Unlocking the Future: Nvidia's AI Prowess and Investment Potential

The AI Computing Arena: A Landscape of Deals and Innovations

The artificial intelligence computing sector is currently experiencing a boom, marked by a constant stream of new deals signaling strong demand for advanced AI infrastructure. This surge in investment is particularly beneficial for hardware providers, enabling them to strategically plan their production capacities. Amidst this vibrant market, Elon Musk's xAI has emerged as a significant player, reportedly finalizing a substantial $20 billion agreement with Nvidia. This landmark deal is set to supply xAI with essential Graphics Processing Units (GPUs) for its sophisticated Memphis Colossus 2 data center, reinforcing Nvidia's leading role in powering the next generation of AI models.

Nvidia's Enduring Growth Trajectory

While the $20 billion agreement with xAI is substantial, it contributes a nuanced percentage to Nvidia's overall revenue, given its quarterly data center earnings of $41.1 billion. This indicates that the deal's financial impact will be distributed over multiple fiscal periods. Nevertheless, this partnership underscores a broader industry trend: the relentless expansion of AI. Even as rivals like Broadcom and AMD secure their own AI computing contracts – with AMD directly competing in GPU design and Broadcom offering bespoke, cost-effective solutions – Nvidia continues to be a preferred choice for developing advanced AI systems. The company's dominance is further evidenced by its ongoing collaborations with major entities like OpenAI, despite the latter also engaging with Nvidia's competitors. Jensen Huang, Nvidia's CEO, has boldly predicted a colossal increase in global data center capital expenditures, forecasting a jump from $600 billion by late 2025 to an astounding $3 trillion to $4 trillion by 2030, positioning Nvidia for continuous substantial expansion.

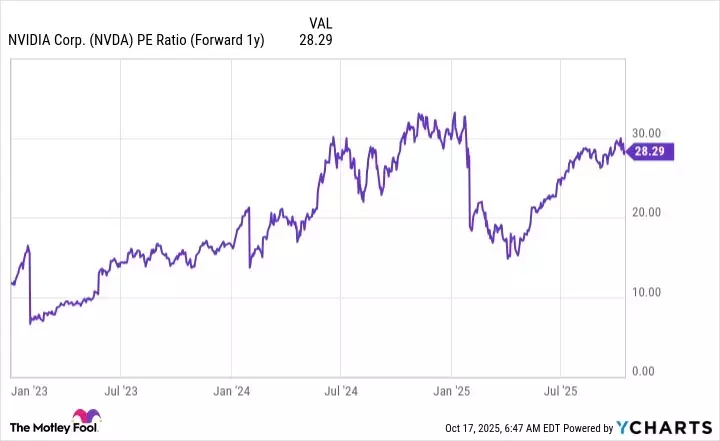

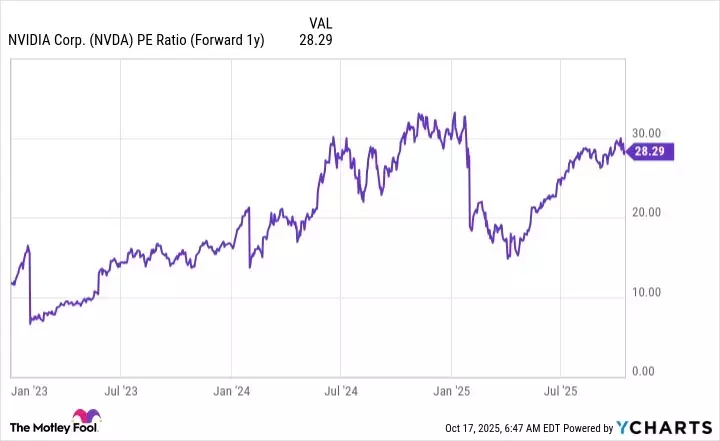

Analyzing Nvidia's Valuation in a Growing Market

Should Nvidia's projections for AI spending hold true, the industry would witness a remarkable compound annual growth rate (CAGR) of 42% over the next five years. This figure significantly surpasses Wall Street analysts' current revenue growth estimates of 33% for Nvidia's fiscal year 2027. Historically, analysts have often underestimated Nvidia's growth potential, suggesting a similar scenario might unfold again. If Nvidia maintains a revenue growth rate exceeding 40% through 2026, its current valuation, approximately 28 times next year's earnings, could appear considerably undervalued in retrospect. The company's entrenched position in the AI sector, bolstered by continuous major deals, suggests that Nvidia remains an attractive long-term investment, with its current stock price potentially offering significant value over the coming years.