The transition into the new year ushers in a multitude of economic uncertainties. While some risks have garnered significant attention, others remain under the radar. High-profile concerns include potential trade disruptions due to anticipated policy changes. Less visible but equally impactful are shifts in financial markets driven by various factors. Market analysts predict that these changes will not only be influenced by inflationary pressures or central bank policies but also by government fiscal actions and market liquidity adjustments.

Policy Shifts Spark Trade Concerns

As the new administration prepares to take office, there is growing apprehension about the direction of international trade. The incoming leader's proposed economic strategies may lead to substantial modifications in global commerce practices. These alterations could disrupt established supply chains and affect import costs significantly. Businesses and investors are closely monitoring how these policy shifts might reshape economic landscapes and influence market stability.

In particular, the suggestion of imposing higher tariffs on imported goods has raised eyebrows among economists and business leaders alike. Such measures could trigger retaliatory actions from trading partners, leading to broader economic repercussions. Tariffs may increase production expenses for companies reliant on foreign materials, potentially passing those costs onto consumers. Additionally, this could foster uncertainty in investment decisions as businesses navigate the evolving regulatory environment. The overall impact on consumer prices and corporate profitability remains a key area of concern for many stakeholders.

Financial Markets Face Unseen Pressures

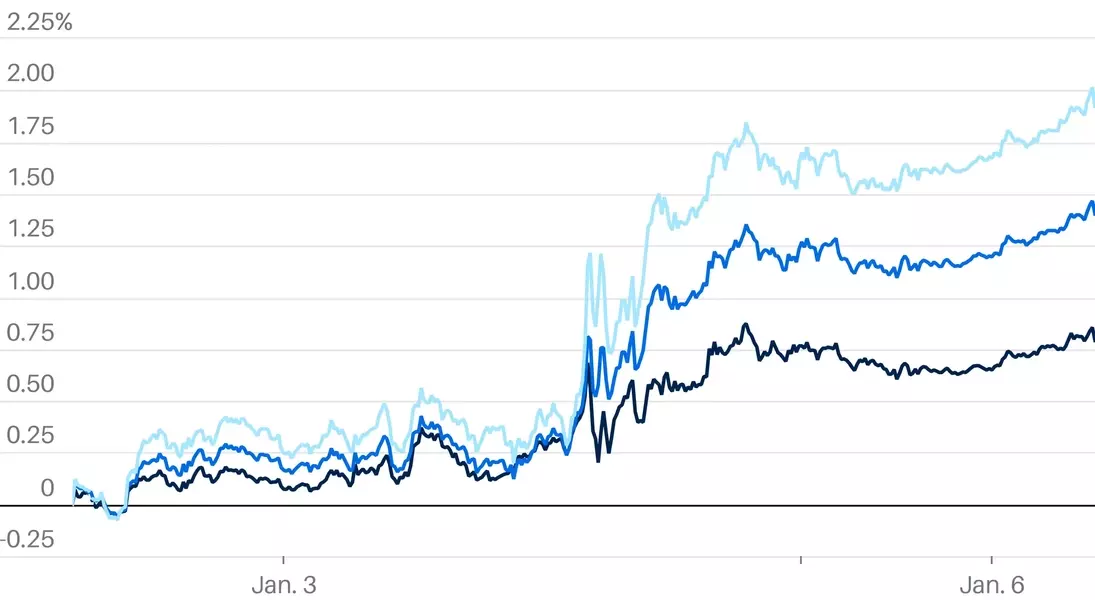

Beyond trade policies, financial markets are bracing for less obvious yet profound challenges. Changes in bond yields and treasury operations are expected to play critical roles in shaping economic conditions. Analysts suggest that these movements will be influenced by multiple factors, including government spending and monetary policy adjustments. Investors are preparing for volatility as they assess the implications of these changes on portfolio performance.

One notable factor contributing to rising bond yields involves the Federal Reserve’s decision to reduce its holdings of government securities. This action aims to normalize balance sheets after years of expansionary monetary policy. However, it could result in decreased demand for bonds, pushing yields upward. Moreover, concerns over the federal budget deficit may exacerbate these trends. A widening deficit could necessitate increased borrowing, further impacting interest rates and investor confidence. Together, these elements create an intricate web of financial pressures that market participants must carefully navigate in the coming months.