According to the latest U.S. Census Construction Spending data, private residential construction spending witnessed a significant increase in October. This upward trend has various implications for the housing sector and the economy as a whole.

Uncover the Dynamics of Private Residential Construction Spending

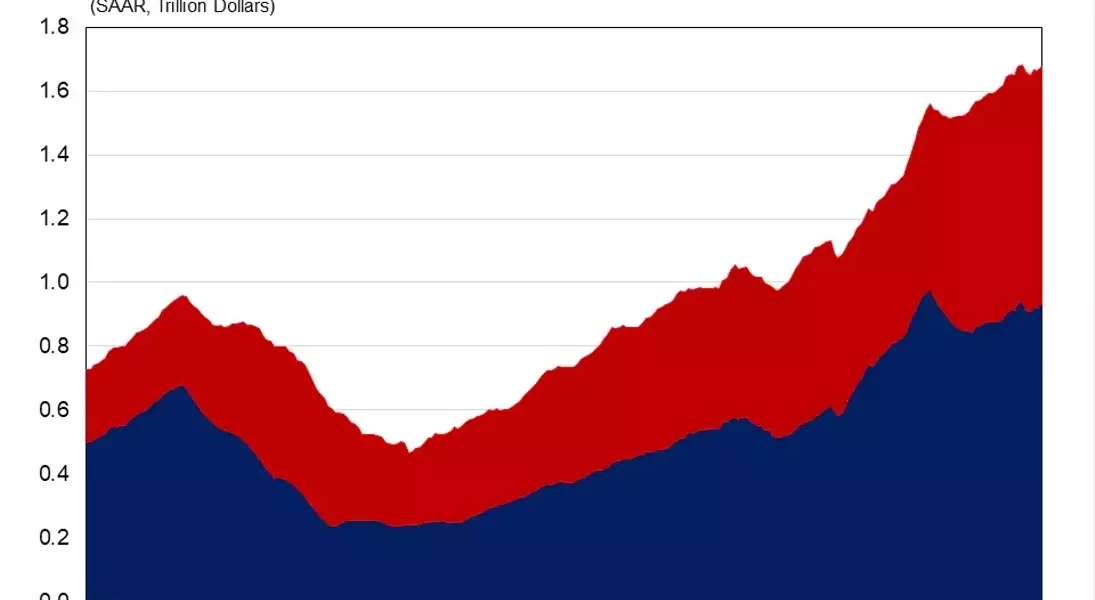

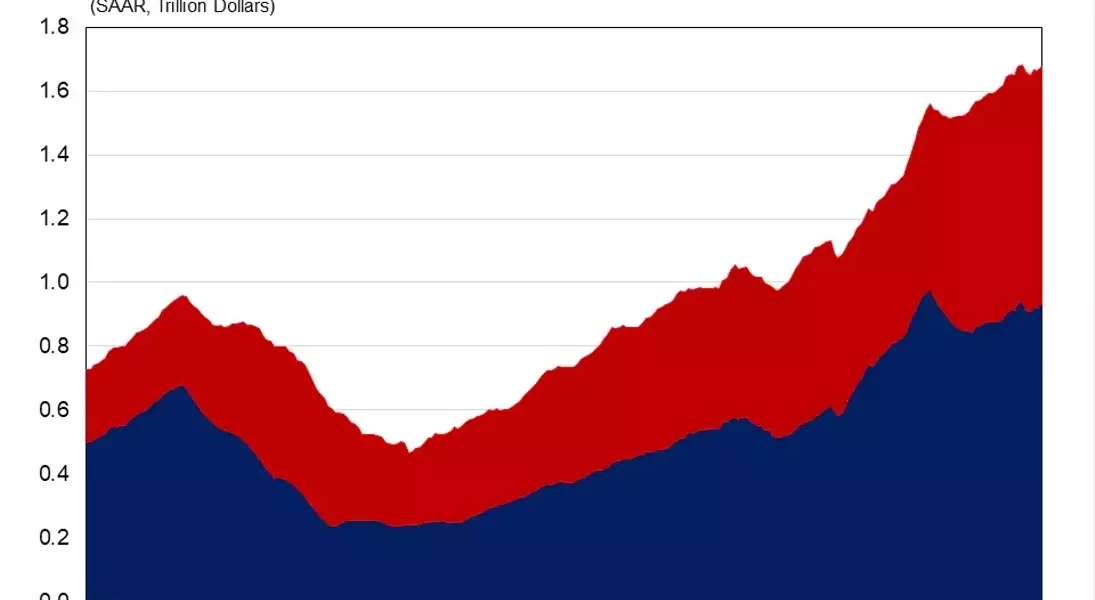

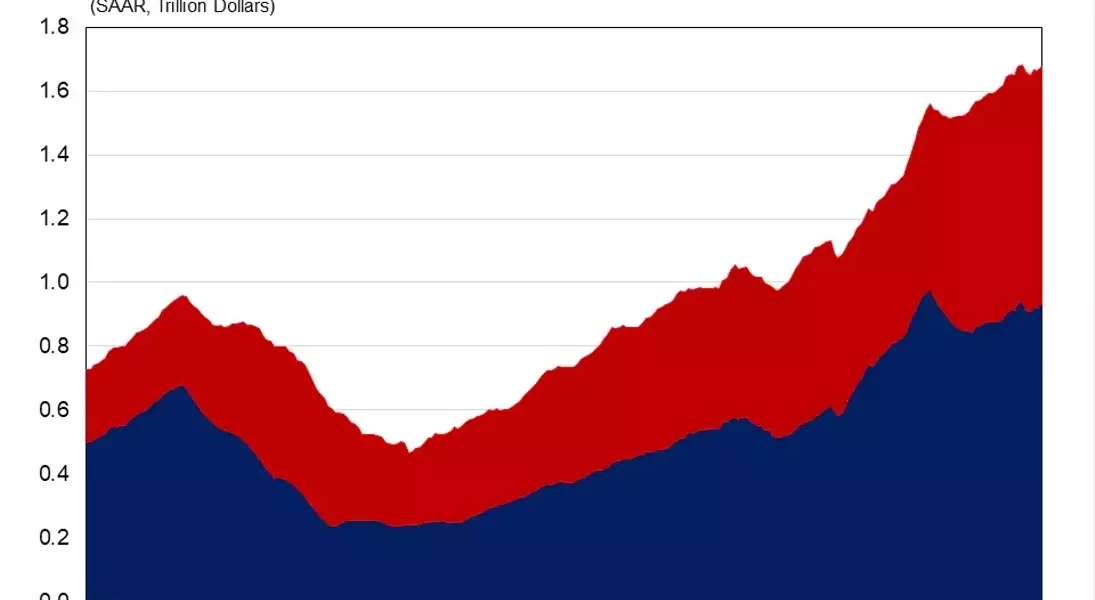

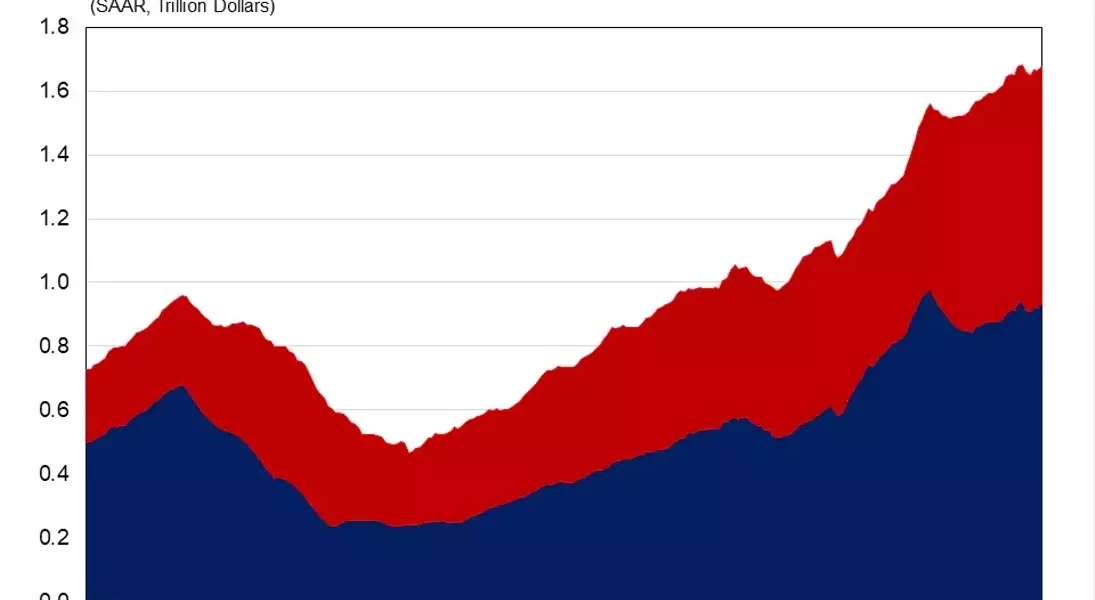

Residential Improvements: The Driving Force

In October, the monthly increase in total private construction spending was mainly fueled by higher spending on residential improvements. The surge in improvement spending, which climbed by 2.7% during the month and was 18.5% higher compared to the same period last year, showcases the growing focus on enhancing existing residential properties. This indicates a positive sentiment among homeowners and developers alike, as they invest in upgrading and modernizing their homes. For instance, many homeowners are choosing to renovate their kitchens and bathrooms to increase the value and comfort of their living spaces. This trend not only benefits individual homeowners but also has a ripple effect on the construction industry and the economy.Single-Family Construction: A Steady Growth

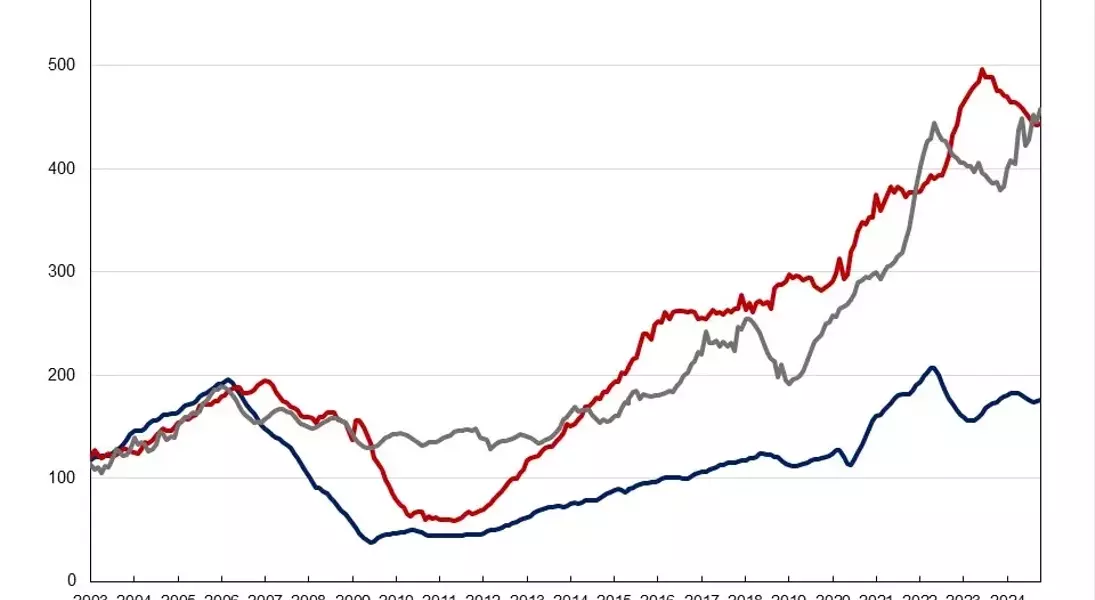

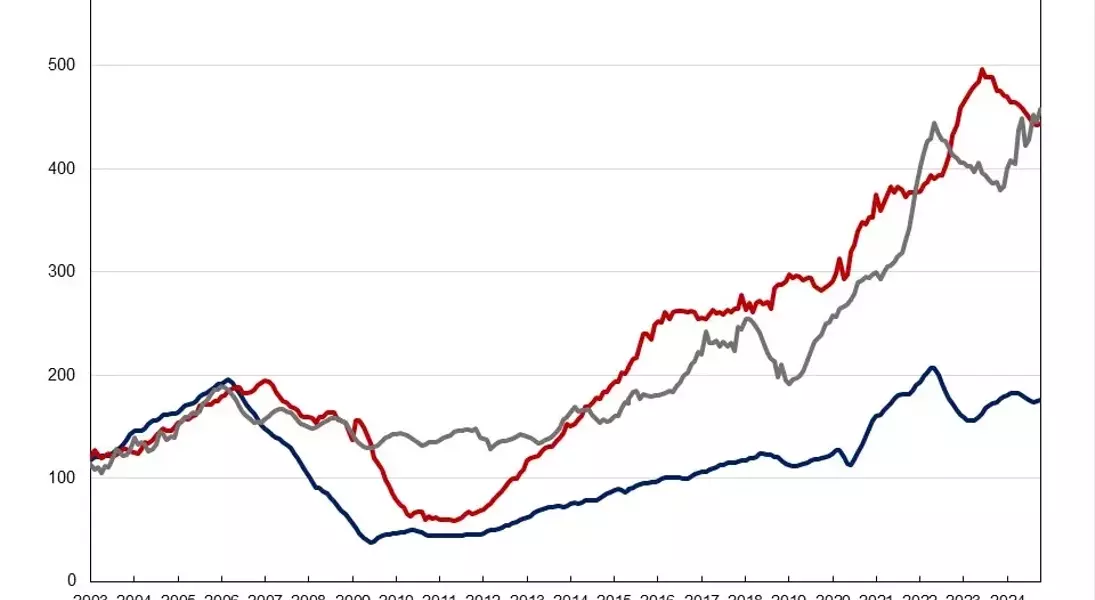

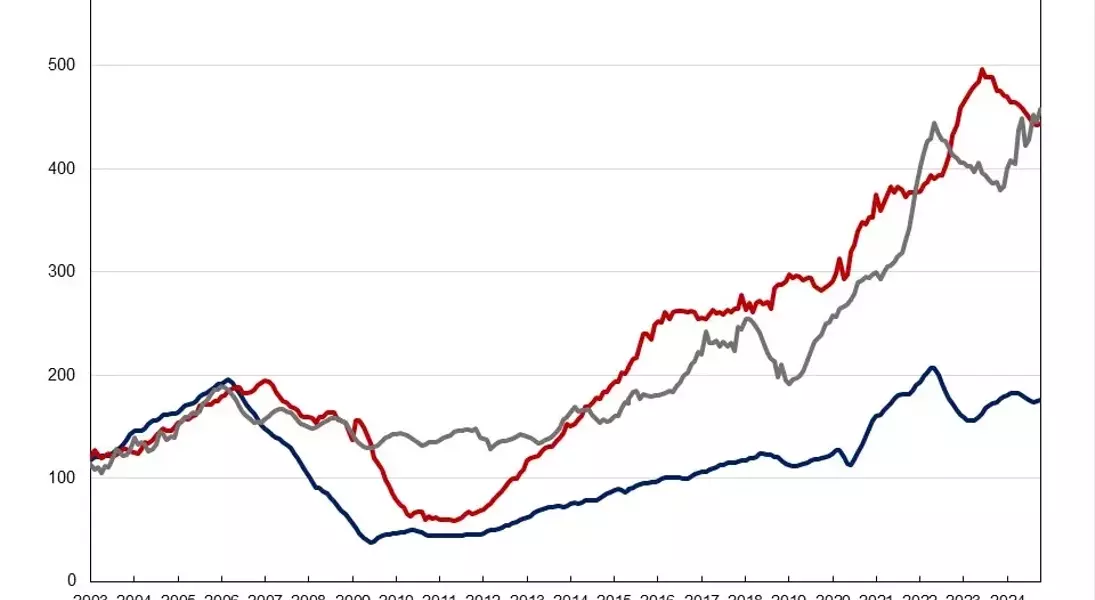

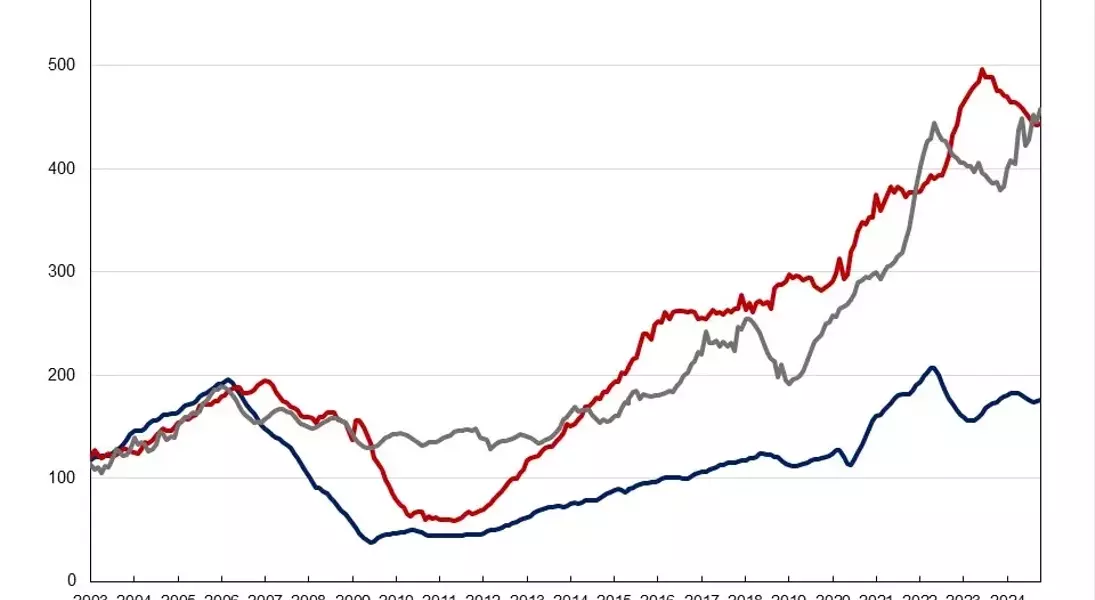

Spending on single-family construction inched up by 0.8% in October. This marks a continuation of growth after a five-month decline from April to August, which aligns with the rising builder confidence. Compared to a year ago, spending on single-family construction was 1.3% higher. This steady growth in single-family construction is a promising sign for the housing market. It suggests that demand for new single-family homes is gradually picking up, despite the challenges posed by elevated interest rates. Builders are showing resilience and adapting to the changing market conditions by focusing on quality and innovation. They are incorporating energy-efficient features and modern designs to attract homebuyers and meet the evolving needs of consumers.Multifamily Construction: A Turnaround

Multifamily construction spending ended its streak of ten consecutive monthly declines and edged up by 0.2% in October. Although this is a slightly monthly gain, multifamily construction spending remained 6.8% lower compared to a year ago. This turnaround in multifamily construction indicates that the market is gradually recovering. Despite the challenges, developers are seeing opportunities in the multifamily sector, especially in urban areas where there is a high demand for rental housing. They are focusing on building affordable and sustainable multifamily units to meet the needs of renters. This trend is likely to continue as the population continues to grow and urbanization accelerates.Private Nonresidential Construction: A Boost

Spending on private nonresidential construction was up 3.5% over a year ago. The annual private nonresidential spending increase was mainly due to higher spending for the class of manufacturing ($32.9 billion), followed by the power category ($6.4 billion). This growth in private nonresidential construction is a positive sign for the business sector. It indicates that companies are investing in expanding their operations and upgrading their facilities. This, in turn, creates jobs and stimulates economic growth. The increase in manufacturing spending is particularly significant as it reflects the growing demand for goods and the need for modernization in the manufacturing industry.You May Like