Nvidia, a leading entity in the artificial intelligence sector, has recently experienced a downturn in its stock valuation. This has been partially attributed to uncertainties surrounding its operations in China, particularly after the company's fiscal 2026 second-quarter report indicated no H20 chip sales in the region and excluded future sales from its third-quarter projections. While these developments have unsettled some market participants, the prevailing sentiment among analysts suggests that the broader global AI market's immense potential far outweighs these localized challenges. This period of decreased stock price is viewed by many as an opportune moment for investors to acquire Nvidia shares, leveraging the company's strong position within an expanding industry.

The current market sentiment, primarily focused on Nvidia's performance in the Chinese market, appears to be overshadowing the company's significant global opportunities in artificial intelligence. Recent reports highlighted that Nvidia did not record any sales of its China-specific H20 chips in the second quarter of fiscal year 2026, and these sales were not factored into the third-quarter outlook. This news, following the company's quarterly announcement on August 27, contributed to a month-long slide in Nvidia's stock. However, a closer examination reveals that the concerns regarding China may be disproportionate to the overall market landscape.

Nvidia's CEO, Jensen Huang, previously acknowledged the potential "tremendous loss" for U.S. companies if excluded from the $50 billion Chinese market due to chip export restrictions. This statement, made in a May interview, likely contributed to investor apprehension. While Nvidia's data center sales saw only a 5% sequential increase in the most recent quarter, a notable decline from previous periods, this was largely influenced by the absence of China sales. Nevertheless, market observers focusing solely on the China situation are missing the larger narrative.

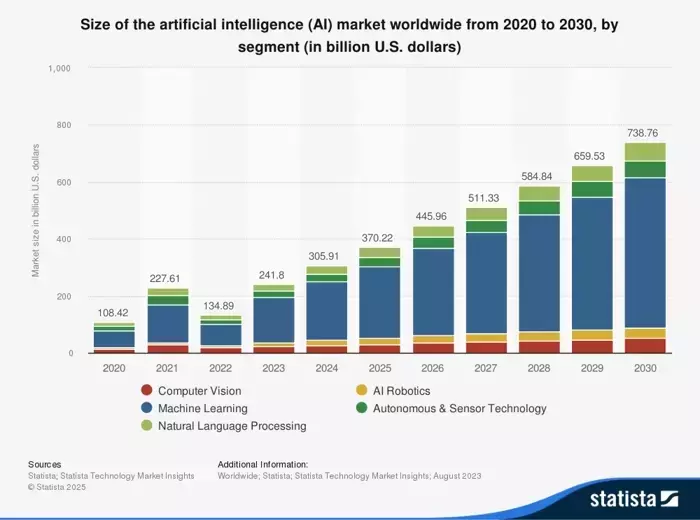

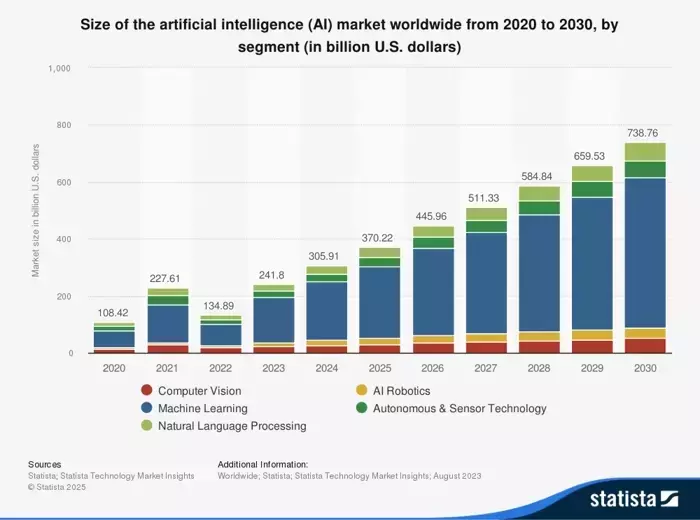

The global artificial intelligence market is projected to sustain robust growth throughout the remainder of the decade. Data suggests a compound annual growth rate of 16.5% over the next three years, maintaining approximately 15% through 2030. Nvidia is poised to be a key player in fulfilling this escalating demand. Despite the lack of sales in China, Nvidia anticipates an overall revenue increase of 15.6% sequentially in the third quarter, underscoring the enduring strength of demand across other markets.

The enduring demand for AI technologies, extending well beyond the current decade, provides a compelling argument for investor confidence in Nvidia. This widespread demand signifies that the company's long-term prospects remain highly favorable, irrespective of the short-term fluctuations tied to specific regional markets. The robust nature of the global AI sector suggests that Nvidia's strategic importance and revenue-generating capacity are anchored in a diverse and expansive market. Consequently, the recent decline in Nvidia's stock valuation, driven by concerns over China, is seen by many as a transient blip, presenting a strategic entry point for investors keen on capitalizing on the broader, sustained growth trajectory of artificial intelligence. This offers a valuable window for those looking to invest in a company that is fundamentally aligned with one of the most transformative technological trends of our time.