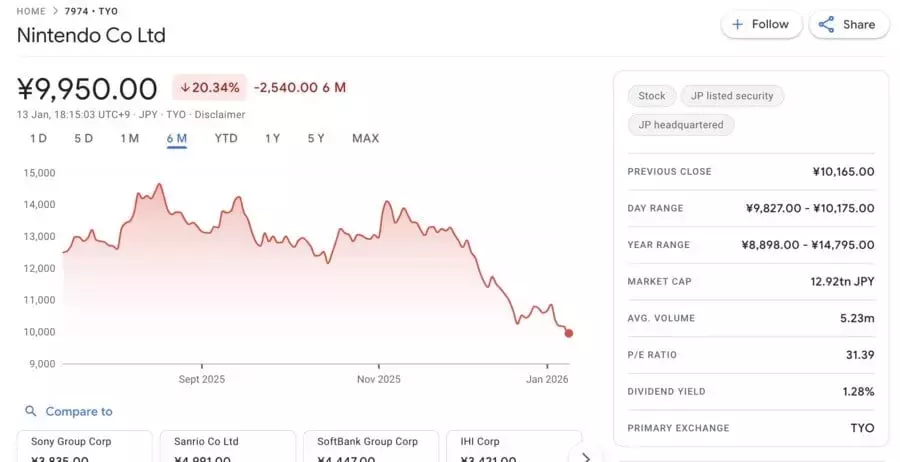

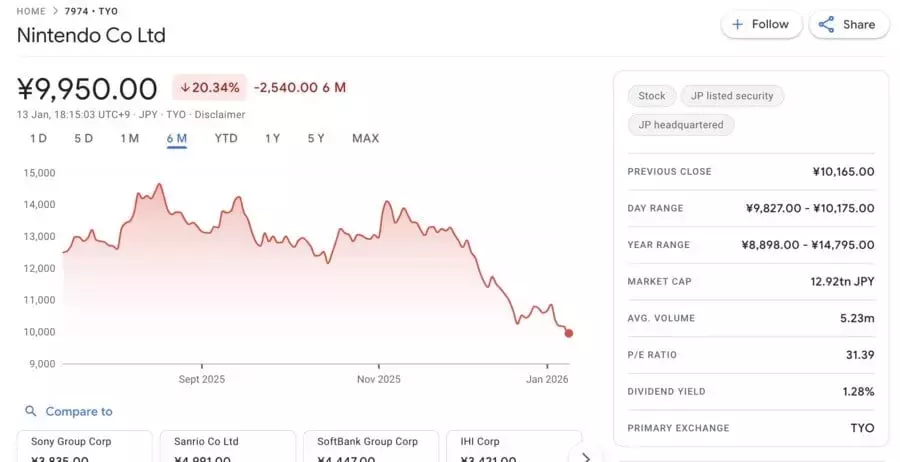

Nintendo's stock has recently experienced a notable decline, causing unease among investors. This downturn is attributed to several factors, including fears of potential price hikes for the Switch 2 console and its software, a perceived shortage of major exclusive titles from Nintendo's internal studios in early 2026, and unexpected hardware discounts during the holiday season in certain markets. Despite these recent challenges, the Switch 2 maintains its status as Nintendo's most rapidly selling console ever. The company remains optimistic about its future, with highly anticipated game releases, such as the next installment in the Pokémon series, expected to invigorate sales and investor confidence in the latter half of the year.

This period of volatility highlights the dynamic nature of the gaming industry and the constant pressure on console manufacturers to balance innovation, pricing, and content delivery. While immediate concerns loom, Nintendo's strong brand loyalty and a promising pipeline of major titles suggest a potential rebound, underscoring the long-term prospects often considered by seasoned investors. The company's ability to adapt to market demands and strategically release compelling games will be crucial in navigating these fluctuations and reassuring its stakeholders.

Investor Unease Over Market Performance

Nintendo's stock has recently taken a hit, dropping significantly from its peak in August 2025. This decline has left investors feeling "spooked" by a combination of factors. Concerns are primarily centered around the possibility of increased pricing for Nintendo's hardware and software, a scarcity of flagship game titles developed by Nintendo itself in the initial months of 2026, and the seemingly premature introduction of discounts on the Switch 2 console in certain Western markets during the festive period. This confluence of events has led to a cautious sentiment among shareholders, prompting questions about the company's immediate strategic direction and its impact on profitability. The market's reaction reflects a sensitivity to pricing strategies and the consistent delivery of high-profile content, both of which are critical drivers of consumer demand and investor confidence in the competitive gaming landscape.

The current market sentiment, as observed through the stock's performance, indicates a period of adjustment following an initial surge. While some industry observers expressed surprise at the notion of holiday discounts so early in the Switch 2's lifecycle, the impact of such decisions on investor perception is undeniable. The market's reaction also underscores the importance of a clear and robust content roadmap, especially for a console in its inaugural year. Analysts and investors alike will be closely watching Nintendo's upcoming announcements and sales figures to gauge the effectiveness of its strategies in addressing these present concerns. The challenge for Nintendo lies in managing expectations while strategically positioning its products and content to ensure sustained growth and a positive outlook.

Resilience and Future Prospects of the Switch 2

Despite the recent dip in its stock value and investor apprehension, the Nintendo Switch 2 continues to demonstrate remarkable market strength. The console has achieved the distinction of being the fastest-selling Nintendo hardware in history, indicating a robust initial demand from consumers. This strong performance suggests that while investor concerns are valid, the underlying product appeal and sales momentum remain significant. The company, known for its strategic long-term planning, is widely expected to unveil a series of major game titles in the latter half of 2026, which could include highly anticipated releases like the next generation of Pokémon games. These upcoming titles are poised to re-energize the market, attract new users, and provide a substantial boost to both console sales and investor confidence.

The gaming industry is inherently cyclical, often characterized by periods of intense excitement followed by phases of consolidation. Nintendo has historically navigated these cycles effectively, often leveraging its iconic franchises to drive sustained engagement. The current situation, while presenting challenges, is viewed by many as a temporary phase. The anticipation of new first-party blockbusters and the inherent innovation within Nintendo's game development ecosystem are strong indicators of a potential rebound. As the year progresses, the focus will shift from initial launch performance and early market jitters to the impact of new software releases on hardware adoption and overall financial results. Nintendo's track record of delivering engaging experiences and its commitment to a strong game lineup are key factors that could mitigate current investor concerns and pave the way for renewed growth and market optimism.