The nonresidential construction sector witnessed a significant resurgence in December, primarily fueled by robust planning activities for data centers and warehouses. According to the latest report from Dodge Construction Network, this momentum is expected to bolster spending throughout 2025.Unveiling New Horizons: The Future of Nonresidential Construction

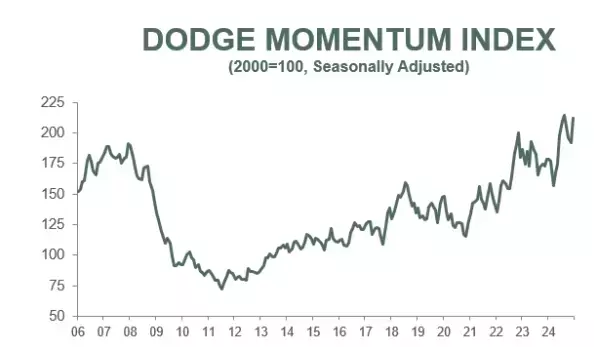

The nonresidential construction industry has experienced a remarkable upturn, propelled by substantial advancements in data center and warehouse projects. The Momentum Index, which gauges the planning phase of nonresidential construction, surged by 10.2% as we closed out 2024. Commercial planning spearheaded this growth with a notable 14.2% increase, while institutional planning saw a modest rise of 2.5%. This surge reflects a broader trend of increasing investment in infrastructure that supports modern technological needs.

Commercial Planning Rebounds Strongly

The commercial sector's rebound in December was nothing short of impressive. A reacceleration in data center and warehouse planning activity played a pivotal role in this resurgence. Sarah Martin, associate director of forecasting at Dodge Construction Network, highlighted the significance of this shift. "The strong performance of the Momentum Index this past year is expected to support nonresidential construction spending throughout 2025," she remarked. On an annual basis, the Momentum Index soared by 19% compared to December 2023, with commercial planning jumping by a staggering 30%. Even without the inclusion of data centers, commercial planning would have grown by 8%, underscoring the broad-based nature of this expansion.

Data Centers Drive Growth

Data centers continue to be a cornerstone of this growth. Projects such as the $1.6 billion Powerhouse 95 data center in Fredericksburg, Virginia, and the $1 billion Brambleton data center at Tech Park in Ashburn, Virginia, exemplify the scale and ambition behind these initiatives. These projects not only signify substantial financial investments but also highlight the critical importance of data infrastructure in today's digital economy. The development of these facilities ensures that businesses can meet the ever-increasing demand for cloud storage and computing power, thereby driving further economic growth and innovation.

Institutional Projects Gain Traction

While commercial planning took the spotlight, institutional projects also made notable strides. Major developments like the $226 million OhioHealth Outpatient Cancer Center in Columbus, Ohio, and the $220 million county jail in Peoria, Illinois, underscore the ongoing commitment to enhancing public infrastructure. These projects are vital for addressing societal needs and improving community services. The steady progress in institutional planning, despite its more modest gains, indicates a balanced approach to construction investment, ensuring that both commercial and public sectors benefit from the current momentum.

Looking Ahead: Prospects for 2025

The outlook for nonresidential construction in 2025 appears promising. With 32 projects valued at $100 million or more entering the planning phase in December alone, the industry is poised for sustained growth. The combination of robust commercial activity and steady institutional progress creates a solid foundation for future development. As the demand for advanced data infrastructure continues to rise, alongside the need for improved public facilities, the nonresidential construction sector is well-positioned to thrive in the coming year. The resilience and adaptability demonstrated in 2024 bode well for a prosperous 2025.