The landscape of the housing market is undergoing a significant transformation, with newly constructed homes emerging as a more financially accessible alternative for prospective buyers. A recent analysis by Realtor.com for the second quarter of 2025 reveals a remarkable reduction in the price differential between new and pre-owned properties, marking an unprecedented low. This trend indicates a pivotal shift, offering potential homeowners greater opportunities to enter the market or upgrade their living situations. As existing home prices continue their upward trajectory, the stability in new home pricing presents a compelling case for those seeking value and modern amenities.

This evolving dynamic is reshaping buyer behavior and market strategies across various regions. Builders are increasingly focusing on affordability, implementing pricing strategies that attract a broader range of buyers, especially in areas where new inventory is abundant. The report highlights how this convergence of new and existing home values is not merely a statistical anomaly but a reflection of concerted efforts to address housing shortages and enhance market balance. Such developments are crucial for fostering a healthier, more equitable housing ecosystem, providing diverse options for individuals and families navigating today's complex real estate environment.

New Construction: A Beacon of Affordability in the Housing Market

The latest market insights underscore a significant shift towards greater affordability in the new construction sector. The premium for newly built homes has plummeted to an unprecedented 7.8% in the second quarter of 2025, making them a more viable option for many homebuyers. This contrasts sharply with the continued ascent of existing home prices, which saw a 2.4% increase. The median price for a new home held steady at approximately $450,797, while pre-owned residences climbed to $418,300, showcasing a clear divergence in pricing trends. This convergence in prices means that new properties, often larger and more modern, now offer enhanced value on a per-square-foot basis, averaging $218.66 compared to $226.56 for existing homes.

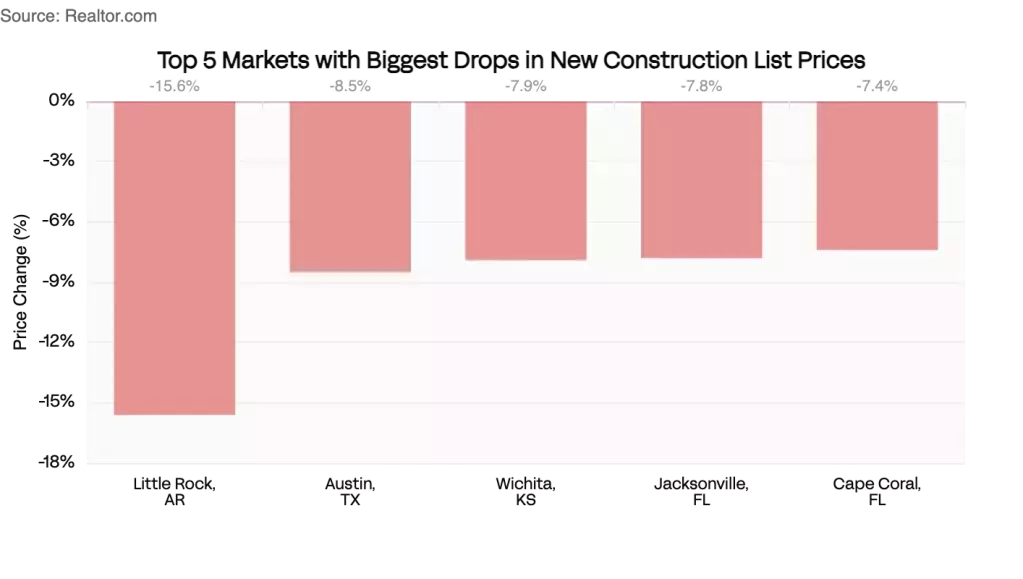

This enhanced affordability is particularly evident in the Southern and Western regions, where new constructions constitute a larger segment of available listings. These areas are experiencing a pronounced advantage for new builds, with some Western markets even seeing a rise in the new home price premium, yet maintaining overall affordability due to drops in existing home values. Furthermore, price reductions in new construction have been observed in 30 of the largest 100 U.S. metropolitan areas, predominantly in the South. These declines are largely attributable to heightened competition from the resale market, elevated mortgage rates impacting buyer confidence, and strategic incentives offered by builders to attract cost-conscious consumers. The South, despite representing a smaller portion of U.S. households, accounts for over half of all new and existing home listings, a testament to ongoing builder activity. Conversely, regions like the Northeast and Midwest continue to see new homes priced at a significant premium, often over 50% higher than existing properties, positioning them as luxury products in these constrained markets.

Market Dynamics and Regional Variations in Buyer Behavior

Despite previous concerns regarding tariffs, escalating construction costs, and a general dip in buyer demand, the pace of home completions has remained consistent, contributing significantly to the current market landscape. Since early 2020, there has been a remarkable 37.3% surge in new construction listings, far outstripping the 15.4% increase in existing home listings, with the majority of this growth occurring in the most recent quarter. As the supply of existing homes has expanded, the proportion of new homes in the market has naturally adjusted, settling at 16.4% in the second quarter, down from 17.9% a year prior and a peak of 20.2% in Q2 2023. This indicates a normalizing market as more inventory becomes available across the board, providing consumers with broader choices.

Analysis of cross-market demand reveals fascinating variations in buyer preferences and mobility. In major urban centers such as Los Angeles, New York, and Miami, demand for new construction is predominantly fueled by buyers relocating from outside the area, signaling a pursuit of lifestyle changes or investment opportunities. In stark contrast, smaller markets like Tucson, Arizona; Toledo, Ohio; and Bakersfield, California, show that local residents are the primary drivers of new construction interest, suggesting a focus on community ties and local amenities. Moreover, in metropolitan areas characterized by robust new construction activity, including Durham, North Carolina; Atlanta; and Salt Lake City, a significant number of prospective buyers are searching for new homes beyond their immediate localities. This pattern implies that positive experiences with the local housing supply can inspire confidence and encourage exploration of similar markets elsewhere, fostering a more interconnected national housing demand.