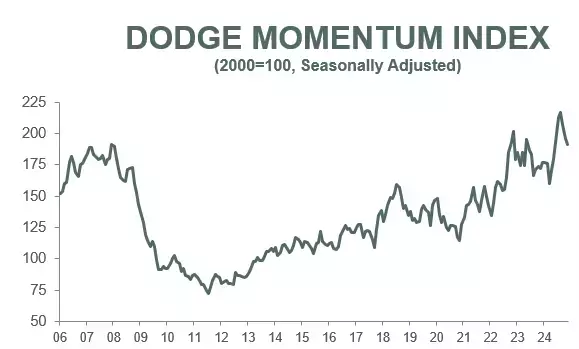

Nonresidential construction planning activity witnessed a decline in November, marking the third consecutive month of cooling. This downturn was highlighted by the Dodge Momentum Index, which dropped 2.3%. Commercial activity saw a 4.6% decrease, while institutional planning increased by 2.5%, partially offsetting the decline.

Slower Planning and Its Impact

Slower planning for data centers, offices, warehouses, and retail projects contributed to the commercial sector's downturn. On the other hand, education projects fueled institutional growth. The institutional segment has shown growth in five of the past six months. Sarah Martin, associate director of forecasting at Dodge Construction Network, stated that throughout 2024, there has been robust growth in nonresidential planning activity. However, labor shortages and high construction costs have prevented projects from progressing at a normal pace. Uncertainty over new tariff and immigration policies under President-elect Trump's administration may also cause some hesitation among developers, although it is too early to determine if this is the primary factor.From a year-over-year perspective, the index is 12% higher than November 2023 levels. Commercial planning increased by 13% during this time, while institutional planning jumped 8%.However, data centers have played a significant role in this growth since 2023. Without their inclusion, commercial planning would have tumbled by 6%, and the overall DMI would have decreased by 1%.Martin still expects a rebound in activity. She believes that easing monetary policy will eventually help alleviate the backlog of projects in 2025 and stimulate more demand for construction in the coming months.In November, seventeen projects valued at $100 million or more entered the planning stage. Major commercial projects included the $350 million Bally's hotel tower and casino in Las Vegas and a $312 million Accokeek data center in Stafford, Virginia.The largest institutional projects to enter planning were a $465 million student dormitory at UC Berkeley, California, and the $323 million intensive treatment tower at Texas Health Presbyterian in Plano, Texas.You May Like