In the ever-evolving landscape of the financial world, the U.S. corporate bond market stands as a crucial pillar, reflecting the pulse of the economy and the sentiments of investors. This comprehensive analysis delves into the intricate dynamics of this market, shedding light on the key statistics, performance attribution, and the long-term default outlook for rated public firms. Join us as we navigate the nuances of this dynamic landscape and uncover the insights that can empower informed investment decisions.

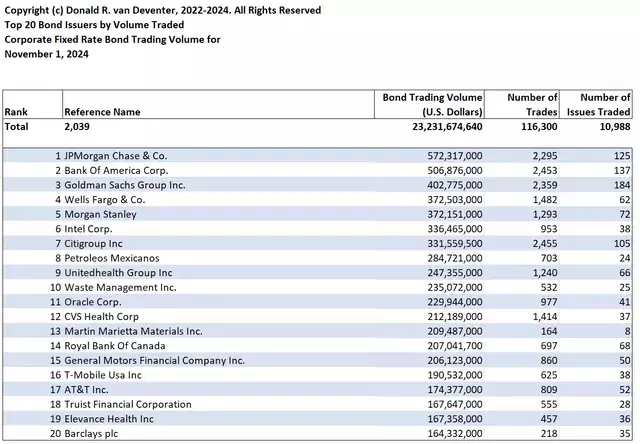

Uncovering the Pulse of the U.S. Corporate Bond Market

Navigating the Tides of Bond Price Fluctuations

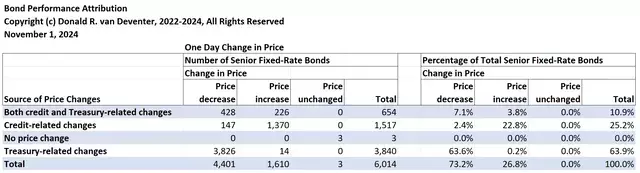

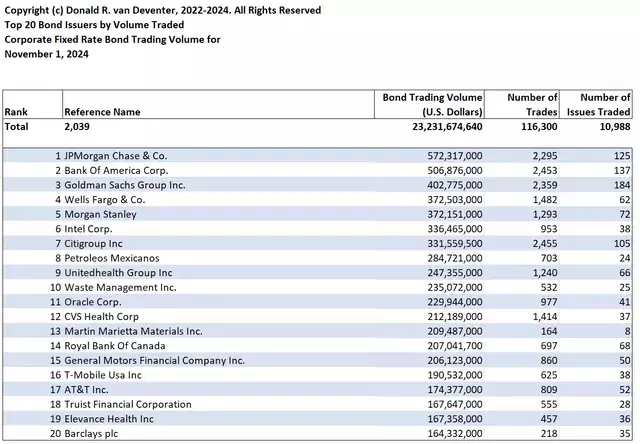

The U.S. corporate bond market is a complex and ever-changing landscape, with a myriad of factors influencing the prices of these fixed-income securities. As of November 1, 2024, our analysis reveals that a significant portion of senior fixed-rate bonds, a staggering 73%, experienced price declines for the day. Interestingly, the primary driver behind these price movements was not credit or liquidity risk, but rather changes in the U.S. Treasury yield curve, accounting for a remarkable 87% of the losses.Dissecting the Drivers of Bond Price Changes

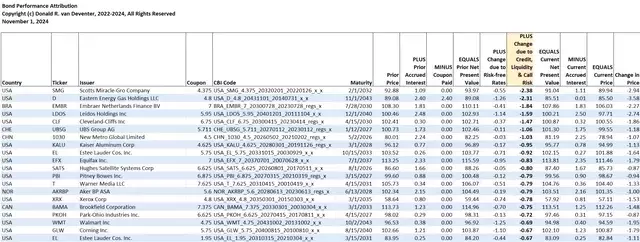

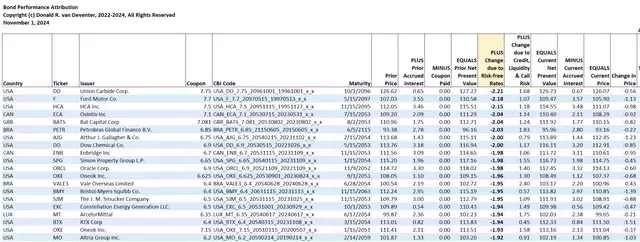

To better understand the nuances of these price fluctuations, we have conducted a comprehensive performance attribution analysis. This analysis delves into the intricate interplay between changes in Treasury yields, credit quality, liquidity risk, and bond call prices, providing a granular understanding of the factors shaping the bond market's dynamics.Identifying the Bonds with Significant Credit-Related Gains and Losses

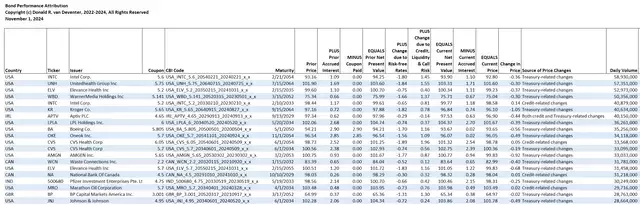

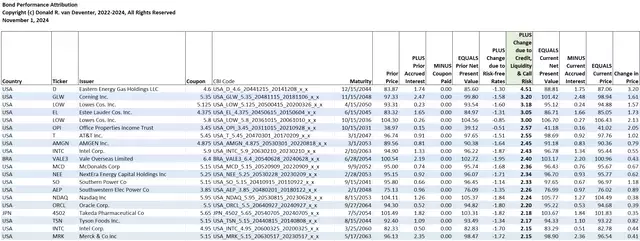

By isolating the credit, liquidity, and call risk components of bond price changes, we have identified the top 20 bonds with the largest positive and negative credit-related price movements. This insight allows us to pinpoint the specific bonds that have seen the most significant changes in their underlying credit quality, liquidity, and call risk profiles.The Impact of Treasury Yield Fluctuations

Recognizing the outsized influence of changes in U.S. Treasury yields on bond prices, we have also analyzed the bonds most affected by these yield movements. As expected, bonds with longer maturities tend to be more sensitive to these yield fluctuations, underscoring the importance of duration management in navigating the corporate bond market.Navigating the Long-Term Default Outlook

Alongside the analysis of short-term price movements, we have also examined the long-term default outlook for rated public firms. The Expected Cumulative Default Rate, as provided by the SAS Institute Inc., remains largely unchanged at 0.52% for the 1-year horizon and has increased marginally to 8.91% for the 10-year horizon. This data point serves as a valuable indicator of the overall credit quality and risk profile of the corporate bond market.Assessing the Troubled Company Index

To further contextualize the current state of the corporate bond market, we have consulted the Kamakura Troubled Company Index. This index, which tracks daily worldwide corporate credit conditions, has risen by 2 points, placing it at the 80th percentile compared to the 1990-2024 range. This data point suggests a heightened level of stress and risk in the broader corporate credit landscape.Questioning the Relevance of Legacy Credit Ratings

In the ever-evolving world of finance, the relevance of legacy credit ratings has come under scrutiny. As we explore in a separate daily blog post, the basic business model of these ratings has become increasingly outdated, much like the famed Pony Express. The low correlation between legacy ratings and state-of-the-art default probability models, such as Kamakura's KRIS, further underscores the need for a more sophisticated and dynamic approach to credit risk assessment.In conclusion, this comprehensive analysis of the U.S. corporate bond market provides a multifaceted perspective on the current state of this crucial financial landscape. By delving into the intricate drivers of bond price movements, the long-term default outlook, and the evolving role of credit ratings, we aim to empower investors with the insights necessary to navigate this dynamic market with confidence and make informed decisions that align with their investment objectives.