New Jersey Resources (NJR) exemplifies the often-understated value of regulated utilities, offering a compelling investment thesis grounded in stability and strategic growth. While such companies rarely capture sensational headlines, their foundational role in the economy provides a bedrock of consistent, predictable returns. NJR’s recent performance, particularly its robust first-quarter results, underscores its resilience and proactive management, enabling the company to confidently raise its fiscal year 2026 earnings guidance. This financial prudence is further evidenced by its meticulously managed balance sheet, ensuring operational flexibility and long-term viability.

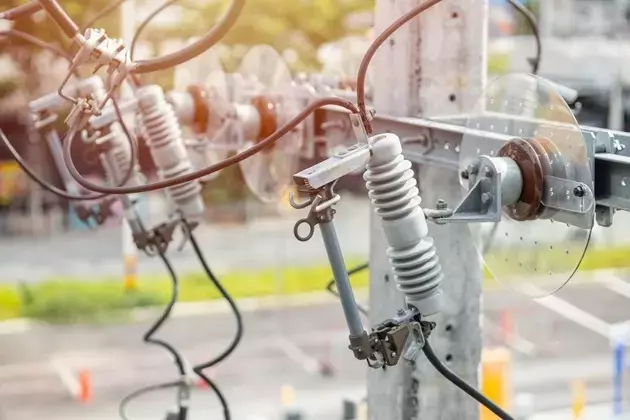

The cornerstone of NJR’s success is its regulated utility arm, New Jersey Natural Gas. This division consistently delivers reliable growth, anchored by a substantial $3.2 billion rate base. Projections indicate a healthy 7-9% rate base expansion through 2030, reflecting ongoing investments in infrastructure and service enhancements. Beyond its core operations, NJR strategically diversifies its portfolio with ventures into Clean Energy and essential storage and transportation projects. These initiatives are carefully selected to provide incremental, contract-backed revenue streams, enhancing overall profitability without introducing undue risk. This balanced approach ensures that while the core utility business provides a steady foundation, supplementary projects contribute to sustainable growth, maintaining a prudent risk profile.

From an investment standpoint, NJR presents an attractive opportunity. Currently, the company trades at a forward price-to-earnings ratio of 16.4 times, positioning it favorably below the sector’s median valuation. This appealing valuation is complemented by a solid 3.5% dividend yield, making it an appealing choice for income-focused investors. Analyst expectations suggest a potential upside in its stock price, with targets ranging from $53 to $56 per share. This blend of strong fundamentals, strategic growth initiatives, a reliable dividend, and a reasonable valuation strongly supports a 'buy' recommendation for investors looking for a secure yet growing asset in their portfolio.

Investing in companies like New Jersey Resources reminds us that true progress often lies in foundational strength and prudent, long-term planning. In a rapidly evolving world, the steadfast provision of essential services, coupled with a commitment to sustainable growth and responsible financial stewardship, creates enduring value. This approach not only benefits shareholders through consistent returns but also serves the broader community by ensuring reliable infrastructure and fostering a resilient economic environment. Such endeavors reinforce the idea that integrity and foresight are key ingredients for prosperity and a brighter future.