The stock market has been on a rollercoaster ride, with the major indexes experiencing sharp losses, particularly on Friday. This volatility has led to concerns about the future direction of the market, and Nvidia's upcoming earnings report is poised to play a pivotal role in shaping the trajectory of the market's performance.

Navigating the Turbulent Waters of the Stock Market

The Trump Trade Falters

The stock market's "Trump trade" has faltered, with the major indexes, including the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite, all experiencing significant declines. This reversal has been particularly pronounced in sectors that were expected to benefit from the new administration's policies, such as government tech consultants and housing-related stocks. As the market grapples with these shifts, investors must be cautious about making new purchases, focusing instead on cutting losses and taking profits on recent winners.Nvidia's Earnings: A Pivotal Moment

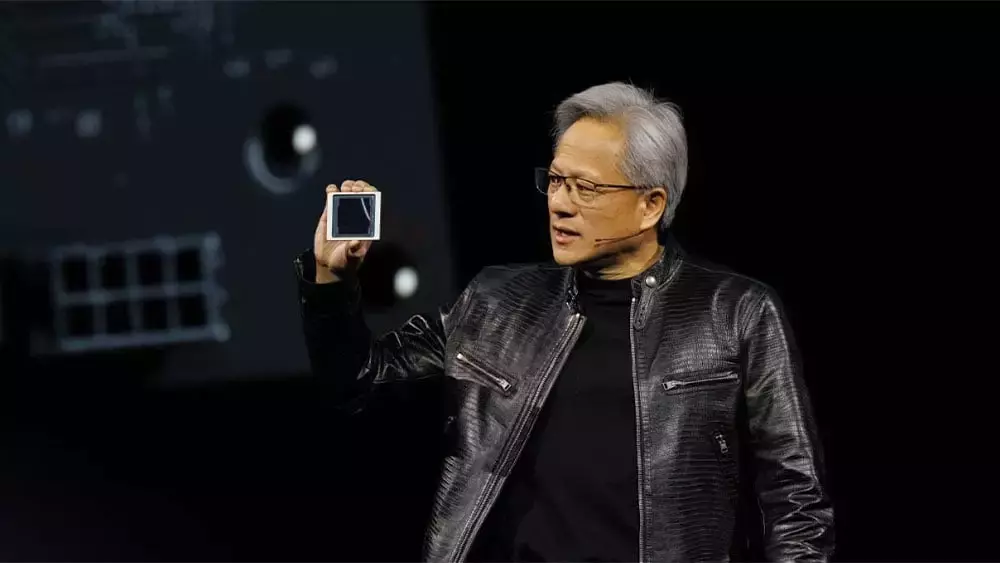

Nvidia's upcoming earnings report is poised to have a significant impact on the broader market, particularly in the artificial intelligence (AI) and semiconductor sectors. As the dominant player in the AI chip market, Nvidia's performance and guidance will be closely watched by investors. The company's ability to maintain its impressive growth trajectory and provide a positive outlook for the future will be crucial in determining the market's direction.Sector Shifts and Investor Caution

The recent market volatility has also highlighted the shifting fortunes of various sectors. Drugmakers and biotechs have plunged, while government tech consultants have suffered significant losses. Meanwhile, housing and China stocks have also been struggling, as rising Treasury yields and concerns about new tariffs weigh on these sectors.In this environment, investors must exercise caution and be prepared to adjust their portfolios accordingly. Cutting losses and taking profits on recent winners may be necessary to protect against further downside. At the same time, investors should keep a close eye on their watchlists, as the market pullback may create new buying opportunities in the near future.The Importance of Nvidia's Guidance

Nvidia's earnings report will be closely watched not only for its own performance but also for its implications for the broader AI and semiconductor sectors. The company's guidance on the ramp-up of its Blackwell production, the next-generation AI processor, will be a key focus for investors. The speed at which Blackwell shipments begin will be a crucial indicator of Nvidia's ability to maintain its market dominance and drive continued growth in the AI space.Navigating the Shifting Landscape

As the market navigates these turbulent waters, investors must be prepared to adapt their strategies. Reducing exposure, especially on margin, may be prudent in the short term. At the same time, investors should continue to work on their watchlists, as the market pullback may create new opportunities for savvy investors.Ultimately, the success or failure of Nvidia's earnings report will have far-reaching implications for the broader market. Investors must stay vigilant, monitor the market's performance, and be ready to adjust their portfolios as the landscape continues to shift.You May Like