Nvidia has officially concluded its direct financial involvement with Arm, divesting its remaining 1.1 million shares, a transaction valued at roughly $140 million. This action marks the definitive end of Nvidia's aspirations for a deeper integration with the British chip design powerhouse, following its failed acquisition attempt in 2022. The sale, detailed in recent regulatory disclosures, underscores a significant strategic pivot for Nvidia, though it does not impact its ongoing ability to utilize Arm's intellectual property through existing licensing agreements.

This divestment, completed towards the close of the previous year, has prompted speculation regarding Nvidia's future intentions and its perception of Arm's market trajectory. While Nvidia has maintained silence on the specifics of the transaction, industry observers note that the move is purely a financial one, unrelated to Nvidia's technological capacity to produce and market Arm-based processors. The company continues to hold comprehensive licensing deals with Arm, which grant it the right to both use standard Arm CPU designs and develop custom core architectures leveraging Arm's foundational instruction set architecture (ISA).

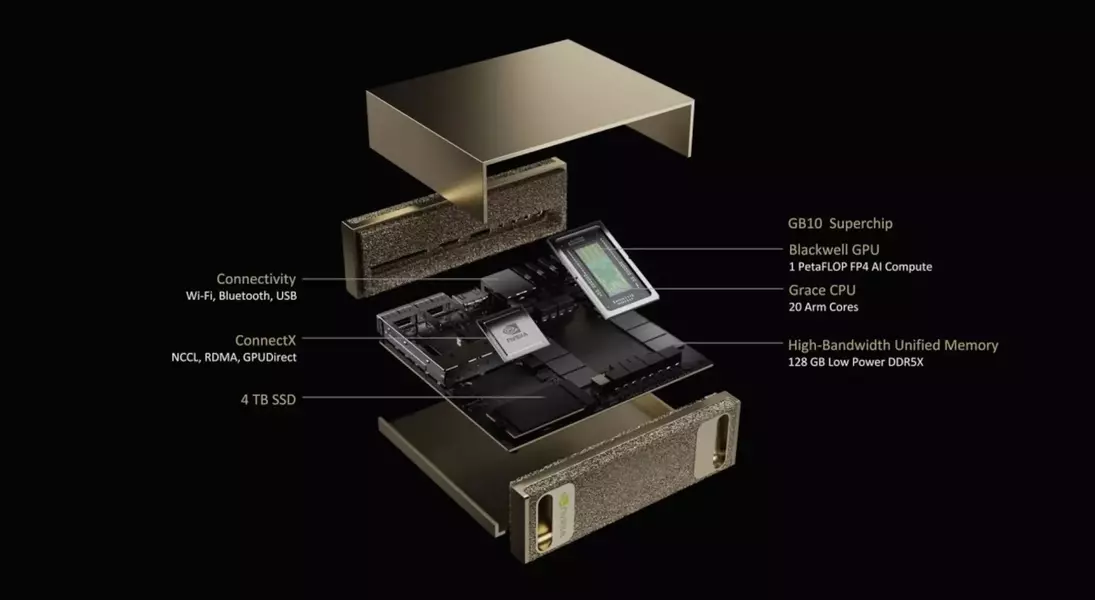

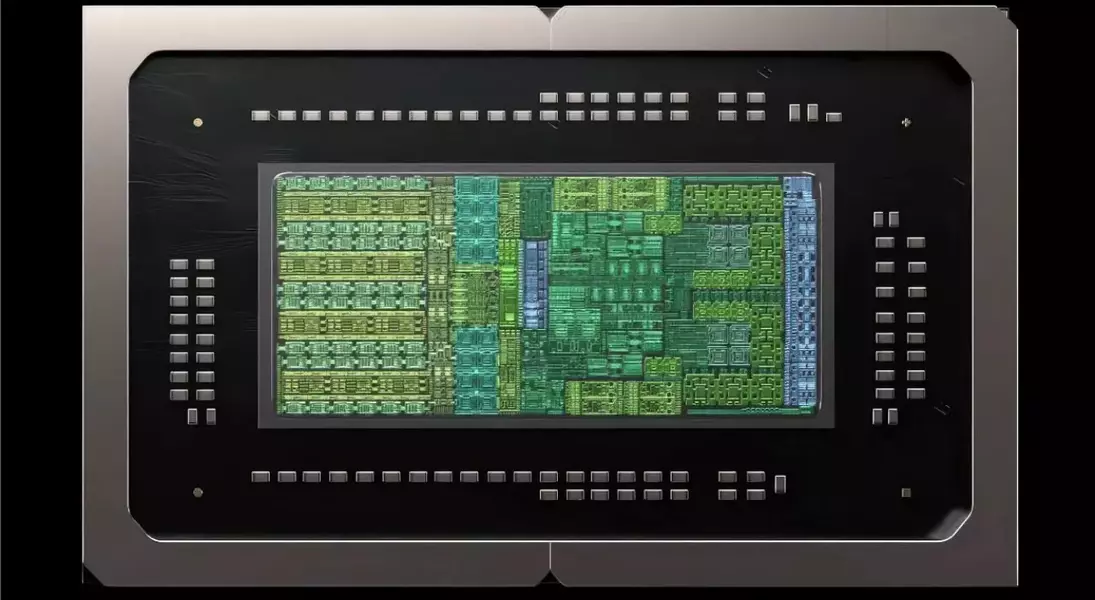

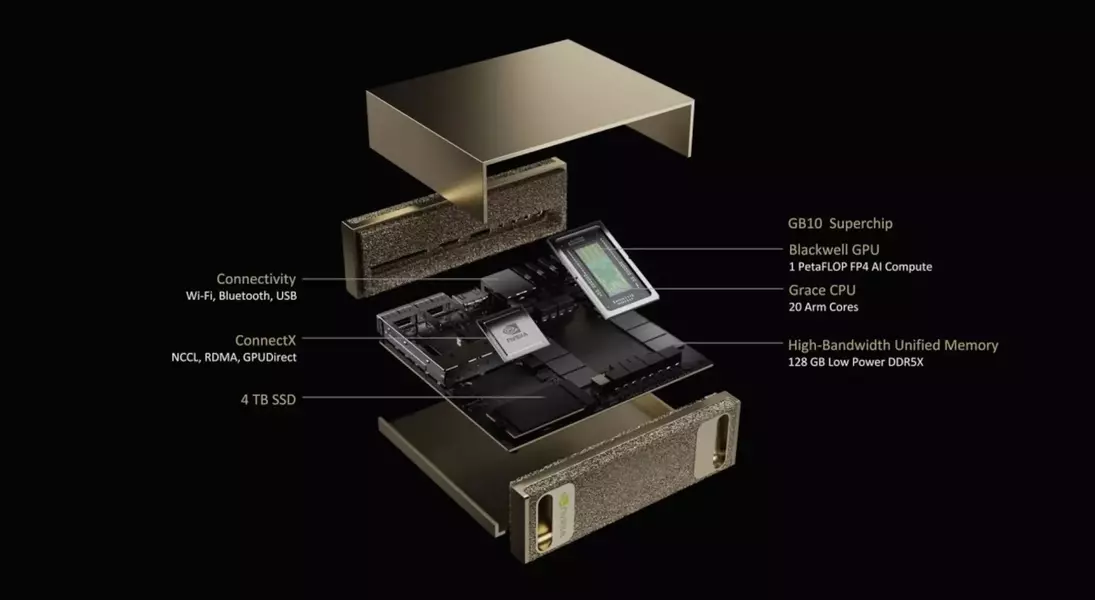

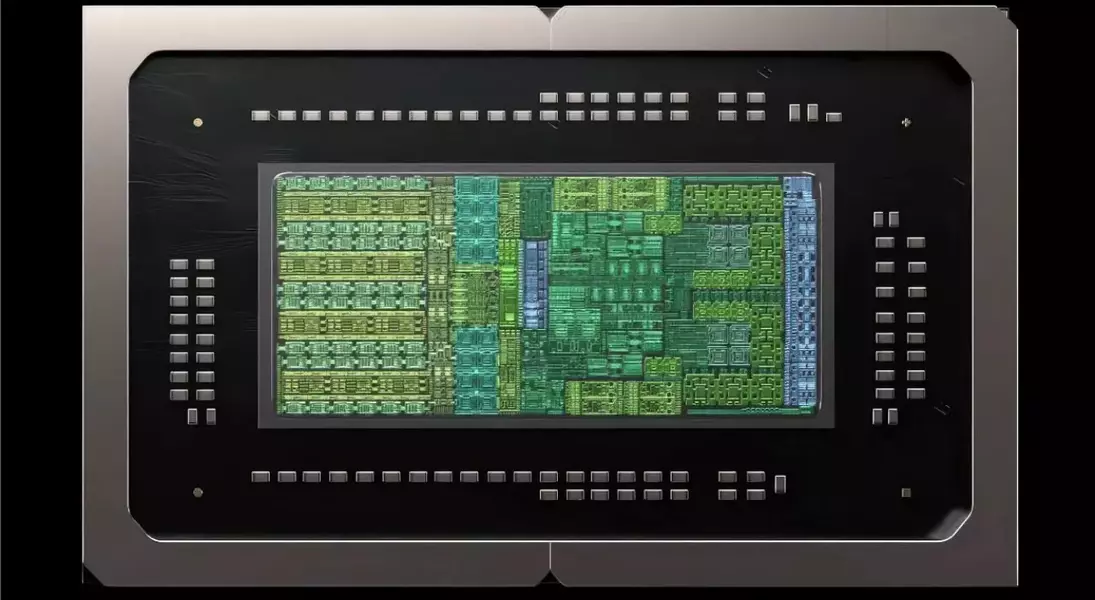

A prime example of Nvidia's ongoing commitment to Arm-based development is the recent unveiling of its Vera CPU, an Arm-powered chip featuring an in-house designed "Olympus" core. Although Vera is primarily targeting the burgeoning AI server market, Nvidia has also confirmed plans for an Arm-based CPU aimed at the PC sector, codenamed N1X. Nvidia CEO Jensen Huang has indicated that the N1X shares a close architectural lineage with the GB10 "superchip" found in Nvidia's DGX Spark AI systems, further solidifying the company's dual approach to Arm-based chip development for both high-performance computing and personal computing environments.

The financial implications of this divestment are particularly intriguing, especially given Nvidia's current standing as the world's most valuable company, with projected revenues exceeding $130 billion in 2025. The relatively modest sum of $140 million obtained from the sale of Arm shares suggests that the transaction was not driven by an urgent need for capital. Instead, it could be interpreted as a reflection of Nvidia's revised outlook on the long-term investment value of Arm as a standalone entity, or perhaps a symbolic gesture following the regulatory obstacles that thwarted its acquisition ambitions.

Ultimately, the cessation of Nvidia's equity stake in Arm reinforces the finality of the previously proposed acquisition. What began as a bold strategic maneuver to gain full control over a critical technology provider has now culminated in a clean break from direct ownership. Despite this, the foundational relationship through licensing remains intact, ensuring that Nvidia can continue to innovate with Arm's architecture across diverse computing platforms.