Uncertainty Prevails: Deciphering the Job Market's Health Amidst Data Voids

The Impact of Governmental Stoppage on Economic Visibility

For two consecutive months, the federal government's operational pause has halted the release of crucial employment statistics. This absence of the Bureau of Labor Statistics' comprehensive reports leaves a significant gap in the nation's understanding of its workforce dynamics. Consequently, economists and financial experts are compelled to look towards alternative, often fragmented, data sources to piece together a picture of the job market's current trajectory.

Conflicting Signals from Private Sector Metrics

The available information from non-governmental entities offers a mixed bag of results. A major payroll processing firm recently indicated an increase in new hires during October, hinting at positive movement. However, a different consulting group, specializing in workforce reductions, reported a substantial rise in termination notices for the same period. These contrasting reports underscore the difficulty in forming a clear consensus on the state of employment without the standardized and broad overview typically provided by government data.

Expert Perspectives on Navigating Data Scarcity

Federal Reserve Governor Lisa Cook acknowledged the inherent challenges in delivering an economic forecast when key data is unavailable, noting that the prolonged shutdown exacerbates this issue. Despite the data disruption, Cook asserted that authorities are not operating entirely without guidance. They are diligently examining private-sector employment figures and gathering qualitative insights from diverse business connections to inform their economic outlook and policy decisions.

Eroding Worker Confidence in a Shifting Landscape

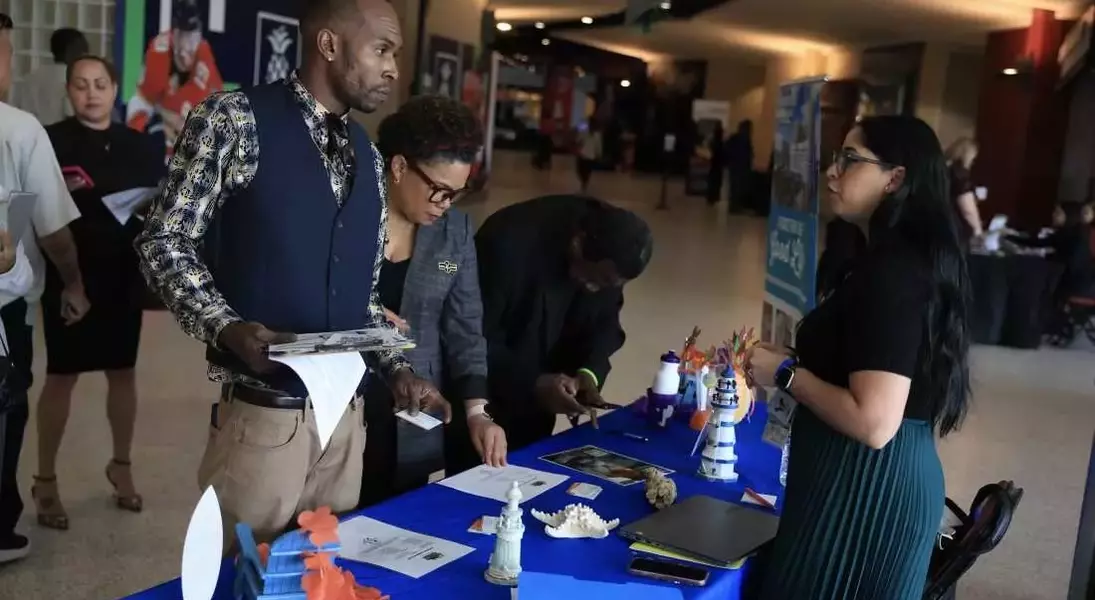

The climate of economic ambiguity is visibly affecting the American workforce. Data from a prominent job-search platform reveals a noticeable dip in employee confidence concerning job availability over the last quarter. This decline is further illustrated by a reduced propensity for job seekers to decline employment offers in October compared to previous months, indicating a perceived decrease in negotiating power amidst rising concerns about job security.

High-Profile Layoffs and Their Ripple Effects

Recent announcements of significant workforce reductions by major corporations, including technology and logistics giants, are likely contributing to the prevailing anxiety among workers. A leading outplacement firm reported October as the worst month for job cut announcements in over two decades, with a substantial number of planned layoffs. Experts from the firm suggest that those recently displaced from their jobs are facing prolonged searches for new roles, potentially leading to a further softening of the overall labor market.

Persistent Stability in Unemployment Claims Amidst Slowdown

Despite the grim layoff figures, state-level records for new unemployment benefits applications have remained relatively stable, suggesting that a widespread surge in job losses has yet to materialize. Furthermore, a major payroll services provider indicated a modest, albeit significant, uptick in private-sector employment for October, breaking a two-month trend of decline. This suggests a continued, albeit slower, pace of job creation.

Demographic Shifts and Uneven Economic Impacts

Prior to the data blackout, official figures showed a deceleration in job growth, partially attributed to an aging workforce and reduced immigration impacting labor supply. While the overall unemployment rate remains historically low, a closer look reveals a disproportionate impact on certain demographic groups. Younger workers and African American communities have experienced more pronounced increases in unemployment, highlighting a "two-speed" economy where economic prosperity is not evenly distributed across all segments of society.