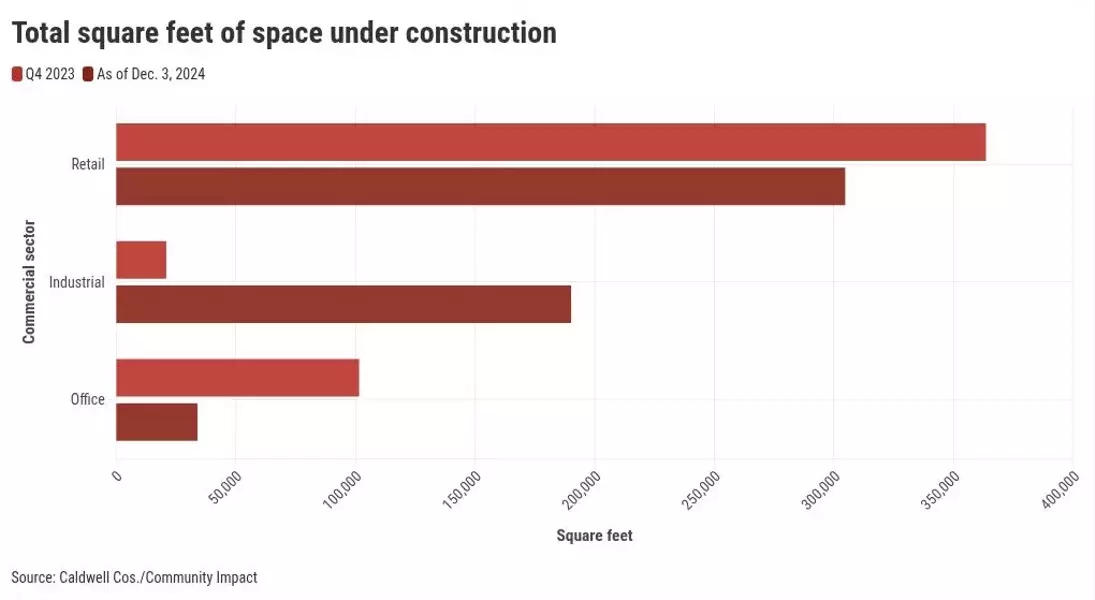

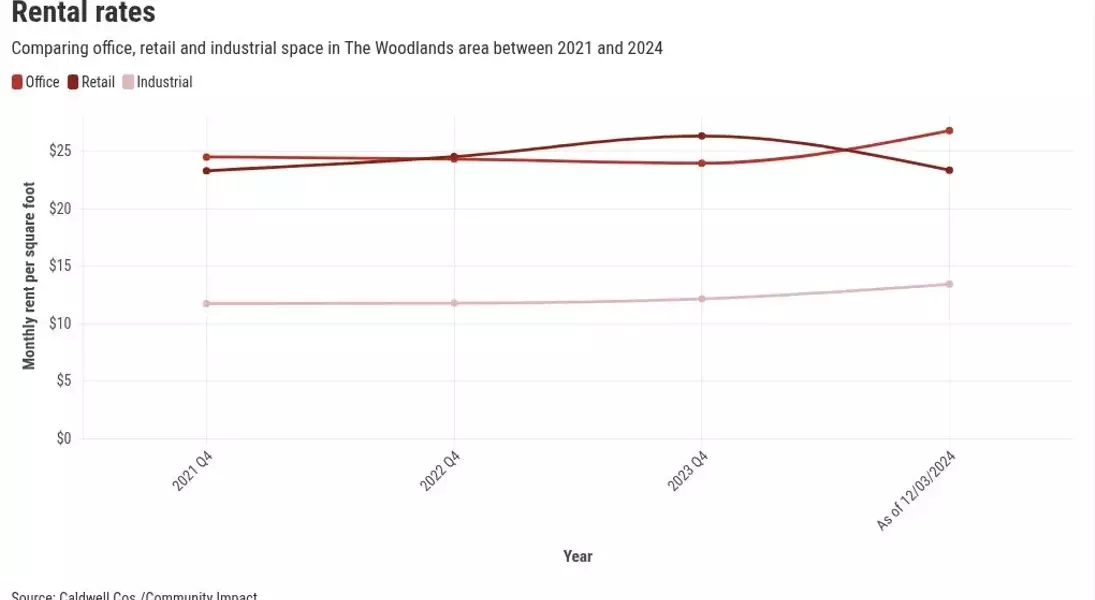

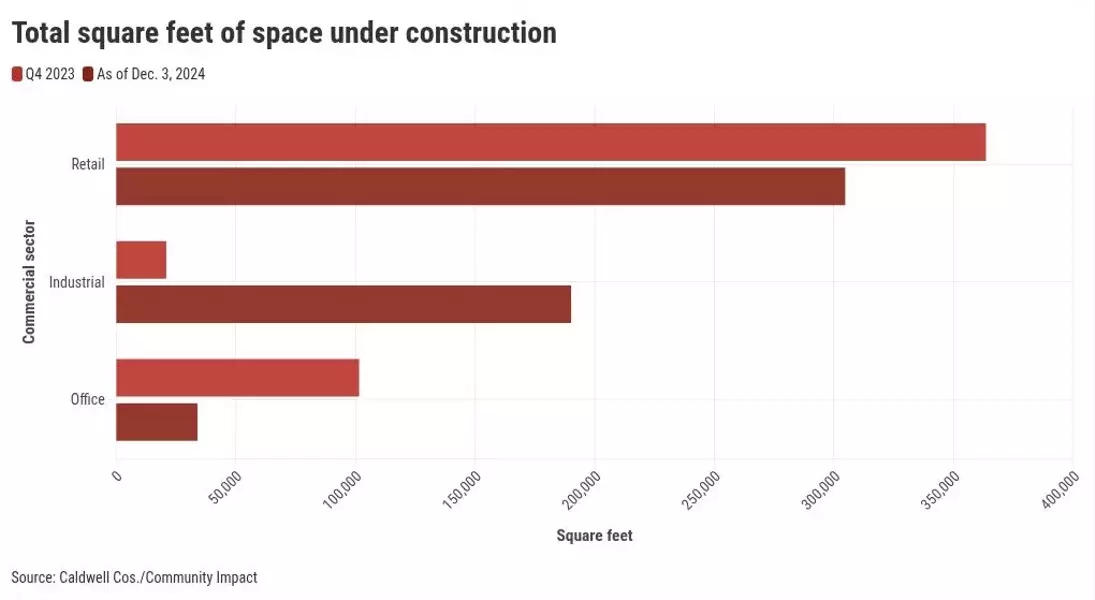

Office and retail trends in the area remained consistent with those observed in October. This indicates a certain stability in these sectors during this period. Regarding rental rates, industrial spaces have shown an upward trajectory since 2021. On the other hand, retail rental rates have witnessed a decline since reaching a four-year high in late 2023. These fluctuations provide valuable insights into the local market dynamics.Office Sector

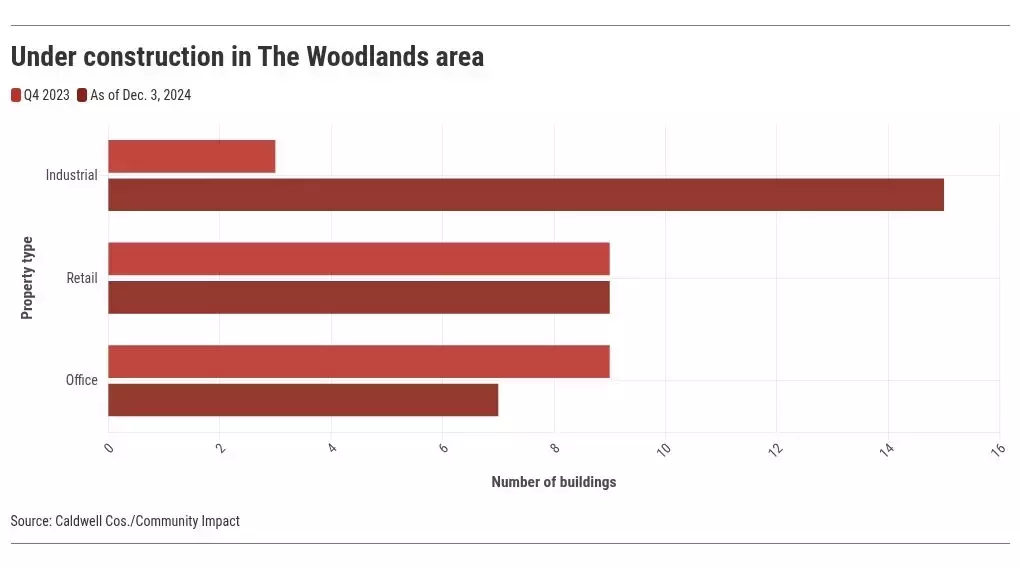

There are fewer buildings under construction in the office sector. This could potentially lead to a more balanced supply and demand situation in the future. With fewer new offices coming up, existing spaces might become more sought after, which could have implications for rental prices and occupancy rates. It also suggests that the market is maturing and evolving.Another aspect to consider is the impact of these occupancy changes on businesses operating in the area. For example, office-based companies might need to adapt their strategies to accommodate the changing landscape. Retailers, on the other hand, might need to focus on differentiating their offerings to attract customers in a competitive market.

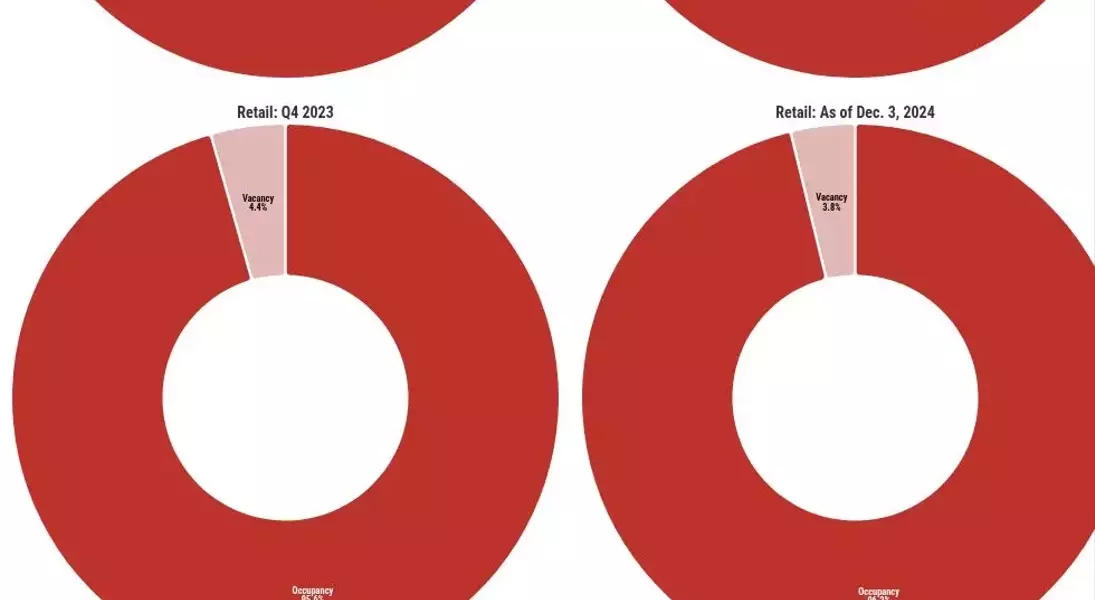

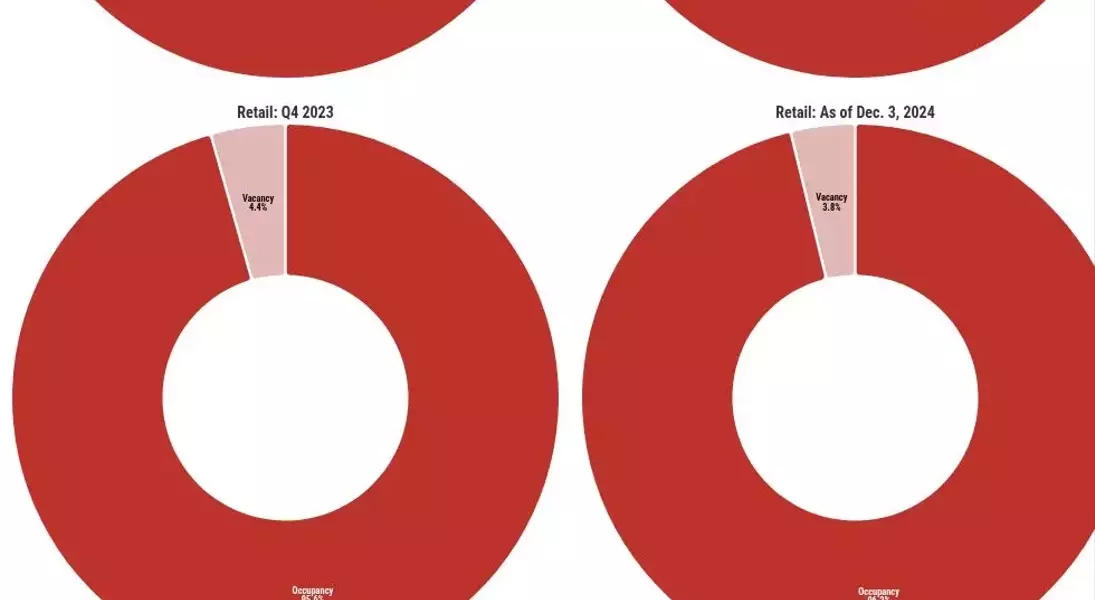

Retail Sector

The consistent trend with October indicates that the retail sector in the Woodlands area is showing some resilience. Despite the overall economic conditions, retailers are able to maintain a certain level of occupancy. However, the decrease in rental rates since late 2023 poses a challenge for retailers. They need to find ways to optimize their operations and manage costs to stay profitable in this environment.One possible strategy for retailers is to focus on customer experience and offer unique products or services. By differentiating themselves from competitors, they can attract more customers and justify higher prices. Additionally, collaborating with local businesses and community organizations can help build a stronger customer base and enhance the overall shopping experience.

Industrial Sector

The increase in rental rates since 2021 shows the growing demand for industrial spaces in the area. This could be due to various factors such as the expansion of local businesses or the rise in e-commerce activities. However, the recent decrease in occupancy by about 15 percentage points compared to 2023's fourth quarter is a cause for concern.Industrial developers and investors need to closely monitor these trends and adjust their strategies accordingly. They might need to focus on improving the quality and functionality of industrial spaces to attract tenants. Additionally, providing flexible leasing options and better infrastructure can help address the challenges faced by the industrial sector.