The semiconductor landscape is experiencing a significant upheaval, with Nvidia reportedly displacing Apple as the dominant client for TSMC's advanced chip fabrication services. This pivot is attributed to the explosive growth in demand for artificial intelligence processors, which now consumes a substantial portion of TSMC's high-end wafer output. While Apple has historically held a privileged position due to its consistent volume and long-standing partnership, the immense financial investment and urgent need for AI-focused hardware have recalibrated the priorities of the leading chip manufacturer.

This shift raises questions about the future dynamics between tech giants and their manufacturing partners, highlighting the strategic importance of AI in the global economy. Although Apple's continued success in consumer electronics ensures a steady demand for its chips, the sheer scale and specialized requirements of AI accelerators are reshaping the competitive landscape. TSMC, as the bottleneck for cutting-edge chip production, now finds itself in a powerful position, dictating access to its most advanced fabrication nodes.

The Ascent of AI: Nvidia's Dominance in Wafer Allocation

In a notable development within the semiconductor industry, Nvidia has reportedly surpassed Apple as TSMC's primary consumer of advanced wafers. This shift is primarily fueled by the burgeoning demand for AI-specific chips, which are significantly larger and more complex than those used in consumer devices like iPhones. For years, Apple enjoyed preferential access to TSMC's latest fabrication processes, securing a substantial allocation of wafers for its various product lines. However, the unprecedented investment and rapid expansion in artificial intelligence technologies have altered this long-standing arrangement, pushing Nvidia to the forefront. This strategic realignment underscores the profound impact of AI on manufacturing priorities and resource allocation in the high-tech sector.

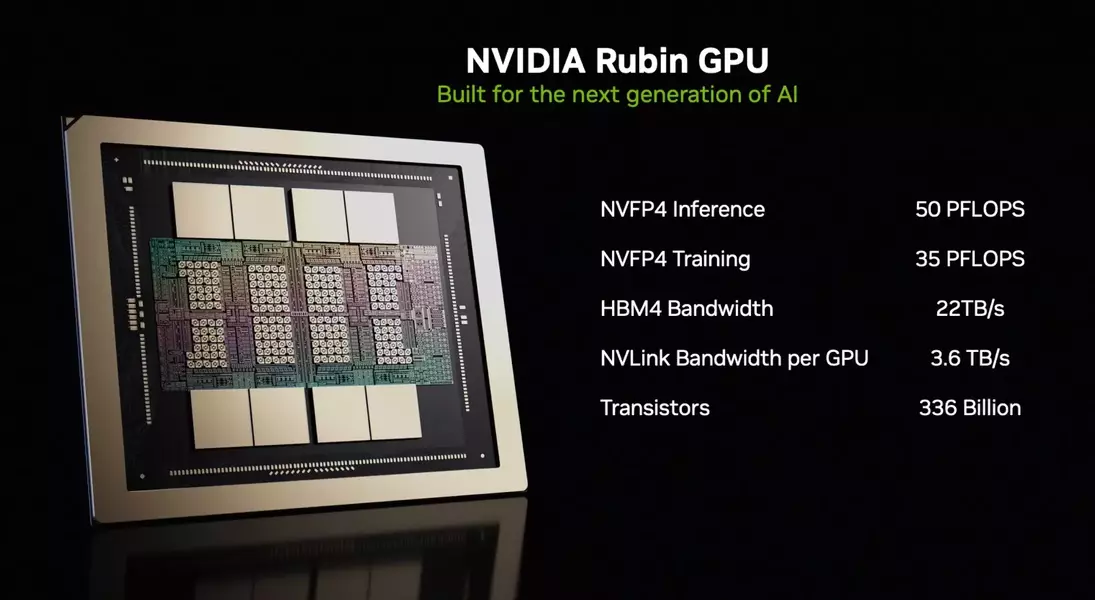

According to insights from Taiwan-based technology reporter Tim Culpan, a veteran from Bloomberg, Nvidia's requirements for large, advanced AI chips, such as the Rubin-Vera AI behemoths, demand a disproportionately higher number of wafers compared to Apple's mobile processors. For instance, Apple's A19 processor, destined for the iPhone 17 and produced on TSMC's N3P node, boasts a die area of roughly 100 square millimeters, allowing hundreds of dies per 300 mm wafer. In contrast, Nvidia's upcoming Rubin GPU, utilizing the N3 node, features two 'reticle-sized' dies, each measuring between 750 to 800 square millimeters. This massive size means a single wafer yields fewer than 100 usable dies, dramatically increasing Nvidia's wafer consumption per chip. This stark difference in chip architecture and production scale demonstrates why Nvidia's surging AI demand has repositioned it as TSMC's top client, despite Apple's consistent volume in the smartphone market.

Shifting Tides: Long-term Implications for Tech Giants

While Nvidia currently commands the lion's share of TSMC's most advanced wafer production due to the explosive demand for AI, the long-term sustainability of this shift remains a subject of considerable debate. Apple, with its vast financial resources and consistently high sales across a diverse ecosystem of products, including Macs, MacBooks, and other devices, represents a deeply entrenched and reliable customer for TSMC. Its consistent annual production of hundreds of millions of units offers a stable and predictable revenue stream, a stark contrast to the potentially more volatile nature of the rapidly evolving AI market. This inherent stability and financial strength allow Apple to remain a formidable force in the semiconductor procurement landscape, capable of influencing future manufacturing allocations.

Despite the current surge in AI-driven demand, the long-term trajectory of this sector is not without its uncertainties. While Nvidia enjoys a significant lead in consumer GPU sales and is capitalizing on the AI boom, the sustained growth of AI chip demand over several years is not guaranteed. Other major players, including AMD and Intel, are also heavily investing in high-performance computing (HPC) and AI chips, collectively spending massive sums on advanced wafers. These HPC customers are willing to pay premium prices for the latest nodes, and can easily pass these costs onto end-users, giving TSMC considerable leverage. Ultimately, TSMC holds the decisive position in this ecosystem; regardless of which company presents the most compelling case or the safest bet, access to cutting-edge fabrication largely depends on TSMC's capacity and strategic decisions, ensuring its continued dominance in the global semiconductor supply chain.