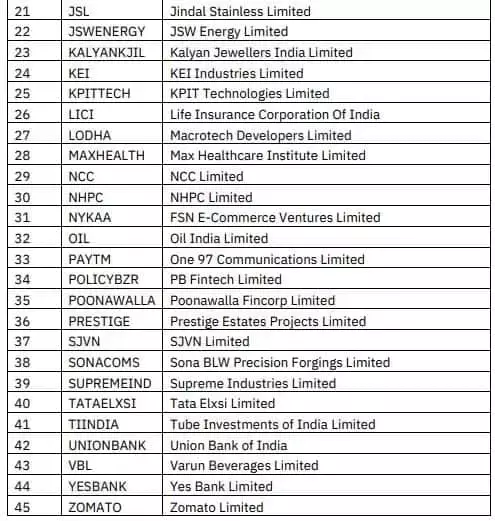

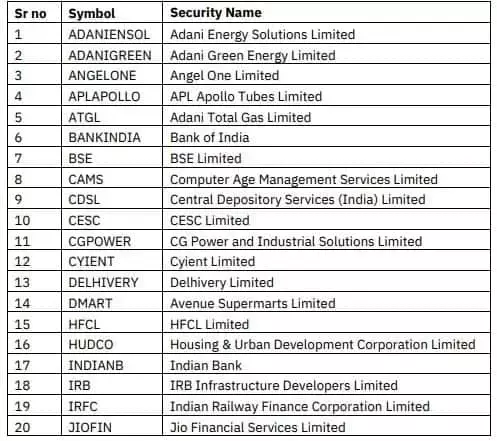

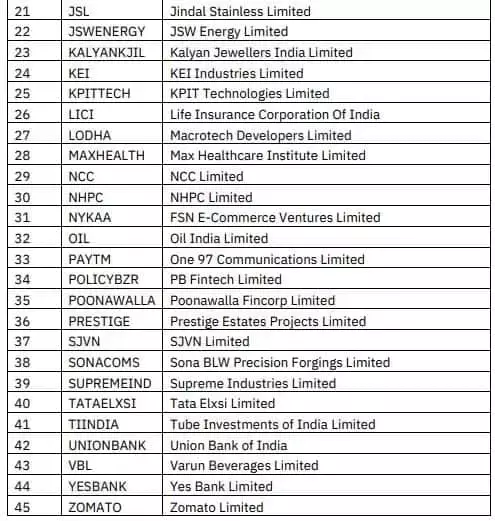

The National Stock Exchange (NSE) made a significant announcement on November 13. It stated that futures and options contracts on 45 stocks would become available for trading starting from November 29. This move includes prominent companies like Life Insurance Corporation, Jio Financial Services, Adani Energy Solutions, Adani Green Energy, Nykaa, Paytm, YES Bank, and Zomato, among others. The NSE's decision is set to bring new opportunities and dynamics to the stock market. Unlock New Trading Horizons with NSE's F&O Expansion

Impact on the Stock Market

This expansion of futures and options trading on 45 stocks is likely to have a profound impact on the stock market. It provides traders with additional tools and strategies to manage their portfolios. For example, futures and options allow investors to hedge against market fluctuations and take advantage of price movements. With a wider range of stocks available for trading, market participants can diversify their portfolios and potentially increase their returns.Moreover, the inclusion of these major companies in the F&O segment adds to the market's liquidity and depth. It attracts more investors and traders, leading to increased trading volumes and market efficiency. This, in turn, can enhance price discovery and provide better pricing for investors.Benefits for Investors

Investors stand to benefit from this expansion in several ways. Firstly, it offers them greater flexibility in trading. They can now use futures and options to speculate on the price movements of these stocks without actually owning them. This allows for more strategic trading and the ability to profit from both rising and falling markets.Secondly, the availability of F&O contracts on a larger number of stocks reduces concentration risk. Investors can spread their risk across different companies and sectors, reducing the impact of any single stock's performance on their portfolios. This helps in achieving a more balanced and diversified investment approach.Finally, the increased trading activity and market visibility associated with the expansion can lead to improved market sentiment. It can attract more institutional investors and enhance the overall market confidence.Regulatory Framework and Compliance

The NSE's decision to introduce futures and options contracts on these 45 stocks is in compliance with the regulations set by the Securities and Exchange Board of India (SEBI). SEBI has prescribed specific stock selection criteria and obtained approval for the trading of these contracts. This ensures that the trading is conducted in a transparent and regulated manner, protecting the interests of investors.The market lot, scheme of strikes, and quantity freeze limit of the securities will be communicated to members on November 28 through a separate circular. This provides clear guidelines and information to market participants, enabling them to make informed trading decisions.Currently, there are 178 stocks available for F&O trading. The addition of these 45 stocks further expands the range of investment options available to traders and investors. It allows them to explore new opportunities and build more diversified portfolios.In conclusion, the NSE's decision to introduce futures and options contracts on 45 stocks is a significant development in the Indian stock market. It offers various benefits and opportunities for traders and investors, while also ensuring compliance with regulatory requirements. As the market evolves, it will be interesting to observe how these new contracts impact trading patterns and market dynamics.

You May Like